Form TX 17 "Quarterly Tax and Wage Report" Rhode Island 2022

What is the Form TX 17 "Quarterly Tax And Wage Report" Rhode Island

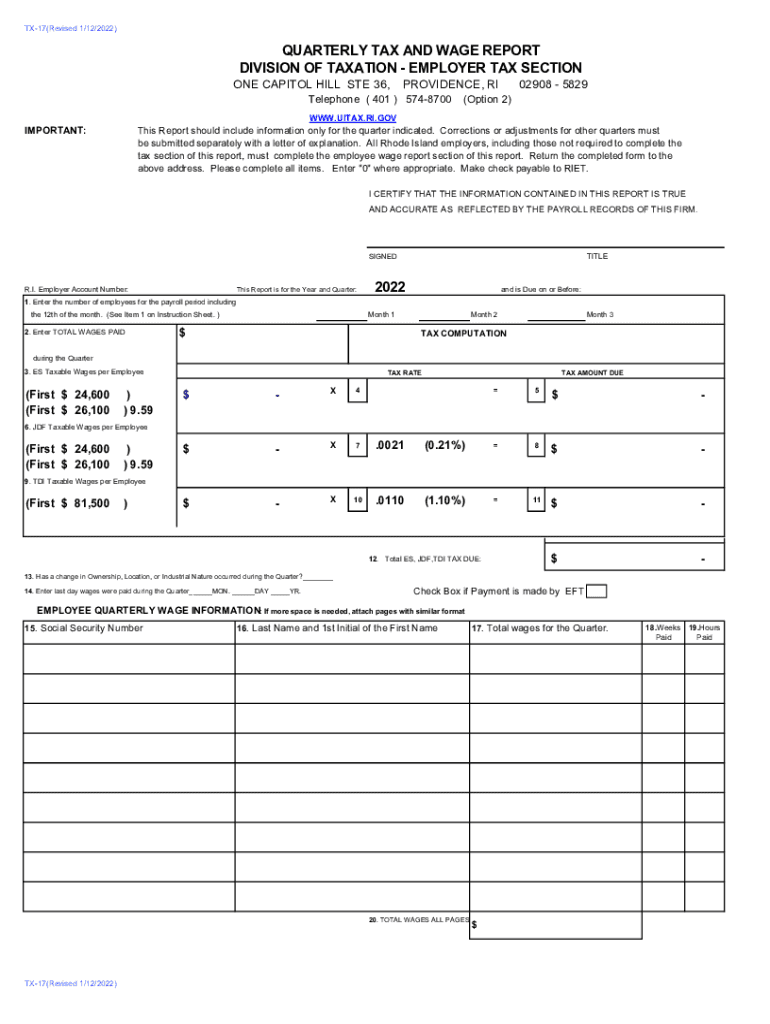

The Form TX 17, also known as the Quarterly Tax and Wage Report, is a crucial document for employers in Rhode Island. This form is used to report wages paid to employees and the corresponding taxes withheld during a specific quarter. It ensures compliance with state tax laws and helps maintain accurate records for both employers and the state. The information provided on this form is essential for calculating unemployment insurance and other tax liabilities, making it a vital part of the payroll process.

Steps to Complete the Form TX 17 "Quarterly Tax And Wage Report" Rhode Island

Completing the Form TX 17 involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll information for the reporting period, including total wages paid, employee details, and tax withholdings. Next, accurately fill out each section of the form, ensuring that all figures are correct and match your payroll records. After completing the form, review it for any errors before submission. Finally, ensure that you submit the form by the designated deadline to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form TX 17 are critical for compliance. Employers must submit this form quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, the deadlines for the first, second, third, and fourth quarters are usually April 30, July 31, October 31, and January 31, respectively. It is essential to be aware of these dates to avoid late fees and maintain good standing with state tax authorities.

Required Documents

To accurately complete the Form TX 17, employers need to have several documents on hand. These include payroll records for the reporting period, employee W-2 forms, and any records of tax withholdings. Additionally, having previous TX 17 forms can be helpful for reference. Ensuring that all necessary documentation is organized and accessible will streamline the completion process and help prevent errors.

Legal Use of the Form TX 17 "Quarterly Tax And Wage Report" Rhode Island

The legal use of the Form TX 17 is governed by Rhode Island state tax laws. This form must be completed accurately to reflect the wages paid and taxes withheld, as it serves as an official record for both the employer and the state. Failure to submit this form or submitting inaccurate information can lead to penalties, including fines and potential legal action. Therefore, understanding the legal implications of this form is crucial for all employers.

Digital vs. Paper Version

The Form TX 17 is available in both digital and paper formats, allowing employers flexibility in how they choose to submit their reports. The digital version offers advantages such as ease of completion, automatic calculations, and faster submission times. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete form tx 17 ampquotquarterly tax and wage reportampquot rhode island

Prepare Form TX 17 "Quarterly Tax And Wage Report" Rhode Island effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Handle Form TX 17 "Quarterly Tax And Wage Report" Rhode Island on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form TX 17 "Quarterly Tax And Wage Report" Rhode Island easily

- Locate Form TX 17 "Quarterly Tax And Wage Report" Rhode Island and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight key areas of the documents or redact sensitive information with features specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only a few moments and carries the same legal validity as a traditional wet ink signature.

- Review all information thoroughly and then click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form TX 17 "Quarterly Tax And Wage Report" Rhode Island and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tx 17 ampquotquarterly tax and wage reportampquot rhode island

Create this form in 5 minutes!

How to create an eSignature for the form tx 17 ampquotquarterly tax and wage reportampquot rhode island

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is RI TX 17 and how does it relate to airSlate SignNow?

RI TX 17 refers to a specific process or feature within the airSlate SignNow platform that enhances document management. With airSlate SignNow, RI TX 17 makes signing and sending documents streamlined and efficient for businesses, facilitating a faster workflow.

-

What are the pricing plans for airSlate SignNow related to RI TX 17?

AirSlate SignNow offers various pricing plans tailored to different business sizes and needs. The RI TX 17 features are included in these plans, ensuring you have access to essential e-signature tools without breaking the bank.

-

What features does airSlate SignNow provide for RI TX 17?

AirSlate SignNow includes features such as custom workflows, document templates, and collaboration tools, all of which are relevant to RI TX 17. These functionalities make document signing simple and intuitive, helping your team work more effectively.

-

How can RI TX 17 benefit my business?

Utilizing RI TX 17 with airSlate SignNow can signNowly reduce the time it takes to sign documents. This efficiency not only enhances productivity but also improves client satisfaction by expediting the document turnaround process.

-

Can I integrate airSlate SignNow with other applications when using RI TX 17?

Yes, airSlate SignNow supports integration with various third-party applications, which works seamlessly alongside the RI TX 17 features. This flexibility allows businesses to tailor their document processes according to their existing tech stack.

-

Is airSlate SignNow secure when managing documents via RI TX 17?

Absolutely, airSlate SignNow employs robust security measures to protect your documents, including those processed through RI TX 17. Features like SSL encryption and secure storage ensure that your sensitive information remains safe.

-

What types of documents can I send and sign with RI TX 17 using airSlate SignNow?

With RI TX 17 on airSlate SignNow, you can manage a wide range of documents, including contracts, agreements, and forms. The platform makes it easy to upload, send, and e-sign these documents with minimal hassle.

Get more for Form TX 17 "Quarterly Tax And Wage Report" Rhode Island

Find out other Form TX 17 "Quarterly Tax And Wage Report" Rhode Island

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement