Www Incometaxpro Nettax Formschedule 88122021 Schedule 8812 Form and Instructions Form 1040 2021

Understanding the 8812 instructions tax form

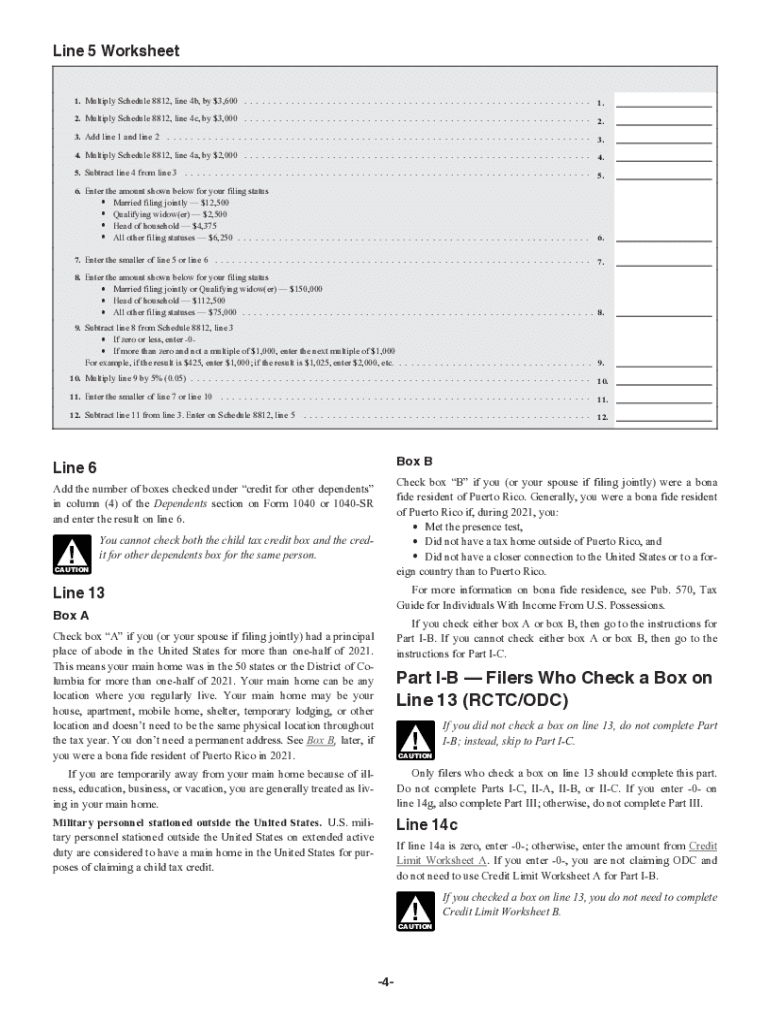

The 8812 instructions tax form, also known as the Schedule 8812, is essential for taxpayers who are claiming the Child Tax Credit and the Additional Child Tax Credit. This form helps determine the amount of credit a taxpayer may qualify for based on their income and the number of qualifying children. It is particularly relevant for parents and guardians who are filing their federal income tax returns using Form 1040. Understanding the requirements and calculations involved in this form is crucial for ensuring accurate tax filings and maximizing potential credits.

Steps to complete the 8812 instructions tax form

Completing the 8812 instructions tax form involves several key steps:

- Gather necessary information: Collect details about your qualifying children, including their names, Social Security numbers, and ages.

- Determine eligibility: Review the eligibility criteria for the Child Tax Credit, ensuring your income falls within the required thresholds.

- Fill out the form: Carefully enter the required information on the form, including the number of qualifying children and any applicable income adjustments.

- Calculate the credit: Use the provided tables in the instructions to determine the amount of credit you are eligible for based on your income and the number of children.

- Review and submit: Double-check all entries for accuracy before submitting the form with your tax return.

IRS guidelines for the 8812 instructions tax form

The IRS provides specific guidelines for completing the 8812 instructions tax form. These guidelines include detailed instructions on who qualifies as a dependent child, how to calculate the credit, and what documentation may be required. Taxpayers should refer to the latest IRS publications and instructions to ensure compliance with current tax laws and regulations. Staying informed about any changes in tax law is vital for accurate filings and to avoid potential penalties.

Filing deadlines for the 8812 instructions tax form

Taxpayers must adhere to specific filing deadlines when submitting the 8812 instructions tax form. Generally, the deadline for filing federal income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to file the form along with your federal income tax return to ensure that you receive any eligible credits in a timely manner. Late submissions may result in penalties or loss of credits.

Required documents for the 8812 instructions tax form

When completing the 8812 instructions tax form, certain documents may be required to support your claims. These documents typically include:

- Social Security cards: For each qualifying child, you need their Social Security number.

- Proof of residency: Documentation that verifies the child’s residency in your household may be necessary.

- Income statements: W-2 forms or other income documentation to determine eligibility for the credit.

Having these documents ready can streamline the process and help ensure that your tax return is accurate and complete.

Legal use of the 8812 instructions tax form

The legal use of the 8812 instructions tax form is governed by IRS regulations. Filing the form accurately is essential for compliance with tax laws. Misrepresentation or failure to provide accurate information may result in penalties, including fines or audits. It is important to understand the legal implications of the information provided on this form and to ensure that all entries are truthful and supported by appropriate documentation.

Quick guide on how to complete wwwincometaxpronettax formschedule 88122021 schedule 8812 form and instructions form 1040

Manage Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly solution to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly and without hassle. Manage Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040 seamlessly

- Obtain Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040 and click Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwincometaxpronettax formschedule 88122021 schedule 8812 form and instructions form 1040

Create this form in 5 minutes!

How to create an eSignature for the wwwincometaxpronettax formschedule 88122021 schedule 8812 form and instructions form 1040

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the purpose of the 8812 instructions tax form?

The 8812 instructions tax form is designed to help taxpayers claim the Additional Child Tax Credit. It provides detailed guidelines on how to properly fill out the form and maximize your eligible credits, ensuring you get the correct tax benefits.

-

How do I fill out the 8812 instructions tax form using airSlate SignNow?

To fill out the 8812 instructions tax form using airSlate SignNow, simply upload your form to the platform. You can easily add fields, eSign, and send it securely to others, making the process efficient and straightforward for all users.

-

Are there any costs associated with using airSlate SignNow for the 8812 instructions tax form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features for managing and eSigning documents, including forms like the 8812 instructions tax form, making it a cost-effective solution for all users.

-

What features does airSlate SignNow offer for managing the 8812 instructions tax form?

airSlate SignNow provides several features for managing the 8812 instructions tax form, including customizable templates, easy document editing, and secure eSigning options. These tools simplify the tax filing process and enhance productivity.

-

Can I integrate other software with airSlate SignNow while using the 8812 instructions tax form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems, allowing you to manage the 8812 instructions tax form alongside your other business tools for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for the 8812 instructions tax form?

Using airSlate SignNow for the 8812 instructions tax form provides several benefits, including streamlined document management, improved collaboration, and reduced turnaround times. The platform is designed to be user-friendly, ensuring all users can navigate easily.

-

Is airSlate SignNow secure for handling sensitive tax documents like the 8812 instructions tax form?

Yes, airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication protocols to protect your sensitive tax documents, including the 8812 instructions tax form. You can trust that your data is safe at all times.

Get more for Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040

- Commercial sublease missouri form

- Residential lease renewal agreement missouri form

- Notice to lessor exercising option to purchase missouri form

- Assignment of lease and rent from borrower to lender missouri form

- Mo assignment form

- Letter from landlord to tenant as notice of abandoned personal property missouri form

- Guaranty or guarantee of payment of rent missouri form

- Letter from landlord to tenant as notice of default on commercial lease missouri form

Find out other Www incometaxpro nettax formschedule 88122021 Schedule 8812 Form And Instructions Form 1040

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy