Form911 Rev 1 Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order 2022

Understanding Form 911: Request for Taxpayer Advocate Service Assistance

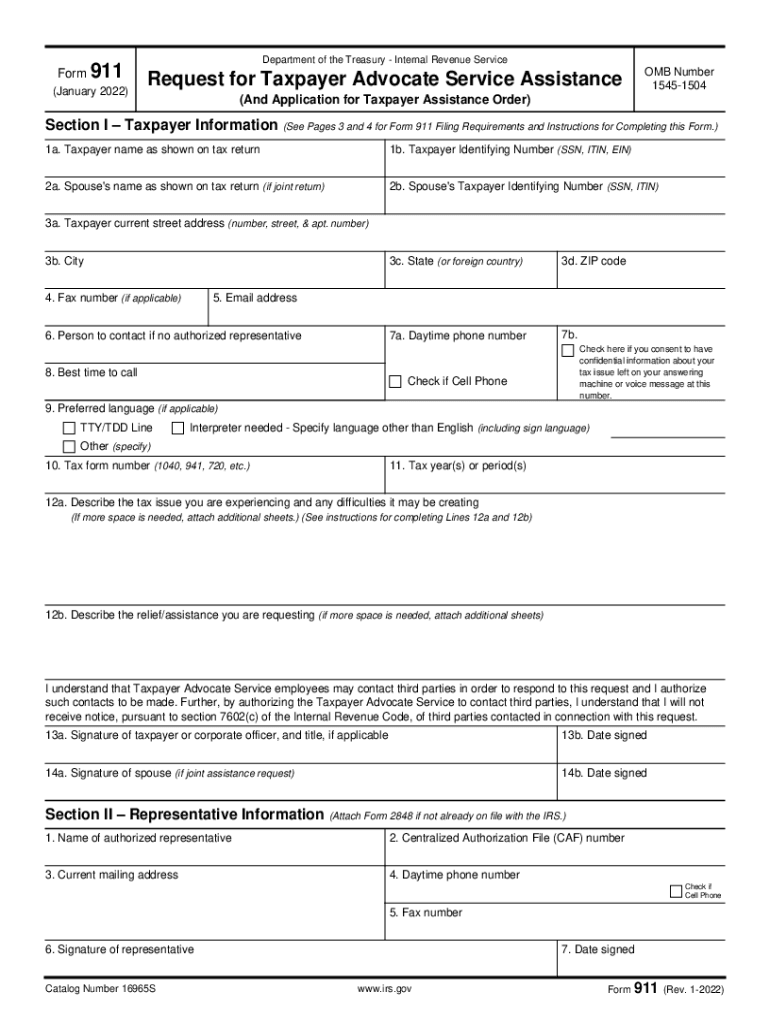

The Form 911, officially titled the Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order, is a crucial document for taxpayers facing issues with the Internal Revenue Service (IRS). This form is designed to help individuals who are experiencing difficulties in resolving their tax problems, providing a pathway to receive assistance from the Taxpayer Advocate Service (TAS). The TAS is an independent organization within the IRS that advocates for taxpayers, ensuring their rights are protected and their concerns are addressed.

Steps to Complete Form 911

Completing Form 911 involves several key steps to ensure that all necessary information is accurately provided. Start by gathering relevant personal information, including your name, address, and Social Security number. Next, clearly describe the issue you are facing with the IRS, providing as much detail as possible. This may include the type of tax problem, any previous communications with the IRS, and the impact it has had on your financial situation. Finally, sign and date the form to validate your request for assistance. Ensure that you keep a copy of the completed form for your records.

Eligibility Criteria for Using Form 911

To utilize Form 911, taxpayers must meet specific eligibility criteria. The form is intended for individuals who are experiencing significant difficulties with the IRS that have not been resolved through normal channels. This may include cases where the taxpayer has not received a response to inquiries or is facing financial hardship due to IRS actions. Additionally, taxpayers should be aware that the TAS prioritizes cases that involve systemic issues affecting multiple taxpayers, as well as those that may require immediate attention due to financial distress.

Submitting Form 911: Methods and Considerations

Form 911 can be submitted through various methods to accommodate different taxpayer needs. Options for submission include online, by mail, or in person at a local TAS office. When submitting the form online, ensure that you have a secure internet connection to protect your personal information. If mailing the form, it is advisable to use a traceable mailing option to confirm receipt by the TAS. For in-person submissions, scheduling an appointment may be necessary to ensure timely assistance.

Key Elements of Form 911

Understanding the key elements of Form 911 is essential for effective completion. The form requires detailed information about the taxpayer's identity, the nature of the tax issue, and any previous attempts to resolve the problem. Additionally, it includes sections for the taxpayer to specify their desired outcome and any supporting documentation that may strengthen their case. Clear and concise information increases the likelihood of receiving prompt assistance from the TAS.

IRS Guidelines for Form 911

The IRS provides specific guidelines regarding the use of Form 911, outlining the types of issues that can be addressed through the form. Taxpayers are encouraged to review these guidelines to determine if their situation qualifies for TAS assistance. Common issues include prolonged delays in processing tax returns, difficulties in obtaining refunds, and challenges related to audits or collections. Familiarity with these guidelines can help taxpayers navigate the process more effectively.

Quick guide on how to complete form911 rev 1 2022 request for taxpayer advocate service assistance and application for taxpayer assistance order

Effortlessly prepare Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order on any device

Digital document management has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order effortlessly

- Locate Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form911 rev 1 2022 request for taxpayer advocate service assistance and application for taxpayer assistance order

Create this form in 5 minutes!

How to create an eSignature for the form911 rev 1 2022 request for taxpayer advocate service assistance and application for taxpayer assistance order

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 911?

airSlate SignNow is a digital signature platform that allows businesses to send and eSign documents efficiently. With its intuitive interface, users can streamline their document workflows, ensuring that urgent tasks, like sending a signed 911 response form, are handled swiftly. The solution caters to various industries, making it versatile for any business looking to enhance their signing process.

-

How much does airSlate SignNow cost?

airSlate SignNow offers several pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget without compromising any essential features. The pricing is competitive, ensuring you get excellent value while managing critical documents like 911 emergency responses.

-

What features does airSlate SignNow provide that can assist with 911 documentation?

airSlate SignNow comes equipped with features such as templates, secure cloud storage, and integration capabilities that simplify the signing process for sensitive documents like 911 forms. Users can easily create reusable templates for common documents, signNowly speeding up the workflow when time is of the essence. Additionally, the secure storage of documents ensures that critical information remains protected.

-

Can airSlate SignNow integrate with other tools for handling 911-related documents?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems, cloud storage, and workflow automation tools. This allows businesses to efficiently manage 911-related documentation alongside their existing systems. The integrations facilitate a smoother workflow, ensuring that all essential information is readily available wherever needed.

-

Is airSlate SignNow compliant with regulations relevant to 911 documentation?

airSlate SignNow is designed with compliance in mind, adhering to various regulations and standards related to electronic signatures. This includes compliance with the ESIGN Act and UETA, ensuring that 911 documentation signed through the platform is legally binding. Businesses can trust that the electronic signing process meets necessary legal requirements.

-

What benefits does airSlate SignNow offer for businesses dealing with emergency response documents like 911?

Using airSlate SignNow to manage 911-related documents provides numerous benefits, including faster turnaround times and reduced paper usage. The platform offers an efficient way to get documents signed and processed, which is critical in emergency response situations. By implementing this digital solution, businesses can enhance their operational efficiency and responsiveness.

-

How easy is it to get started with airSlate SignNow for managing 911 forms?

Getting started with airSlate SignNow is a straightforward process. Users can sign up for a free trial to experience the platform's capabilities in managing 911 forms without any risks. The user-friendly interface ensures that even those with minimal technical skills can navigate the system effortlessly and begin eSigning documents in no time.

Get more for Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order

- Quitclaim deed from corporation to corporation mississippi form

- Warranty deed from corporation to corporation mississippi form

- Mississippi probate form

- Muniment of title form

- Petition real estate form

- Quitclaim deed from corporation to two individuals mississippi form

- Warranty deed from corporation to two individuals mississippi form

- Mississippi sale real form

Find out other Form911 Rev 1 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT