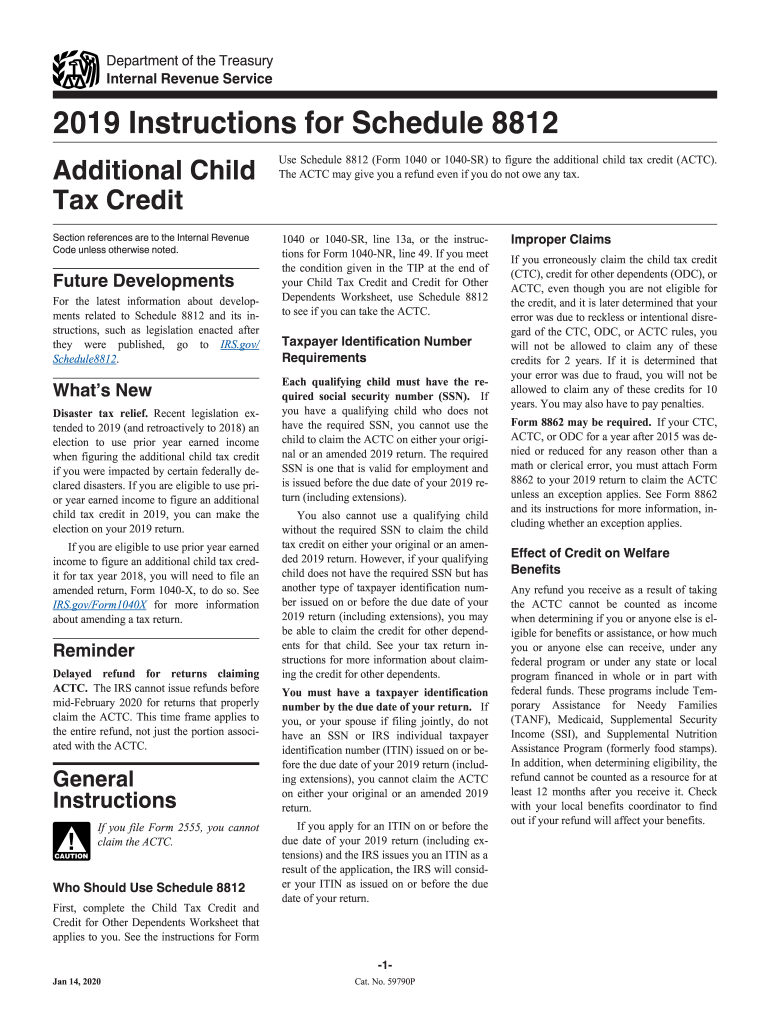

Irs Form 8812 Instructions 2019

What is the IRS Form 8812 Instructions?

The IRS Form 8812 instructions provide detailed guidance on how to claim the Child Tax Credit and the Additional Child Tax Credit. This form is essential for taxpayers who are eligible for these credits, as it helps determine the amount of credit they can receive. The instructions outline eligibility criteria, necessary documentation, and the steps required to complete the form accurately. Understanding the instructions is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete the IRS Form 8812 Instructions

Completing the IRS Form 8812 requires careful attention to detail. Begin by gathering all necessary information, including Social Security numbers for qualifying children and your filing status. Follow the instructions step-by-step:

- Start with your personal information, including your name and address.

- Provide information about your qualifying children, ensuring their details match IRS records.

- Calculate the amount of the Child Tax Credit and any Additional Child Tax Credit based on your income and the number of qualifying children.

- Review your calculations for accuracy before finalizing the form.

Once completed, ensure that the form is signed and dated, as this is a requirement for submission.

Legal Use of the IRS Form 8812 Instructions

The IRS Form 8812 instructions are legally binding guidelines that taxpayers must follow to claim the Child Tax Credit. Compliance with these instructions is essential to avoid penalties or audits. The instructions ensure that all claims are made in accordance with current tax laws, which can change annually. Understanding the legal implications of the instructions helps taxpayers navigate their responsibilities and rights effectively.

Eligibility Criteria for the IRS Form 8812 Instructions

To qualify for the Child Tax Credit and the Additional Child Tax Credit, certain eligibility criteria must be met. Key factors include:

- The taxpayer must have a qualifying child under the age of 17 at the end of the tax year.

- The taxpayer's income must fall within specified thresholds set by the IRS.

- The child must have a valid Social Security number.

- The taxpayer must claim the child as a dependent on their tax return.

Reviewing these criteria carefully ensures that taxpayers can accurately determine their eligibility before filing.

How to Obtain the IRS Form 8812 Instructions

The IRS Form 8812 instructions can be obtained directly from the IRS website or through various tax preparation services. The instructions are available in PDF format, making them easy to download and print. Additionally, many tax software programs include the instructions as part of their filing process, providing users with integrated guidance as they complete their tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8812 coincide with the standard tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to be aware of these dates to avoid late filing penalties. Additionally, if an extension is filed, the deadline may change, so keeping track of these important dates is crucial for compliance.

Quick guide on how to complete 2019 instructions for schedule 8812 2019 instructions for schedule 8812 additional child tax credit

Effortlessly Prepare Irs Form 8812 Instructions on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without complications. Manage Irs Form 8812 Instructions across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to edit and electronically sign Irs Form 8812 Instructions with ease

- Find Irs Form 8812 Instructions and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your preferred method for sending your form, be it via email, SMS, or an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Irs Form 8812 Instructions and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for schedule 8812 2019 instructions for schedule 8812 additional child tax credit

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for schedule 8812 2019 instructions for schedule 8812 additional child tax credit

How to make an electronic signature for the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit in the online mode

How to create an eSignature for the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit in Google Chrome

How to create an eSignature for putting it on the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit in Gmail

How to generate an electronic signature for the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit straight from your smartphone

How to create an electronic signature for the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit on iOS devices

How to make an electronic signature for the 2019 Instructions For Schedule 8812 2019 Instructions For Schedule 8812 Additional Child Tax Credit on Android OS

People also ask

-

What is the schedule 8812 instructions form?

The schedule 8812 instructions form provides guidelines on how to claim the Child Tax Credit for qualifying children. This form is essential for taxpayers looking to receive the benefits associated with the Child Tax Credit and requires careful attention to detail to ensure accurate filing.

-

How can airSlate SignNow assist with the schedule 8812 instructions form?

airSlate SignNow offers a user-friendly platform to eSign and manage your documents, including the schedule 8812 instructions form. With its intuitive interface, you can fill out and sign the form digitally, streamlining the process and ensuring compliance with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the schedule 8812 instructions form?

Yes, airSlate SignNow provides a cost-effective solution with various pricing plans tailored to fit your business needs. By using SignNow, you can save time and reduce errors when completing the schedule 8812 instructions form, ultimately providing value for your investment.

-

What features does airSlate SignNow offer for completing the schedule 8812 instructions form?

airSlate SignNow includes features like easy document editing, electronic signatures, and secure storage, making it perfect for managing the schedule 8812 instructions form. Additionally, users can collaborate in real-time, enhancing productivity and ensuring all information is accurate before submission.

-

Can I integrate airSlate SignNow with other tools while working on the schedule 8812 instructions form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to enhance functionality while working on the schedule 8812 instructions form. This means you can easily connect with your CRM or cloud storage solutions for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for the schedule 8812 instructions form?

Using airSlate SignNow for the schedule 8812 instructions form improves efficiency, decreases turnaround time, and reduces paperwork. Its electronic signature capabilities help you meet deadlines with ease and maintain compliance with IRS guidelines.

-

How do I get started with airSlate SignNow for my schedule 8812 instructions form?

Getting started with airSlate SignNow is simple. Visit our website, sign up for an account, and explore the various features that will aid in completing your schedule 8812 instructions form. Our support team is also available to assist you along the way.

Get more for Irs Form 8812 Instructions

- Kerrigan scholarship form

- Dr2174 form

- Vitals sheet form

- State of alaska burial assistance form

- Sample international sos authorization form tricare overseas

- Iowa iep keystone area education agency aea1 k12 ia form

- Grant application our military kids wisconsinmilitary form

- Opra request form englewood cliffs public schools

Find out other Irs Form 8812 Instructions

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement