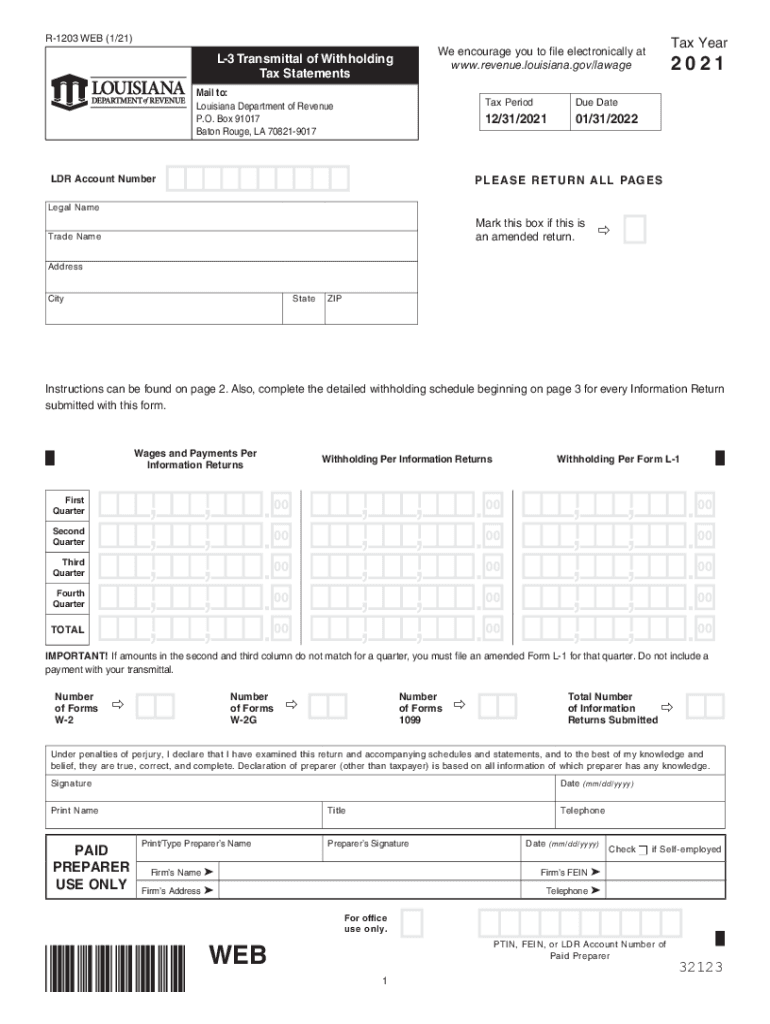

32123 Louisiana Department of Revenue 2021

Understanding the Louisiana Department of Revenue

The Louisiana Department of Revenue (LDR) is the state agency responsible for administering tax laws and collecting taxes in Louisiana. It plays a crucial role in ensuring compliance with state tax regulations and provides various services to taxpayers, including the issuance of tax forms, guidance on tax obligations, and assistance with filing returns. The LDR oversees a range of taxes, including income tax, sales tax, and corporate taxes, making it an essential resource for both individuals and businesses operating within the state.

Steps to Complete Forms for the Louisiana Department of Revenue

Completing forms for the Louisiana Department of Revenue involves several key steps to ensure accuracy and compliance. Begin by identifying the specific form required for your situation, such as the Louisiana tax exempt form R-1056 or other state tax forms. Gather all necessary documentation, including your LDR account number, income statements, and any supporting documents. Carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it through the appropriate method, whether online, by mail, or in person.

Required Documents for Louisiana Department of Revenue Forms

When preparing to submit forms to the Louisiana Department of Revenue, specific documents are typically required. These may include:

- Your LDR account number, which is essential for identifying your tax records.

- Income statements, such as W-2s or 1099s, to report earnings accurately.

- Supporting documentation for deductions or credits claimed on your tax return.

- Any previous correspondence from the Louisiana Department of Revenue, such as notices or letters.

Ensuring that you have all necessary documents will facilitate a smoother filing process and help avoid delays.

Filing Methods for Louisiana Department of Revenue Forms

The Louisiana Department of Revenue offers several methods for submitting forms, allowing taxpayers to choose the option that best fits their needs. These methods include:

- Online Submission: Many forms can be completed and submitted electronically through the LDR website, providing a quick and efficient option.

- Mail: Taxpayers can print their completed forms and send them to the appropriate address provided by the LDR.

- In-Person: For those who prefer face-to-face interaction, forms can be submitted at designated LDR offices throughout the state.

Choosing the right submission method can help ensure that your forms are processed promptly and accurately.

Legal Use of Louisiana Department of Revenue Forms

Forms from the Louisiana Department of Revenue are legally binding documents that must be filled out accurately to comply with state tax laws. Electronic submissions are recognized as valid under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This means that when using a reliable electronic signature solution, such as airSlate SignNow, your submissions are considered legally executed. It is important to ensure that all forms are completed in accordance with LDR guidelines to avoid penalties or issues with compliance.

Penalties for Non-Compliance with Louisiana Tax Regulations

Failure to comply with Louisiana tax regulations can result in various penalties imposed by the Louisiana Department of Revenue. Common penalties include:

- Late Filing Penalties: Taxpayers who fail to file their returns by the due date may incur penalties based on the amount of tax owed.

- Late Payment Penalties: If taxes are not paid by the deadline, additional charges may be applied.

- Interest Charges: Unpaid taxes accrue interest over time, increasing the total amount owed.

Understanding these penalties can help taxpayers take proactive measures to remain compliant and avoid unnecessary costs.

Quick guide on how to complete 32123 louisiana department of revenue

Effortlessly Prepare 32123 Louisiana Department Of Revenue on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle 32123 Louisiana Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to Modify and eSign 32123 Louisiana Department Of Revenue with Ease

- Find 32123 Louisiana Department Of Revenue and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign 32123 Louisiana Department Of Revenue while ensuring outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 32123 louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 32123 louisiana department of revenue

The best way to create an e-signature for a PDF document in the online mode

The best way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

How does airSlate SignNow help with compliance regarding the Louisiana Department of Revenue?

airSlate SignNow ensures that your eSigning process complies with the standards set by the Louisiana Department of Revenue. By utilizing secure and legally recognized eSignatures, businesses can confidently manage documents required by the state, reducing the risk of non-compliance.

-

What features does airSlate SignNow offer to assist with the Louisiana Department of Revenue requirements?

airSlate SignNow offers a range of features including customizable templates, automated workflows, and secure storage. These tools simplify the handling of documents related to the Louisiana Department of Revenue, making it easier for businesses to maintain accurate records.

-

Is airSlate SignNow cost-effective for businesses dealing with the Louisiana Department of Revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By implementing our eSigning platform, you can save on printing and mailing costs while ensuring swift compliance with the Louisiana Department of Revenue requirements.

-

Can airSlate SignNow integrate with other tools for managing documents related to the Louisiana Department of Revenue?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM and accounting software. This integration simplifies the management of documents required by the Louisiana Department of Revenue, promoting an efficient workflow.

-

What benefits does airSlate SignNow provide for businesses submitting documents to the Louisiana Department of Revenue?

By using airSlate SignNow, businesses can streamline their document submission process to the Louisiana Department of Revenue. Our platform enhances efficiency, reduces turnaround times, and ensures that crucial tax documents are signed and submitted swiftly.

-

How does airSlate SignNow ensure document security for submissions to the Louisiana Department of Revenue?

Security is a top priority at airSlate SignNow. Our platform employs military-grade encryption and secure access controls, ensuring that all documents sent to the Louisiana Department of Revenue are protected throughout the eSigning process.

-

Are there any training resources available for using airSlate SignNow for Louisiana Department of Revenue submissions?

Yes, airSlate SignNow provides comprehensive training resources to help users navigate the platform effectively. Our resources include tutorials and webinars geared towards optimizing document management tailored for the Louisiana Department of Revenue’s requirements.

Get more for 32123 Louisiana Department Of Revenue

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return mississippi form

- Letter from tenant to landlord containing request for permission to sublease mississippi form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497313865 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent 497313866 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable mississippi form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497313868 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497313869 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement mississippi form

Find out other 32123 Louisiana Department Of Revenue

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself