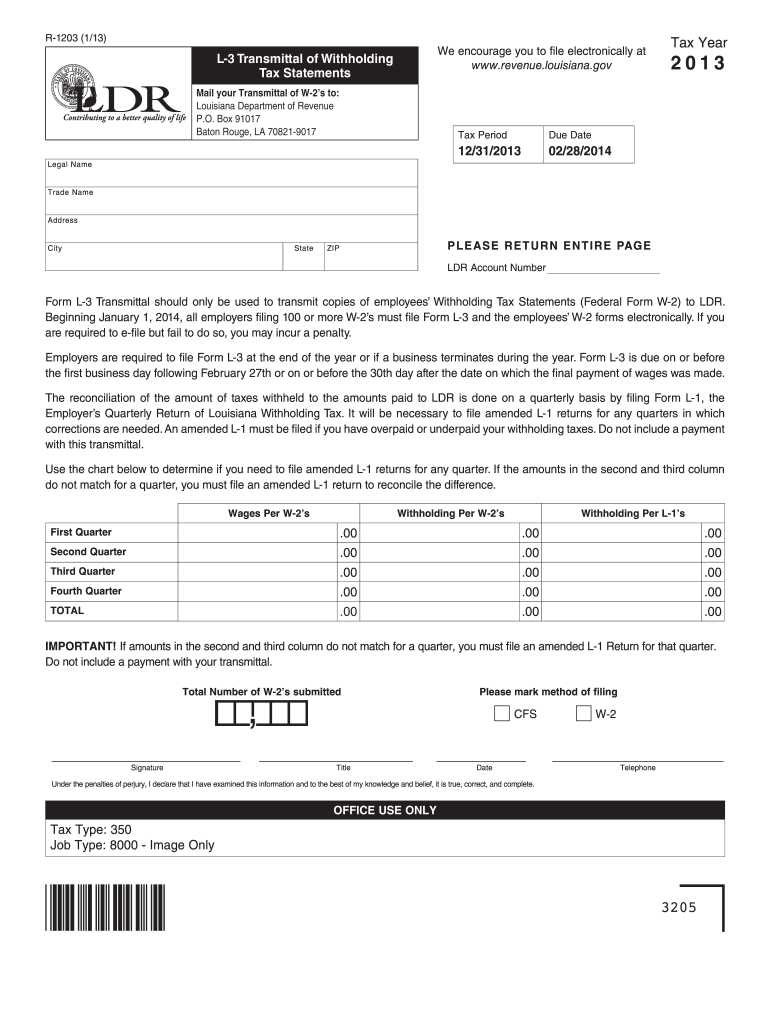

Form Louisiana Department of Revenue Louisiana Gov Revenue Louisiana 2013

What is the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

The Form Louisiana Department Of Revenue is an essential document used for various tax-related purposes within the state of Louisiana. This form is designed to facilitate the accurate reporting of income, deductions, and credits, ensuring compliance with state tax laws. It is commonly utilized by individuals, businesses, and tax professionals to report earnings and calculate tax liabilities. Understanding the specific requirements of this form is crucial for proper tax filing and to avoid any potential penalties.

How to use the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

Using the Form Louisiana Department Of Revenue involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, download the form from the official Louisiana Department of Revenue website or access it through a trusted eSignature platform. Fill out the form carefully, ensuring all required fields are completed. After completing the form, it can be signed electronically using a secure eSignature solution, which enhances the submission process by providing a legally binding signature.

Steps to complete the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

Completing the Form Louisiana Department Of Revenue requires attention to detail. Follow these steps for a smooth process:

- Begin by downloading the form from the official website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and any other earnings.

- List any deductions or credits you are eligible for, ensuring you have documentation to support these claims.

- Review the completed form for accuracy and completeness.

- Sign the form electronically using a secure eSignature solution.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

The legal use of the Form Louisiana Department Of Revenue is governed by state tax regulations. This form must be filled out accurately and submitted by the appropriate deadlines to avoid penalties. Electronic signatures are recognized as legally binding under the ESIGN Act, making it possible to complete and submit the form digitally. It is essential to ensure that all information provided is truthful and complies with Louisiana tax laws to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Form Louisiana Department Of Revenue vary depending on the type of tax being reported. Typically, individual income tax returns are due by May fifteenth of each year. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees and ensure timely processing of your tax returns. Mark your calendar and consider setting reminders to help you meet these important deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form Louisiana Department Of Revenue can be submitted through various methods to accommodate different preferences. You can file online using the Louisiana Department of Revenue's e-filing system, which allows for quick processing and confirmation of receipt. Alternatively, you can print the completed form and mail it to the appropriate address provided on the form. In-person submissions may also be possible at designated tax offices, but it is advisable to check for any specific requirements or availability before visiting.

Quick guide on how to complete form louisiana department of revenue louisianagov revenue louisiana

Your assistance manual on how to prepare your Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

If you’re wondering how to complete and submit your Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana, here are some brief instructions to streamline tax processing.

First, you simply need to create your airSlate SignNow profile to change how you manage documentation online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to adjust details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana in a matter of minutes:

- Create your account and start working on PDFs right away.

- Use our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to launch your Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if applicable).

- Review your document and fix any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper can lead to more return errors and slower refunds. Before e-filing your taxes, ensure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form louisiana department of revenue louisianagov revenue louisiana

FAQs

-

If you were to go out 10 feet into the Bayou Swamp area of New Orleans, Louisiana, how deep down does it get?

This depends. How much are you drinking or smoking before you do that? Seriously it could be 5 feet or 50 feet, depending on the location of the swamp.http://relocatenola.com

-

In Louisiana, can I fill my prescription on the fill date if I filled my last 30 day prescription 17 days ago? I understand my insurance won't pay for it, but is it possible to pay for it out of pocket?

No. It’s a controlled substance and you’re abusing the medication. It’s unreal the questions I get from ppl with Substance Use Disorder. Use caution be long term use at high doses can result in drug induced psychosis and a stay on a psych ward.

Create this form in 5 minutes!

How to create an eSignature for the form louisiana department of revenue louisianagov revenue louisiana

How to create an eSignature for your Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana online

How to create an eSignature for the Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana in Google Chrome

How to make an electronic signature for putting it on the Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana in Gmail

How to create an eSignature for the Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana right from your mobile device

How to create an eSignature for the Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana on iOS devices

How to make an electronic signature for the Form Louisiana Department Of Revenue Louisianagov Revenue Louisiana on Android devices

People also ask

-

What is the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana?

The Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana is a crucial document used for various tax purposes in the state of Louisiana. It is essential for both individuals and businesses to accurately complete and submit this form to ensure compliance with state regulations.

-

How can airSlate SignNow help with the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana?

airSlate SignNow simplifies the process of filling and eSigning the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana. Our platform allows users to complete documents electronically, ensuring that all fields are filled out correctly and securely.

-

What are the pricing plans for using airSlate SignNow for eSigning documents?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses of various sizes. Each plan includes features that facilitate easy document management, including support for the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana.

-

Are there any features specifically designed for handling tax forms such as the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana?

Yes, airSlate SignNow includes features that enhance the management of tax forms like the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana. Our platform allows users to automate workflows, track document statuses, and securely store completed forms all in one place.

-

What are the benefits of using airSlate SignNow for the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana?

Using airSlate SignNow for the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana offers several benefits, including time savings and improved accuracy. The eSigning feature reduces the likelihood of mistakes and helps ensure timely submissions, which can signNowly impact your tax compliance.

-

Can airSlate SignNow integrate with other software for handling tax documents?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions commonly used for accounting and tax preparation. This allows for easy management and submission of the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana alongside your existing workflows.

-

Is it secure to use airSlate SignNow for sensitive documents like the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana?

Yes, airSlate SignNow prioritizes security and provides a compliant platform for signing sensitive documents such as the Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana. We utilize advanced encryption and authentication measures to ensure that your information remains confidential and protected.

Get more for Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497326350 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497326351 form

- South dakota corporation 497326352 form

- Living trust for husband and wife with no children south dakota form

- South dakota living trust form

- Living trust for individual who is single divorced or widow or widower with children south dakota form

- Living trust for husband and wife with one child south dakota form

- Living trust for husband and wife with minor and or adult children south dakota form

Find out other Form Louisiana Department Of Revenue Louisiana gov Revenue Louisiana

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT