Ri Tx 17 Form 2019

What is the RI TX 17 Form

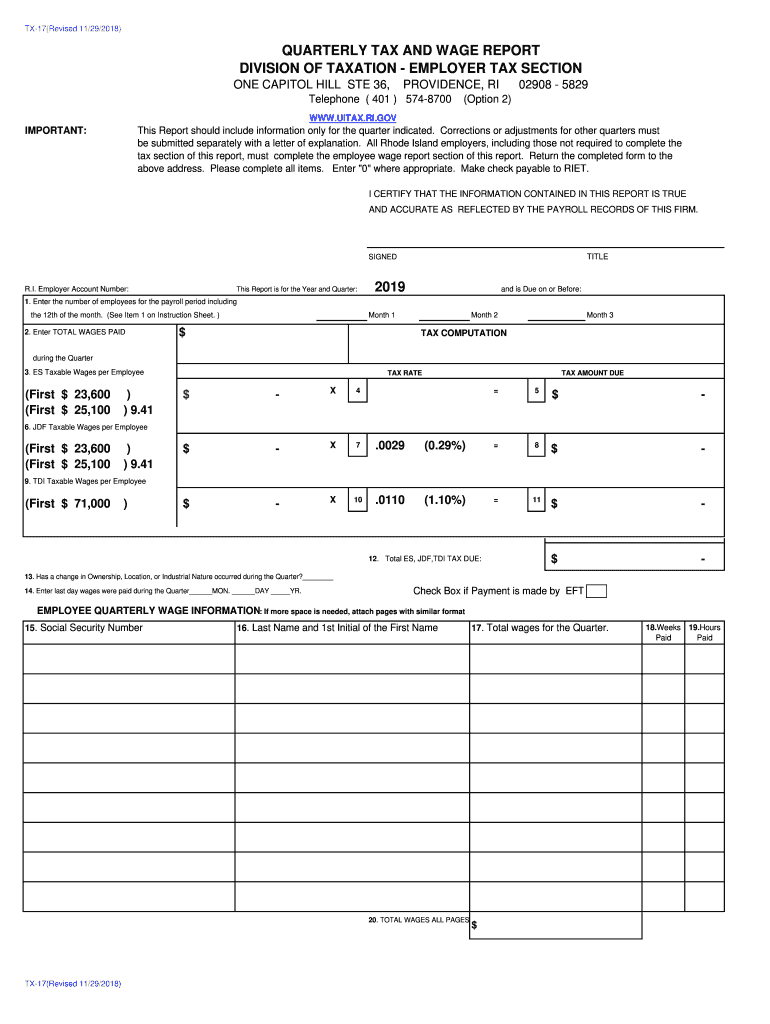

The RI TX 17 Form is a tax document used in Rhode Island for reporting income and calculating tax liabilities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It collects various financial information, including income sources, deductions, and credits, to determine the overall tax obligation. Understanding the purpose and structure of the RI TX 17 Form is crucial for accurate tax reporting.

How to Use the RI TX 17 Form

Using the RI TX 17 Form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it carefully for any errors before signing and submitting it. The form can be filed electronically or mailed to the appropriate state tax authority, depending on your preference.

Steps to Complete the RI TX 17 Form

Completing the RI TX 17 Form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Access the RI TX 17 Form online or obtain a physical copy.

- Begin filling out the form, starting with personal information such as name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and dividends.

- List any deductions and credits applicable to your situation.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy and sign it before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the RI TX 17 Form. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any changes in deadlines that may arise due to state or federal regulations. Keeping track of these important dates helps ensure timely compliance and avoids penalties.

Form Submission Methods (Online / Mail / In-Person)

The RI TX 17 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Rhode Island Division of Taxation's website, which offers a streamlined process.

- Mail: For those who prefer a paper submission, the completed form can be mailed to the designated tax office. Ensure to use the correct address to avoid delays.

- In-Person: Taxpayers may also choose to submit the form in person at local tax offices, where assistance may be available.

Legal Use of the RI TX 17 Form

The RI TX 17 Form is legally recognized for tax reporting in Rhode Island. It must be completed accurately and submitted in compliance with state laws to avoid penalties. The form's legal validity is supported by adherence to the guidelines set forth by the Rhode Island Division of Taxation. Taxpayers should ensure that all information provided is truthful and complete to maintain compliance and avoid potential legal issues.

Quick guide on how to complete quarterly tax and wage report division of taxation employer tax

Your assistance manual on preparing your Ri Tx 17 Form

If you are curious about how to finalize and submit your Ri Tx 17 Form, here are a few straightforward tips to streamline tax declaration.

To begin, all you need to do is set up your airSlate SignNow profile to alter your approach to managing documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, reverting to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and simple sharing options.

Follow the steps below to complete your Ri Tx 17 Form in no time:

- Establish your account and start working on PDFs in moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to open your Ri Tx 17 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Leverage the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in hard copy may increase return errors and delay refunds. It is advisable to check the IRS website for filing guidelines in your jurisdiction before electronically filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct quarterly tax and wage report division of taxation employer tax

FAQs

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

I am being made redundant and my employer want me to help them fill out tax forms after I leave, can I charge them a consultancy fee for this?

You are not obligated to do work for an employer after your last date of employment. Generally, if you are asked to do work for them after you leave, you should:determine if you are interested since this will impact time you can give to a job searchbe polite however you answer because being asked to do additional work for them does reflect well on your work with themhave some idea of what you would do the work for. Unless you have access to medical or other lost benefits, you would typically expect to be paid somewhat more than you were paid in salary (because you now have to provide your own benefits). ask them to make you an offer and put it in writing including what the responsibilities will be, the dates they anticipate you will be needed, will you have to work through a contract provider, etc. Be sure this documentation includes how and on what timing you will be paid (do you have to invoice them, etc.) Once you are doing this job, work hard specifically on your responsibilities. If they ask for additional types of work, remind them politely of what your documentation requested, but indicate you'll be glad to do it as long as a change in documentation is promptly done (and you should take responsibility to make sure that happens).So, bottom line, negotiate the fee or payment and complete all the documentation before you do the work, so that everythi is clear to you and your former employer.Thanks for the A2A.

Create this form in 5 minutes!

How to create an eSignature for the quarterly tax and wage report division of taxation employer tax

How to generate an electronic signature for your Quarterly Tax And Wage Report Division Of Taxation Employer Tax in the online mode

How to create an eSignature for your Quarterly Tax And Wage Report Division Of Taxation Employer Tax in Chrome

How to make an electronic signature for signing the Quarterly Tax And Wage Report Division Of Taxation Employer Tax in Gmail

How to create an electronic signature for the Quarterly Tax And Wage Report Division Of Taxation Employer Tax from your smart phone

How to create an electronic signature for the Quarterly Tax And Wage Report Division Of Taxation Employer Tax on iOS

How to create an eSignature for the Quarterly Tax And Wage Report Division Of Taxation Employer Tax on Android devices

People also ask

-

What is the tx 17 form ri used for?

The tx 17 form ri is a vital document for specific tax reporting purposes in Rhode Island. It allows businesses to declare their income and calculate their tax liabilities accurately. By utilizing airSlate SignNow, you can efficiently eSign and submit your tx 17 form ri.

-

How much does using airSlate SignNow for tx 17 form ri cost?

AirSlate SignNow offers a range of pricing plans tailored to different business needs. Our cost-effective solutions ensure that you can easily manage your tx 17 form ri and other documents without breaking the bank. You can check our website for detailed pricing options.

-

Can I integrate airSlate SignNow with other applications for the tx 17 form ri?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow. Whether you need to connect with CRM systems, cloud storage, or other software, you can streamline the submission of your tx 17 form ri with our integrations. This makes document handling signNowly more efficient.

-

What features does airSlate SignNow offer for managing the tx 17 form ri?

AirSlate SignNow provides numerous features designed to simplify the management of your tx 17 form ri. Key features include eSignature capabilities, document templates, and tracking tools, which help you monitor the status of your form in real-time. These capabilities ensure a smooth and compliant submission process.

-

Is airSlate SignNow secure for submitting the tx 17 form ri?

Absolutely! AirSlate SignNow prioritizes your data security with advanced encryption and compliance with industry standards. When sending and eSigning your tx 17 form ri, you can rest assured that your information is protected, ensuring confidentiality and integrity.

-

How can airSlate SignNow help speed up the tx 17 form ri process?

Utilizing airSlate SignNow can signNowly expedite the tx 17 form ri process by enabling electronic signatures and automated workflows. This reduces the need for printing, signing, and scanning documents, leading to quicker submission times and minimized errors. Efficient document handling ensures that you meet deadlines promptly.

-

Can I track the status of my tx 17 form ri using airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking capabilities for your tx 17 form ri. You can easily monitor who has signed the document and if any actions are still pending. This transparency helps keep your document management organized and efficient.

Get more for Ri Tx 17 Form

- Regional economies create differences worksheet answer key form

- Henderson county 113 north main street hendersonville nc 28792 form

- Lease print out form

- Oppe template form

- Application form for new passport bangladesh

- Niceic online form

- Consignment sale contract template form

- Gig contract template form

Find out other Ri Tx 17 Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation