Irs Form 911 Fillable 2011

What is the IRS Form 911 Fillable

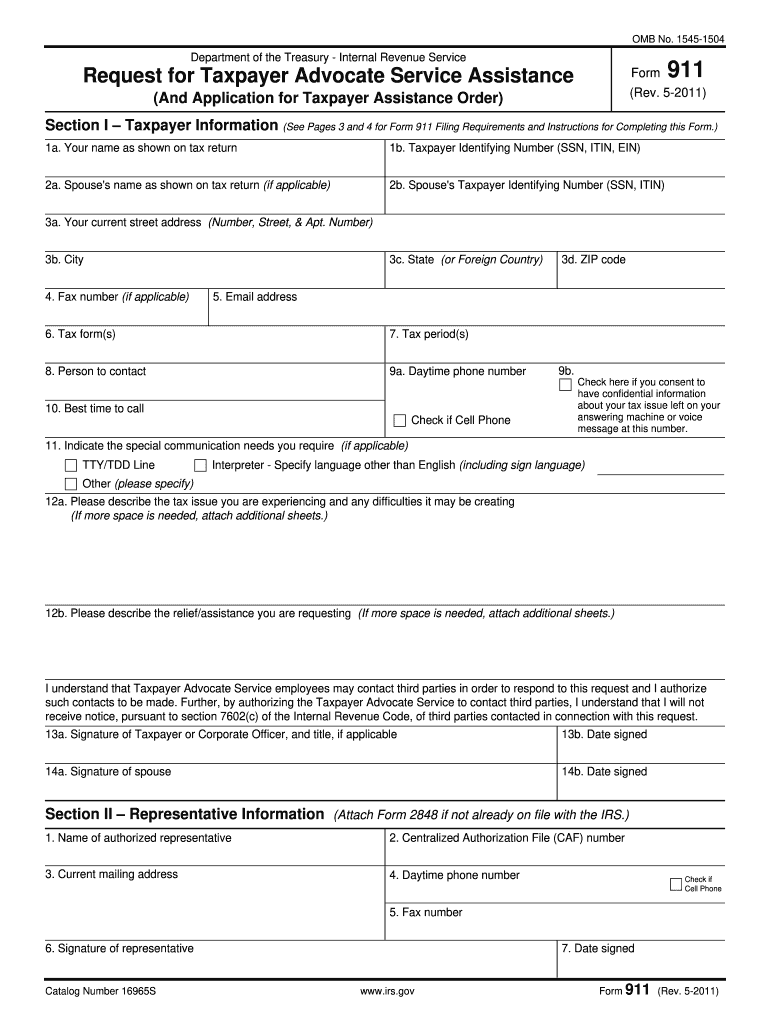

The IRS Form 911, also known as the Request for Taxpayer Advocate Service Assistance, is a crucial document that taxpayers can use to seek assistance from the Taxpayer Advocate Service (TAS). This form is designed for individuals who are facing significant issues with the IRS that have not been resolved through normal channels. The fillable version of this form allows users to complete it digitally, making the process more efficient and accessible.

How to Use the IRS Form 911 Fillable

Using the IRS Form 911 fillable is straightforward. First, ensure that you have all necessary information at hand, including your personal details and specifics about your tax issue. Open the fillable form on your device, fill in the required fields, and review your entries for accuracy. Once completed, you can print the form for submission or save it for electronic filing. This digital format helps streamline the process, ensuring that your request is clear and legible.

Steps to Complete the IRS Form 911 Fillable

Completing the IRS Form 911 fillable involves several key steps:

- Gather your personal information, including your Social Security number, address, and contact details.

- Clearly describe the issue you are facing with the IRS, providing as much detail as possible.

- Indicate any previous attempts to resolve the issue, including dates and outcomes.

- Review the form to ensure all information is accurate and complete.

- Submit the form either by mailing it to the appropriate address or by following the electronic submission guidelines if available.

Legal Use of the IRS Form 911 Fillable

The IRS Form 911 fillable is legally recognized as a formal request for assistance from the Taxpayer Advocate Service. To be considered valid, the form must be filled out completely and accurately. It is essential to provide truthful information, as any discrepancies could lead to delays or complications in processing your request. The form serves as a vital tool for taxpayers seeking help with unresolved issues, ensuring that their rights are protected under IRS regulations.

Key Elements of the IRS Form 911 Fillable

Several key elements must be included in the IRS Form 911 fillable:

- Taxpayer Information: This includes your name, Social Security number, and contact information.

- Description of the Issue: A detailed account of the problem you are facing with the IRS.

- Previous Contact: Information about any prior communications with the IRS regarding your issue.

- Signature: Your signature is required to validate the request.

Form Submission Methods

The IRS Form 911 fillable can be submitted through various methods. Taxpayers can print the completed form and mail it to the designated address provided by the IRS. Alternatively, if you are using a digital platform that supports electronic submission, you may be able to submit the form online. It is important to check the IRS guidelines for the most current submission options and requirements.

Quick guide on how to complete irs form 911 fillable 2011

Easily Prepare Irs Form 911 Fillable on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent green alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and eSign your documents without delays. Handle Irs Form 911 Fillable on any device using the airSlate SignNow apps available for Android and iOS, and enhance any document-related process today.

The Simplest Way to Modify and eSign Irs Form 911 Fillable Effortlessly

- Obtain Irs Form 911 Fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact confidential information with tools specifically designed by airSlate SignNow for this function.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign Irs Form 911 Fillable while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 911 fillable 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form 911 fillable 2011

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Irs Form 911 Fillable, and how can I use it?

The Irs Form 911 Fillable is a digital version of the IRS form that can be easily filled out online. This form is used to request assistance with the IRS, such as when you are experiencing financial hardship. By using the fillable form, you can save time and ensure that all necessary information is entered accurately.

-

How can airSlate SignNow help with the Irs Form 911 Fillable?

airSlate SignNow provides a seamless platform to eSign and send your Irs Form 911 Fillable with ease. Our solution allows you to fill out the form, collect signatures, and store documents securely, ensuring compliance and efficiency throughout the process. It simplifies the task of submitting your request to the IRS.

-

Is there a cost associated with using the Irs Form 911 Fillable via airSlate SignNow?

Using airSlate SignNow to fill out and eSign the Irs Form 911 Fillable involves a subscription fee based on your selected plan. We offer various pricing tiers to accommodate different business needs. The value you receive includes secure storage, unlimited signatures, and integration capabilities.

-

What features does airSlate SignNow offer for completing the Irs Form 911 Fillable?

airSlate SignNow offers features like drag-and-drop document editing, customizable templates, and advanced security options for your Irs Form 911 Fillable. Additionally, you can use our mobile app for on-the-go access, making it convenient to work from anywhere. Our collaborative tools also allow multiple users to manage the document efficiently.

-

Can I integrate airSlate SignNow with other applications for better management of the Irs Form 911 Fillable?

Yes, airSlate SignNow supports integration with various applications, enhancing the management of your Irs Form 911 Fillable. You can connect it with CRM tools, cloud storage services, and other software you already use. This integration allows for a more streamlined workflow, saving you valuable time.

-

How secure is the airSlate SignNow platform when handling the Irs Form 911 Fillable?

Security is a top priority at airSlate SignNow. When handling the Irs Form 911 Fillable, your documents are protected with bank-level encryption and secure access controls. Our platform also complies with industry standards to safeguard your information throughout the eSigning process.

-

Can I track the status of my Irs Form 911 Fillable after sending it with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to see the status of your Irs Form 911 Fillable at any time. You will receive notifications when the document is opened, signed, and completed, giving you peace of mind regarding your submission to the IRS.

Get more for Irs Form 911 Fillable

- Demolition contractor package indiana form

- Security contractor package indiana form

- Insulation contractor package indiana form

- Paving contractor package indiana form

- Site work contractor package indiana form

- Siding contractor package indiana form

- Refrigeration contractor package indiana form

- Indiana drainage 497307184 form

Find out other Irs Form 911 Fillable

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe