R 1203 WEB 119 2019

What is the R-1203 WEB 119?

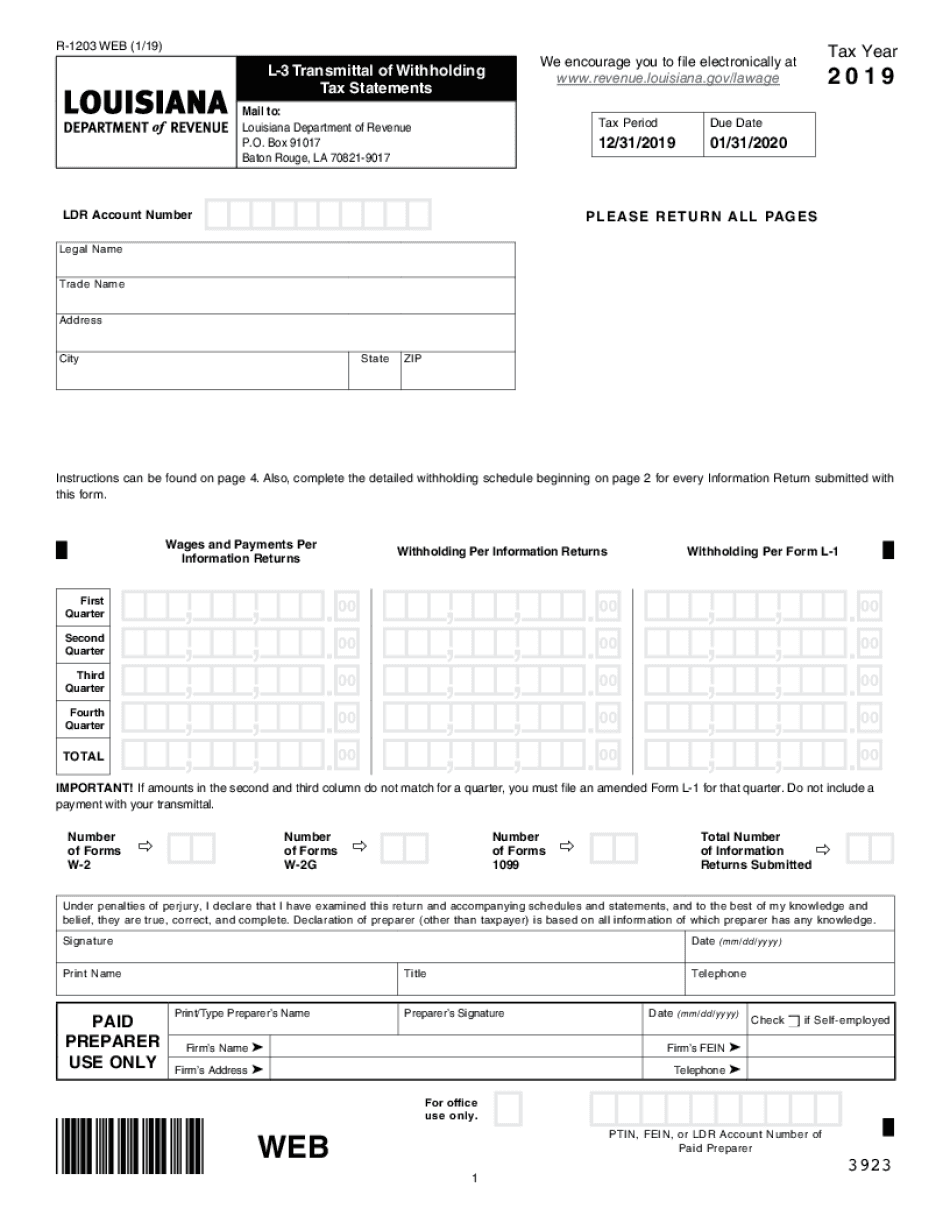

The R-1203 WEB 119 is a specific form used in the state of Louisiana for reporting withholding tax. It is essential for employers to accurately report the amount of state income tax withheld from employee wages. This form is particularly relevant for businesses that operate within Louisiana and have employees subject to state income tax withholding. Understanding the purpose and requirements of the R-1203 WEB 119 is crucial for compliance with state tax regulations.

How to use the R-1203 WEB 119

Using the R-1203 WEB 119 involves several steps to ensure proper completion and submission. Employers must gather the necessary information regarding employee wages and the corresponding tax withheld. The form requires details such as the employer's identification number, the total amount of wages paid, and the total withholding amount. Once the form is filled out accurately, it can be submitted electronically or via mail, depending on the preferred method of submission.

Steps to complete the R-1203 WEB 119

Completing the R-1203 WEB 119 requires careful attention to detail. Follow these steps for accurate submission:

- Gather employee wage data and withholding amounts.

- Fill out the employer identification section with accurate details.

- Calculate the total wages and total withholding for the reporting period.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the state’s tax portal or mail it to the appropriate address.

Legal use of the R-1203 WEB 119

The R-1203 WEB 119 must be used in accordance with Louisiana state laws regarding tax withholding. Employers are legally obligated to report withheld taxes accurately and on time. Failure to comply with these regulations can lead to penalties and interest charges. It is important for employers to stay informed about any changes in tax laws that may affect the use of this form.

Filing Deadlines / Important Dates

Employers should be aware of the filing deadlines associated with the R-1203 WEB 119 to avoid penalties. Typically, this form must be submitted on a quarterly basis, with specific due dates depending on the reporting period. It is essential to mark these dates on the calendar to ensure timely submission and compliance with state tax regulations.

Required Documents

To complete the R-1203 WEB 119, employers must have access to certain documents. These include:

- Employee wage records for the reporting period.

- Documentation of state income tax withheld from employee wages.

- Employer identification information, such as the federal Employer Identification Number (EIN).

Penalties for Non-Compliance

Non-compliance with the requirements for the R-1203 WEB 119 can result in significant penalties. Employers may face fines for late submissions, inaccurate reporting, or failure to file altogether. Understanding these potential penalties emphasizes the importance of accurate and timely completion of the form to avoid unnecessary financial burdens.

Quick guide on how to complete r 1203 web 119

Effortlessly Prepare R 1203 WEB 119 on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly and without delays. Manage R 1203 WEB 119 on any platform using the airSlate SignNow Android or iOS apps and enhance any document-related process today.

The Easiest Way to Edit and eSign R 1203 WEB 119 with Ease

- Find R 1203 WEB 119 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs with just a few clicks from any device of your choice. Edit and eSign R 1203 WEB 119 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 1203 web 119

Create this form in 5 minutes!

How to create an eSignature for the r 1203 web 119

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a la l3 transmittal?

A la l3 transmittal is a document used to formally transmit information or data between parties. In the context of airSlate SignNow, it serves as an essential part of workflow management, ensuring that all documents are sent and received efficiently. Understanding the la l3 transmittal is crucial for optimizing your document processes.

-

How does airSlate SignNow streamline the la l3 transmittal process?

airSlate SignNow simplifies the la l3 transmittal process by allowing users to create, send, and electronically sign documents in a secure environment. This platform offers customizable templates that can accommodate various needs, making the entire process seamless. You can quickly track your la l3 transmittal status and ensure timely communication.

-

Is there a cost associated with using airSlate SignNow for la l3 transmittals?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. These plans provide access to essential features for handling la l3 transmittals and other document workflows without breaking the bank. With airSlate SignNow, you get a cost-effective solution for your eSign needs.

-

What features does airSlate SignNow offer for la l3 transmittal management?

airSlate SignNow includes features like document templates, audit trails, and real-time tracking for all la l3 transmittals. Additionally, you can automate workflows, set reminders, and ensure compliance. These capabilities enhance efficiency and make managing la l3 transmittals much easier.

-

Can I integrate airSlate SignNow with other tools for la l3 transmittals?

Absolutely! airSlate SignNow integrates with various business applications such as CRM systems, cloud storage solutions, and project management tools. These integrations facilitate seamless management of la l3 transmittals across different platforms, making your workflow more efficient and productive.

-

What are the benefits of using airSlate SignNow for la l3 transmittals?

Using airSlate SignNow for la l3 transmittals provides numerous benefits, including increased efficiency, reduced manual errors, and enhanced security. The platform's ease of use empowers teams to focus on critical tasks instead of getting bogged down by paperwork. Additionally, electronic signatures help accelerate the approval process.

-

How secure is the transmission of la l3 transmittals with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption techniques to protect your la l3 transmittals during transmission and storage. You can rest assured that your sensitive information is secure, complying with industry standards and regulations.

Get more for R 1203 WEB 119

Find out other R 1203 WEB 119

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document