Kentucky Resale Certificate 2013

What is the Kentucky Resale Certificate

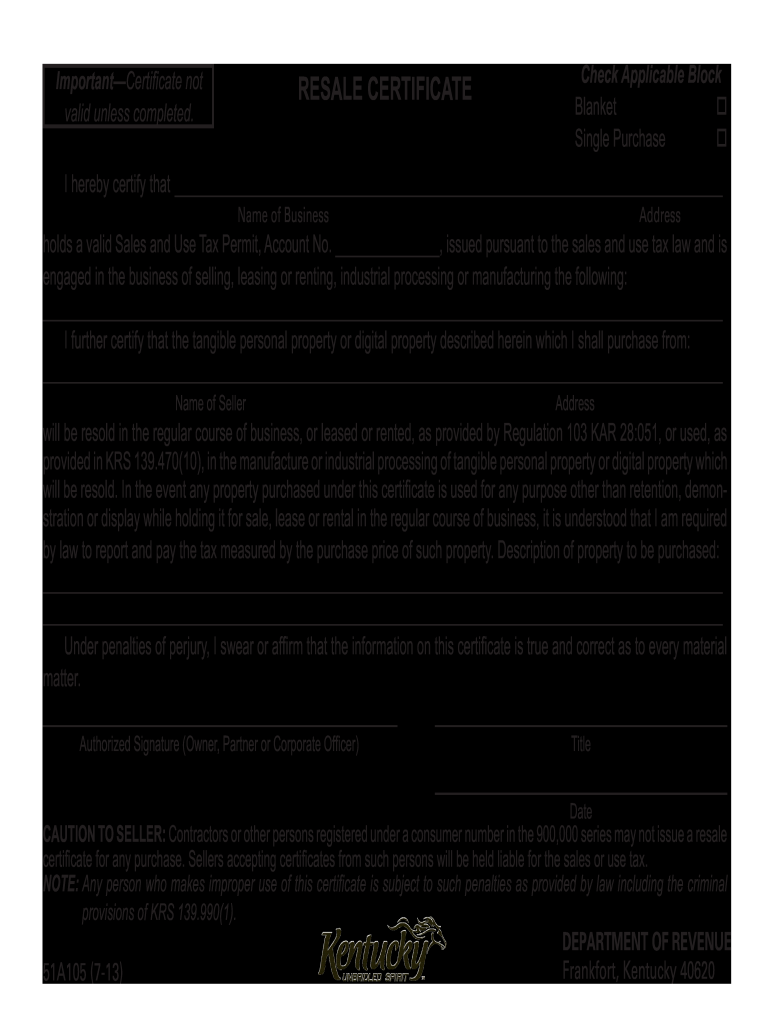

The Kentucky resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate serves as proof that the buyer is exempt from sales tax on items they plan to sell in the regular course of their business. The form is essential for retailers and wholesalers in Kentucky, enabling them to streamline their purchasing process while ensuring compliance with state tax regulations.

How to Use the Kentucky Resale Certificate

To use the Kentucky resale certificate, a buyer must present the completed form to the seller at the time of purchase. The seller should retain a copy of the certificate for their records, as it provides evidence that the transaction is exempt from sales tax. It is important for the buyer to ensure that the certificate is filled out accurately, including their business name, address, and the nature of the goods being purchased for resale. Failure to present a valid resale certificate may result in the buyer being charged sales tax on the transaction.

Steps to Complete the Kentucky Resale Certificate

Completing the Kentucky resale certificate involves several straightforward steps:

- Obtain the fillable Kentucky resale certificate form, typically available from the Kentucky Department of Revenue or online.

- Fill in the business name and address of the purchaser, ensuring that all information is accurate.

- Specify the type of goods being purchased for resale.

- Sign and date the form to validate it.

- Provide a copy of the completed form to the seller at the time of purchase.

Legal Use of the Kentucky Resale Certificate

The legal use of the Kentucky resale certificate is strictly defined by state tax laws. It is intended solely for the purchase of items that will be resold in the regular course of business. Misuse of the certificate, such as using it for personal purchases or for items not intended for resale, can lead to penalties and back taxes owed to the state. Businesses must ensure that they understand the legal implications of using the resale certificate to avoid potential issues with tax compliance.

Eligibility Criteria

To be eligible for a Kentucky resale certificate, a business must be registered with the Kentucky Department of Revenue and possess a valid sales tax permit. The business must be engaged in the sale of tangible personal property or taxable services. Additionally, the goods purchased using the resale certificate must be intended for resale, not for personal use or consumption. It is essential for businesses to maintain accurate records to support their eligibility for using the resale certificate.

Required Documents

When applying for a Kentucky resale certificate, businesses need to provide specific documentation to verify their eligibility. This includes:

- A valid Kentucky sales tax permit.

- Proof of business registration, such as a business license or incorporation documents.

- Any additional documentation that may be required by the Kentucky Department of Revenue.

Having these documents ready ensures a smooth application process and compliance with state regulations.

Quick guide on how to complete ky resale certificate 2013 2019 form

Your assistance manual on how to prepare your Kentucky Resale Certificate

If you’re curious about how to finalize and submit your Kentucky Resale Certificate, here are a few straightforward instructions on how to make tax reporting less challenging.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and complete your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information where necessary. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Kentucky Resale Certificate in a matter of minutes:

- Create your account and start handling PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Get form to access your Kentucky Resale Certificate in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delay refunds. As always, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ky resale certificate 2013 2019 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the ky resale certificate 2013 2019 form

How to make an eSignature for your Ky Resale Certificate 2013 2019 Form online

How to make an electronic signature for the Ky Resale Certificate 2013 2019 Form in Chrome

How to generate an electronic signature for putting it on the Ky Resale Certificate 2013 2019 Form in Gmail

How to make an electronic signature for the Ky Resale Certificate 2013 2019 Form straight from your smart phone

How to generate an electronic signature for the Ky Resale Certificate 2013 2019 Form on iOS devices

How to create an electronic signature for the Ky Resale Certificate 2013 2019 Form on Android

People also ask

-

What is a fillable Kentucky resale certificate 2019?

A fillable Kentucky resale certificate 2019 is a legal document used by sellers in Kentucky to purchase goods without paying sales tax. This certificate allows businesses to buy items intended for resale, helping to streamline the purchasing process. Using airSlate SignNow, you can easily create and fill out this document digitally.

-

How can I obtain a fillable Kentucky resale certificate 2019?

You can obtain a fillable Kentucky resale certificate 2019 by visiting the official Kentucky Department of Revenue website or through platforms like airSlate SignNow that provide editable templates. Once you have the template, simply fill in the required information and save or print it for use. It's quick and convenient!

-

Are there any fees associated with using the fillable Kentucky resale certificate 2019?

There are no direct fees for using the fillable Kentucky resale certificate 2019 itself, as it is a government-issued form. However, if you choose to use airSlate SignNow for document management and eSigning, there may be subscription fees. It's a cost-effective solution considering the ease of use and efficiency it provides.

-

What features does the airSlate SignNow platform offer for a fillable Kentucky resale certificate 2019?

The airSlate SignNow platform offers various features for managing your fillable Kentucky resale certificate 2019, including secure eSigning, document storage, and easy sharing options. You can also integrate with other business applications to automate your workflows. These features enhance efficiency and ensure compliance with state requirements.

-

What are the benefits of using airSlate SignNow for fillable Kentucky resale certificates?

Using airSlate SignNow for fillable Kentucky resale certificates allows for faster processing and signature collection. It eliminates the need for paper and reduces the risk of errors with automated form-filling capabilities. Additionally, you can easily track and manage your documents, ensuring you are always compliant with tax regulations.

-

Can the fillable Kentucky resale certificate 2019 be signed electronically?

Yes, the fillable Kentucky resale certificate 2019 can be signed electronically using airSlate SignNow. Electronic signatures are legally binding and recognized in Kentucky, providing a convenient solution for businesses. This feature saves time and simplifies the documentation process, especially for those who operate remotely.

-

What integrations does airSlate SignNow provide for working with the fillable Kentucky resale certificate 2019?

airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Salesforce, allowing easy access and management of your fillable Kentucky resale certificate 2019. These integrations enhance your workflow by connecting all essential tools into one streamlined platform and improving overall productivity.

Get more for Kentucky Resale Certificate

- Mchr 44 labor mo form

- Continuation sheet quarterly wage report dol ks form

- Michigan form 5092pdffillercom

- Cognitive thinking reports form

- To file a dc franchise otr cfo dc form

- Oil and gas withholding statement dr 0021w colorado form

- Provider directory wv public employees insurance agency state peia wv form

- Oregon estimated tax voucher form

Find out other Kentucky Resale Certificate

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word