PDF RESALE CERTIFICATE Kentucky Department of Revenue 2021

What is the Kentucky resale certificate?

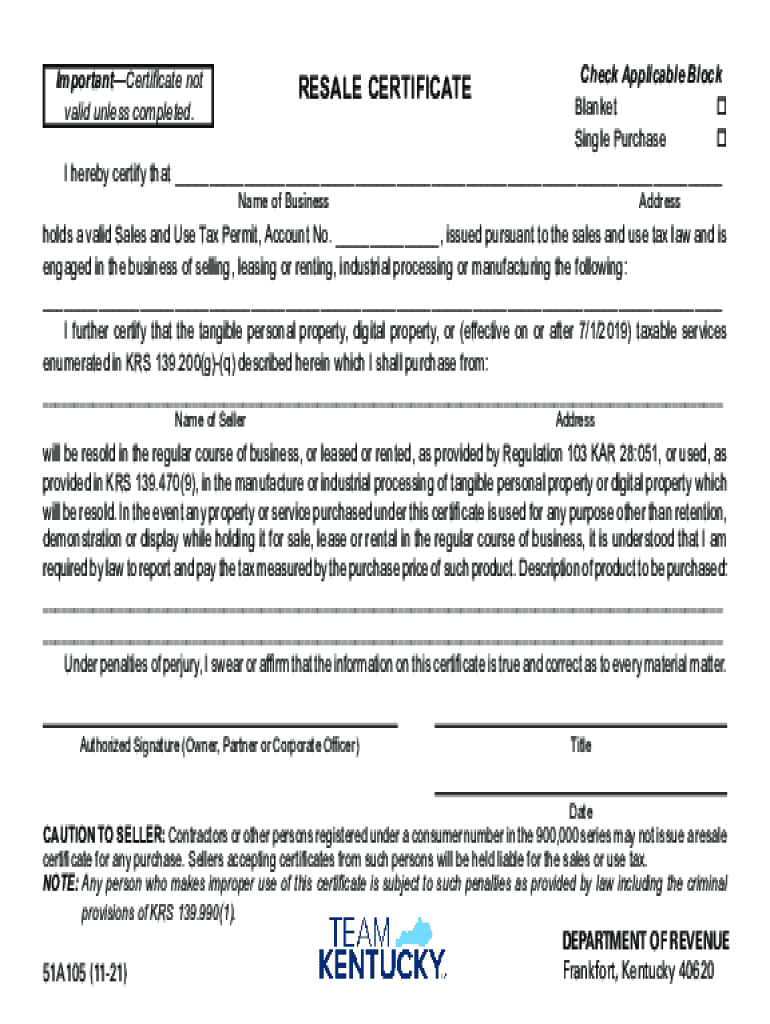

The Kentucky resale certificate is a legal document used by businesses to purchase goods without paying sales tax. This certificate allows retailers to buy items intended for resale, ensuring that they do not incur tax costs on products that will be sold to consumers. The form is issued by the Kentucky Department of Revenue and is essential for businesses looking to maintain compliance with state tax regulations.

How to obtain the Kentucky resale certificate

To obtain a Kentucky resale certificate, businesses must first register with the Kentucky Department of Revenue. This involves completing the necessary application forms and providing relevant business information, such as the business name, address, and tax identification number. Once registered, businesses can download the resale certificate from the department's website or request a physical copy. It is important to ensure that all information is accurate to avoid delays in processing.

Steps to complete the Kentucky resale certificate

Completing the Kentucky resale certificate involves several key steps:

- Download the resale certificate form from the Kentucky Department of Revenue website.

- Fill in the required fields, including the purchaser's name, address, and tax identification number.

- Provide details about the items being purchased for resale, including descriptions and quantities.

- Sign and date the form to certify that the information is true and accurate.

- Submit the completed form to the seller at the time of purchase.

Legal use of the Kentucky resale certificate

The Kentucky resale certificate is legally binding, provided it is completed accurately and used in accordance with state laws. It is crucial for businesses to use the certificate only for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or non-resale items, can result in penalties, including fines and back taxes. Businesses should keep accurate records of all transactions where the resale certificate is used to ensure compliance.

Key elements of the Kentucky resale certificate

Several key elements must be included in the Kentucky resale certificate to ensure its validity:

- Purchaser Information: Name, address, and tax identification number of the purchaser.

- Seller Information: Name and address of the seller from whom goods are being purchased.

- Description of Goods: Detailed descriptions of the items being purchased for resale.

- Signature: The purchaser must sign and date the certificate to affirm its accuracy.

State-specific rules for the Kentucky resale certificate

Businesses must adhere to specific rules when using the Kentucky resale certificate. These rules include ensuring that the certificate is only used for purchases intended for resale and that it is provided to the seller at the time of purchase. Additionally, businesses should be aware of any changes in state tax laws that may affect the use of the resale certificate. Regularly reviewing state guidelines can help businesses remain compliant and avoid potential issues.

Quick guide on how to complete pdf resale certificate kentucky department of revenue

Easily Prepare PDF RESALE CERTIFICATE Kentucky Department Of Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Handle PDF RESALE CERTIFICATE Kentucky Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign PDF RESALE CERTIFICATE Kentucky Department Of Revenue Effortlessly

- Locate PDF RESALE CERTIFICATE Kentucky Department Of Revenue and select Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign PDF RESALE CERTIFICATE Kentucky Department Of Revenue while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf resale certificate kentucky department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf resale certificate kentucky department of revenue

The best way to generate an e-signature for a PDF online

The best way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is a KY resale certificate?

A KY resale certificate is a document that allows businesses in Kentucky to purchase goods without paying sales tax. This certificate is essential for sellers and buyers who engage in resale transactions. It's important to understand how to properly use a KY resale certificate to ensure compliance with tax regulations.

-

How do I apply for a KY resale certificate?

To apply for a KY resale certificate, you need to complete the appropriate application form available on the Kentucky Department of Revenue's website. After submitting the required information, you'll receive your certificate, allowing you to make tax-exempt purchases for resale. airSlate SignNow can help facilitate the document signing process for your application.

-

Are there any fees associated with obtaining a KY resale certificate?

Generally, obtaining a KY resale certificate is free of charge; however, businesses must ensure they are registered for a sales tax permit with the Kentucky Department of Revenue. This registration may have associated fees, and maintaining compliance is essential. Using airSlate SignNow makes managing these documents and signatures effortless.

-

Can I use my KY resale certificate for every purchase?

No, a KY resale certificate can only be used for purchases intended for resale. It cannot be used for personal use or for items that will not be resold. Understanding the proper use of the KY resale certificate is crucial to avoid penalties.

-

What types of businesses typically need a KY resale certificate?

Any business in Kentucky that purchases inventory or goods for resale will benefit from obtaining a KY resale certificate. Retailers, wholesalers, and online sellers commonly utilize this certificate to avoid sales tax on their inventory purchases. airSlate SignNow offers an easy solution for managing and signing relevant paperwork.

-

How long is a KY resale certificate valid?

A KY resale certificate is typically valid until the buyer ceases to operate their business or changes their business type. It's essential to keep your certificate up-to-date and inform the seller of any changes. Regularly reviewing your documents using airSlate SignNow helps ensure compliance.

-

How does airSlate SignNow assist with managing KY resale certificates?

airSlate SignNow provides a user-friendly platform to create, send, and eSign KY resale certificates digitally. This streamlines the process and ensures that documents are stored securely for easy retrieval when needed. Using our service can save you time and enhance your business operations.

Get more for PDF RESALE CERTIFICATE Kentucky Department Of Revenue

- Foreign judgment 497314032 form

- Amended complaint for personal injury by shopping cart mississippi form

- Complaint for injunction mississippi form

- Complaint specific performance

- Imprisonment form

- Petition to commit defendant for mental exam mississippi form

- Personal injury from power lines mississippi form

- Personal injury fell on concrete steps mississippi form

Find out other PDF RESALE CERTIFICATE Kentucky Department Of Revenue

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word