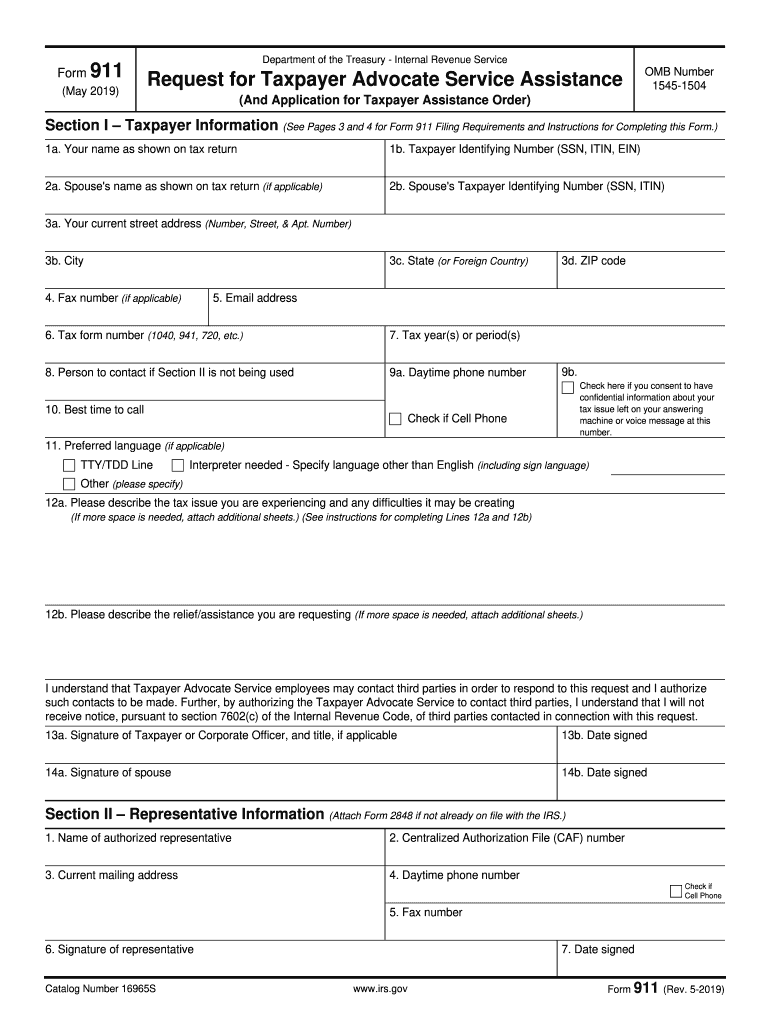

Irs Form 911 2019

What is the IRS Form 911?

The IRS Form 911, also known as the Request for Taxpayer Advocate Service Assistance, is a crucial document designed to help taxpayers who are experiencing difficulties with the IRS. This form allows individuals to request assistance from the Taxpayer Advocate Service (TAS), an independent organization within the IRS that helps taxpayers resolve issues that have not been resolved through normal IRS channels. The form is particularly useful for those facing financial hardship, significant delays, or other unresolved tax-related problems.

How to Use the IRS Form 911

Using the IRS Form 911 involves a straightforward process. Taxpayers should first ensure they meet the eligibility criteria for assistance from the Taxpayer Advocate Service. Once eligibility is confirmed, individuals can fill out the form by providing necessary personal information, details about their tax issue, and the specific assistance they are requesting. After completing the form, it can be submitted to the appropriate TAS office for review. It is essential to keep a copy for personal records.

Steps to Complete the IRS Form 911

Completing the IRS Form 911 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number and details about your tax issue.

- Fill out the form, ensuring that all sections are completed accurately.

- Clearly describe the problem you are facing with the IRS.

- Indicate how the issue has affected you financially or personally.

- Submit the completed form to the appropriate Taxpayer Advocate Service office.

After submission, taxpayers should monitor their case and be prepared to provide additional information if requested by the TAS.

Key Elements of the IRS Form 911

The IRS Form 911 includes several key elements that are essential for a successful submission. These elements include:

- Taxpayer Information: This section requires personal details, such as name, address, and Social Security number.

- Description of the Issue: A detailed account of the tax problem, including any previous attempts to resolve it.

- Impact Statement: An explanation of how the issue has affected the taxpayer's financial situation or well-being.

- Signature: The form must be signed by the taxpayer or their authorized representative.

Providing complete and accurate information in these sections can significantly enhance the chances of receiving timely assistance.

Form Submission Methods

The IRS Form 911 can be submitted through various methods to ensure accessibility for all taxpayers. The primary submission methods include:

- Online: Taxpayers can submit the form electronically via the IRS website, which may expedite processing times.

- Mail: The completed form can be mailed to the appropriate Taxpayer Advocate Service office. It is advisable to send it via certified mail to confirm receipt.

- In-Person: Taxpayers may also choose to deliver the form in person at their local TAS office.

Choosing the right submission method can depend on individual circumstances and preferences.

Eligibility Criteria

To qualify for assistance through the IRS Form 911, taxpayers must meet specific eligibility criteria. These criteria include:

- Experiencing a financial hardship that affects their ability to meet tax obligations.

- Facing delays in resolving tax issues that have not been addressed through regular IRS processes.

- Having a tax issue that requires immediate attention due to its impact on personal or financial circumstances.

Understanding these criteria can help taxpayers determine if they should utilize the form for assistance.

Quick guide on how to complete form911 rev 5 2019 request for taxpayer advocate service assistance and application for taxpayer assistance order

Manage Irs Form 911 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Irs Form 911 on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

How to modify and eSign Irs Form 911 with ease

- Obtain Irs Form 911 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Form 911 and ensure seamless communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form911 rev 5 2019 request for taxpayer advocate service assistance and application for taxpayer assistance order

Create this form in 5 minutes!

How to create an eSignature for the form911 rev 5 2019 request for taxpayer advocate service assistance and application for taxpayer assistance order

How to make an electronic signature for the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order in the online mode

How to create an electronic signature for the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order in Google Chrome

How to create an eSignature for signing the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order in Gmail

How to generate an electronic signature for the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order right from your mobile device

How to make an electronic signature for the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order on iOS devices

How to generate an electronic signature for the Form911 Rev 5 2019 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order on Android

People also ask

-

What is a printable W 9 form 2015?

The printable W 9 form 2015 is an IRS form used by individuals and businesses to provide their taxpayer information. This form is essential for tax reporting purposes, allowing companies to correctly report payments made to contractors and vendors. Having a printable version as of 2015 ensures that you're using the correct format for compliance.

-

How can I obtain a printable W 9 form 2015?

You can easily obtain a printable W 9 form 2015 from the IRS website or through various online platforms that offer downloadable tax forms. Additionally, airSlate SignNow allows you to access and fill out this form digitally, making it convenient and efficient for your business needs.

-

Is there a cost associated with using the printable W 9 form 2015 through airSlate SignNow?

While the printable W 9 form 2015 itself is free to access, using airSlate SignNow’s services may come with a subscription fee. However, the investment provides enhanced features and benefits such as secure eSigning, document management, and easy sharing, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for the printable W 9 form 2015?

airSlate SignNow provides several features for handling a printable W 9 form 2015, including the ability to eSign the document securely, track changes, and store files in the cloud. These features streamline the process of collecting and managing important tax documents, ensuring compliance and efficiency.

-

Can I customize the printable W 9 form 2015 using airSlate SignNow?

Yes, airSlate SignNow allows users to customize the printable W 9 form 2015 to meet their specific needs. You can add your company logo, additional fields for information, and adjust settings to gather the necessary data from contractors and vendors seamlessly.

-

What are the benefits of using airSlate SignNow for the printable W 9 form 2015?

Using airSlate SignNow for the printable W 9 form 2015 offers numerous benefits, including streamlined workflows, enhanced security, and easy access for all parties involved. This solution can save time and reduce the hassle often associated with managing tax forms, ensuring that important documents are handled efficiently.

-

Does airSlate SignNow integrate with other applications for the printable W 9 form 2015?

Yes, airSlate SignNow offers integrations with various applications, allowing you to seamlessly use the printable W 9 form 2015 within your existing workflow. Whether you use project management tools, CRM systems, or accounting software, these integrations can enhance productivity and document management.

Get more for Irs Form 911

- Fort eustis jble eustis department of public health form

- Lcd parenteral nutrition l38953 centers for medicare ampamp medicaid form

- Appendix c 11 sample fgp scp tb test form fill out ampamp sign online

- Pharmacy technician competency checklist form

- Subjective history vestibular drayer physical therapy institute form

- Southeastrans standing order form 574602717

- Aetna dental claim form ampamp instructions accessible pdf aetna dental claim form ampamp instructions

- U n i v er si t y of v i rgi n i a he a lt h syst e m 0100000 place label here virginia form

Find out other Irs Form 911

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking