Form 911 Request for Taxpayer Advocate Service 2024

What is the Form 911 Request For Taxpayer Advocate Service

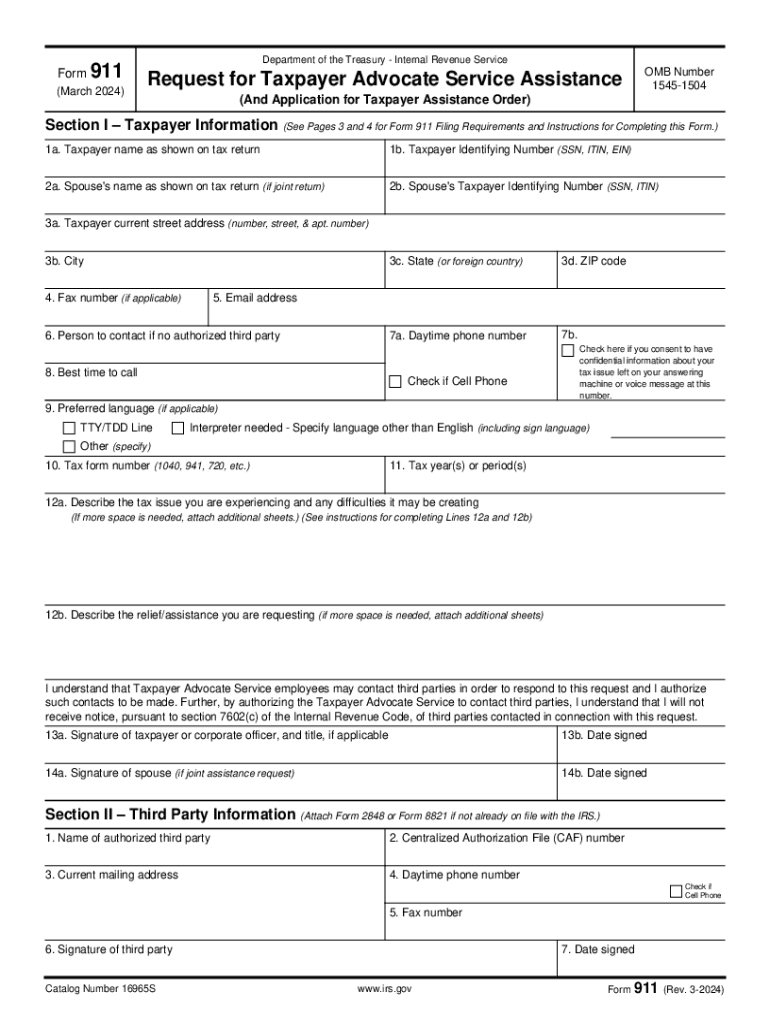

The Form 911, also known as the Request for Taxpayer Advocate Service, is a crucial document designed to assist taxpayers who are experiencing difficulties with the Internal Revenue Service (IRS). This form allows individuals to request help from the Taxpayer Advocate Service (TAS), an independent organization within the IRS that provides free assistance to taxpayers facing challenges. The TAS aims to ensure that taxpayers' rights are upheld and that they receive fair treatment throughout the tax process.

How to use the Form 911 Request For Taxpayer Advocate Service

Using Form 911 is a straightforward process. Taxpayers should complete the form when they feel their tax issues are not being resolved through normal IRS channels. To initiate the process, fill out the form with accurate information regarding your tax situation, including your contact details and a description of the issue. Once completed, submit the form to the TAS office, which will review your case and provide assistance as needed.

Steps to complete the Form 911 Request For Taxpayer Advocate Service

Completing Form 911 involves several key steps:

- Gather necessary information, including your tax identification number and details about your tax issue.

- Fill out the form, ensuring all sections are completed accurately.

- Provide a clear explanation of the problem you are facing with the IRS.

- Submit the form to the appropriate TAS office, either online or by mail.

Following these steps can help facilitate a smoother process in obtaining taxpayer assistance.

Eligibility Criteria

To qualify for assistance through the Taxpayer Advocate Service, certain criteria must be met. Taxpayers should be facing significant hardships, such as financial difficulties, or experiencing delays in resolving their tax issues. Additionally, if the IRS has not responded to inquiries or if taxpayers believe their rights have been violated, they may be eligible to use Form 911 to seek help.

Form Submission Methods (Online / Mail / In-Person)

Form 911 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Taxpayers can complete and submit the form electronically through the TAS website.

- Mail: The completed form can be printed and sent to the nearest TAS office via postal service.

- In-Person: Taxpayers may also visit a TAS office to submit the form directly and discuss their issues with a representative.

Key elements of the Form 911 Request For Taxpayer Advocate Service

Understanding the key elements of Form 911 is essential for effective use. The form includes sections for personal information, a detailed description of the taxpayer's issue, and any relevant documentation that supports the request for assistance. It is important to ensure that all information is accurate and complete to facilitate a timely response from the TAS.

Quick guide on how to complete form 911 request for taxpayer advocate service

Effortlessly Prepare Form 911 Request For Taxpayer Advocate Service on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents quickly and without delays. Manage Form 911 Request For Taxpayer Advocate Service on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

How to Modify and Electronically Sign Form 911 Request For Taxpayer Advocate Service with Ease

- Find Form 911 Request For Taxpayer Advocate Service and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details before clicking on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 911 Request For Taxpayer Advocate Service and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 911 request for taxpayer advocate service

Create this form in 5 minutes!

How to create an eSignature for the form 911 request for taxpayer advocate service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxpayer assistance and how can airSlate SignNow help?

Taxpayer assistance refers to the support provided to individuals and businesses in managing their tax-related documents and processes. airSlate SignNow offers an easy-to-use platform that simplifies the eSigning and document management process, ensuring that you can handle your taxpayer assistance needs efficiently and securely.

-

How much does airSlate SignNow cost for taxpayer assistance services?

airSlate SignNow offers various pricing plans to cater to different business needs, including options specifically designed for taxpayer assistance. Our plans are cost-effective, ensuring that you receive the best value for your investment while streamlining your document processes.

-

What features does airSlate SignNow provide for taxpayer assistance?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for effective taxpayer assistance. These tools help you manage your tax documents efficiently, reducing the time and effort required to complete your tax-related tasks.

-

Can airSlate SignNow integrate with other software for taxpayer assistance?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your taxpayer assistance experience. Whether you use accounting software or CRM systems, our integrations ensure that your document workflows are streamlined and efficient.

-

How does airSlate SignNow ensure the security of taxpayer assistance documents?

Security is a top priority at airSlate SignNow, especially for sensitive taxpayer assistance documents. We utilize advanced encryption and secure cloud storage to protect your data, ensuring that your documents remain confidential and safe from unauthorized access.

-

Is airSlate SignNow user-friendly for those seeking taxpayer assistance?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize for taxpayer assistance. Our intuitive interface allows users to quickly learn how to send, sign, and manage documents without extensive training.

-

What are the benefits of using airSlate SignNow for taxpayer assistance?

Using airSlate SignNow for taxpayer assistance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. By digitizing your document processes, you can save time and focus on more important aspects of your business.

Get more for Form 911 Request For Taxpayer Advocate Service

- Plumbing contract for contractor maine form

- Brick mason contract for contractor maine form

- Roofing contract for contractor maine form

- Electrical contract for contractor maine form

- Sheetrock drywall contract for contractor maine form

- Flooring contract for contractor maine form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract maine form

- Notice of intent to enforce forfeiture provisions of contact for deed maine form

Find out other Form 911 Request For Taxpayer Advocate Service

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement