About Schedule 8812 Form 1040, Credits for Qualifying Children and 2022-2026

Understanding Schedule 8812 Form 1040

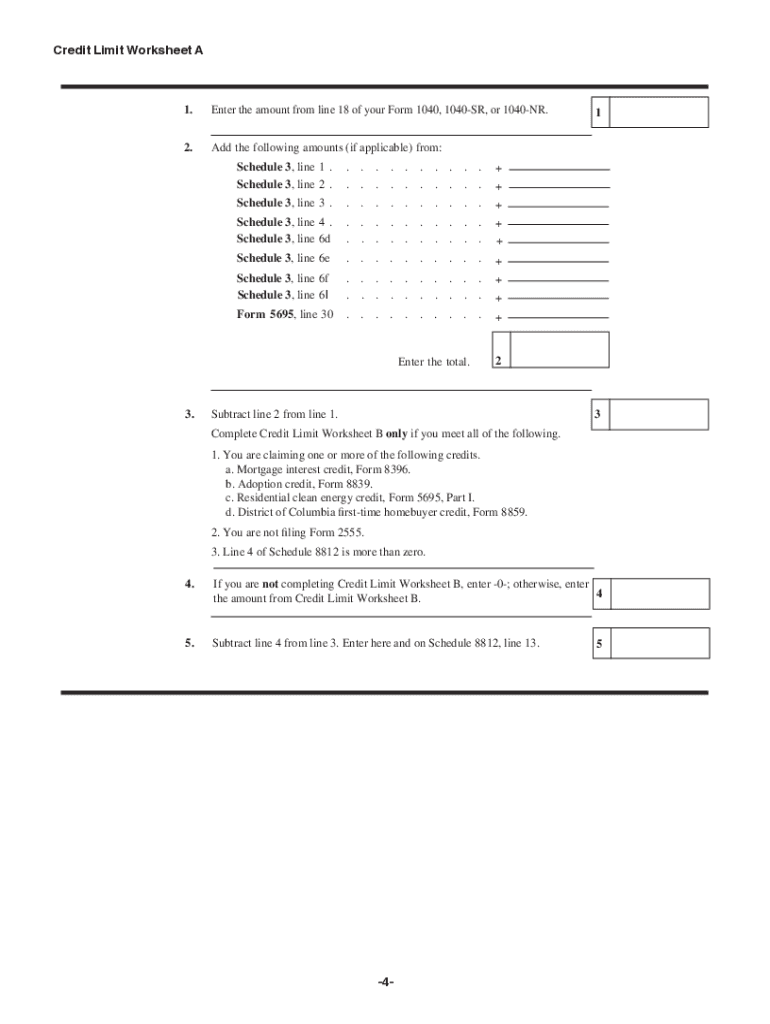

Schedule 8812 is an essential form used by taxpayers in the United States to claim the Additional Child Tax Credit. This credit is designed to provide financial relief to families with qualifying children. The form must be filed alongside Form 1040, which is the standard individual income tax return. Understanding the purpose of Schedule 8812 can help taxpayers maximize their credits and ensure compliance with IRS regulations.

Steps to Complete Schedule 8812

Filling out Schedule 8812 involves several key steps. Begin by gathering necessary information about your qualifying children, including their Social Security numbers and ages. Next, determine your eligibility for the Additional Child Tax Credit based on your income level and filing status. Complete the form by entering the required details, including the number of qualifying children and the corresponding credit amounts. Finally, review your entries for accuracy before submitting the form with your tax return.

Eligibility Criteria for Schedule 8812

To qualify for the Additional Child Tax Credit on Schedule 8812, taxpayers must meet specific criteria. The child must be under the age of seventeen at the end of the tax year, and the taxpayer must have a valid Social Security number for the child. Additionally, the taxpayer's income must fall below certain thresholds, which can vary based on filing status. Understanding these criteria is crucial for ensuring that you can claim the credit without issues.

IRS Guidelines for Schedule 8812

The IRS provides detailed guidelines for completing Schedule 8812, which are essential for compliance. Taxpayers should refer to the official IRS instructions for the most current information on eligibility, calculation methods, and any changes to the tax code. Adhering to these guidelines helps prevent errors that could lead to delays in processing or potential audits.

Filing Deadlines for Schedule 8812

Timely filing of Schedule 8812 is critical to avoid penalties and ensure you receive your tax refund promptly. The deadline for submitting your Form 1040, along with Schedule 8812, typically falls on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these deadlines to avoid late fees and interest on unpaid taxes.

Form Submission Methods for Schedule 8812

Taxpayers have several options for submitting Schedule 8812. The form can be filed electronically using tax software, which often simplifies the process and reduces the likelihood of errors. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person filing is also an option at certain IRS offices. Understanding these submission methods can help streamline the filing process.

Quick guide on how to complete about schedule 8812 form 1040 credits for qualifying children and

Complete About Schedule 8812 Form 1040, Credits For Qualifying Children And effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage About Schedule 8812 Form 1040, Credits For Qualifying Children And on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to adjust and eSign About Schedule 8812 Form 1040, Credits For Qualifying Children And with ease

- Obtain About Schedule 8812 Form 1040, Credits For Qualifying Children And and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign About Schedule 8812 Form 1040, Credits For Qualifying Children And and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule 8812 form 1040 credits for qualifying children and

Create this form in 5 minutes!

People also ask

-

What are the 2017 8812 instructions for claiming the Child Tax Credit?

The 2017 8812 instructions provide detailed guidance on how to claim the Child Tax Credit when filing your taxes. It outlines the eligibility requirements, the calculation of the credit amount, and how to fill out the form correctly to ensure you receive the credit you deserve.

-

How can airSlate SignNow assist with completing the 2017 8812 instructions?

AirSlate SignNow offers features that simplify document signing and management, making it easier for users to fill out and eSign forms like the 2017 8812 instructions. Our user-friendly platform allows you to send, track, and store your tax documents securely, ensuring you never miss a deadline.

-

Are there any costs associated with using airSlate SignNow for the 2017 8812 instructions?

Yes, airSlate SignNow is a cost-effective solution for eSigning documents, including tax forms like the 2017 8812 instructions. We offer various pricing plans tailored to different business needs, ensuring you find a plan that works for your budget while providing all necessary features.

-

What features does airSlate SignNow offer to streamline the 2017 8812 instructions process?

AirSlate SignNow includes features such as customizable templates, in-app messaging, and real-time tracking to streamline the process of completing the 2017 8812 instructions. These tools help users manage their documentation effectively, ensuring a hassle-free experience when handling tax forms.

-

Can I integrate airSlate SignNow with other applications for handling the 2017 8812 instructions?

Absolutely! AirSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and many others. This allows you to easily access and manage your documents related to the 2017 8812 instructions within your preferred workflow.

-

How does airSlate SignNow ensure the security of my 2017 8812 instructions?

Security is a priority at airSlate SignNow. We implement industry-standard encryption and follow best practices to safeguard your sensitive information, including your 2017 8812 instructions. You can trust that your documents are secure each time you eSign or share them.

-

What benefits does using airSlate SignNow provide when filling out the 2017 8812 instructions?

Using airSlate SignNow to handle your 2017 8812 instructions offers numerous benefits, including increased efficiency in document management and reduced turnaround times for getting signatures. Additionally, our platform's ease of use makes the process more straightforward, even for those unfamiliar with tax forms.

Get more for About Schedule 8812 Form 1040, Credits For Qualifying Children And

- Fencing contractor package hawaii form

- Hvac contractor package hawaii form

- Landscaping contractor package hawaii form

- Commercial contractor package hawaii form

- Excavation contractor package hawaii form

- Renovation contractor package hawaii form

- Concrete mason contractor package hawaii form

- Demolition contractor package hawaii form

Find out other About Schedule 8812 Form 1040, Credits For Qualifying Children And

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document