QUARTERLY TAX and WAGE REPORT DEPARTMENT of LABOR 2022-2026

Understanding the Quarterly Tax and Wage Report

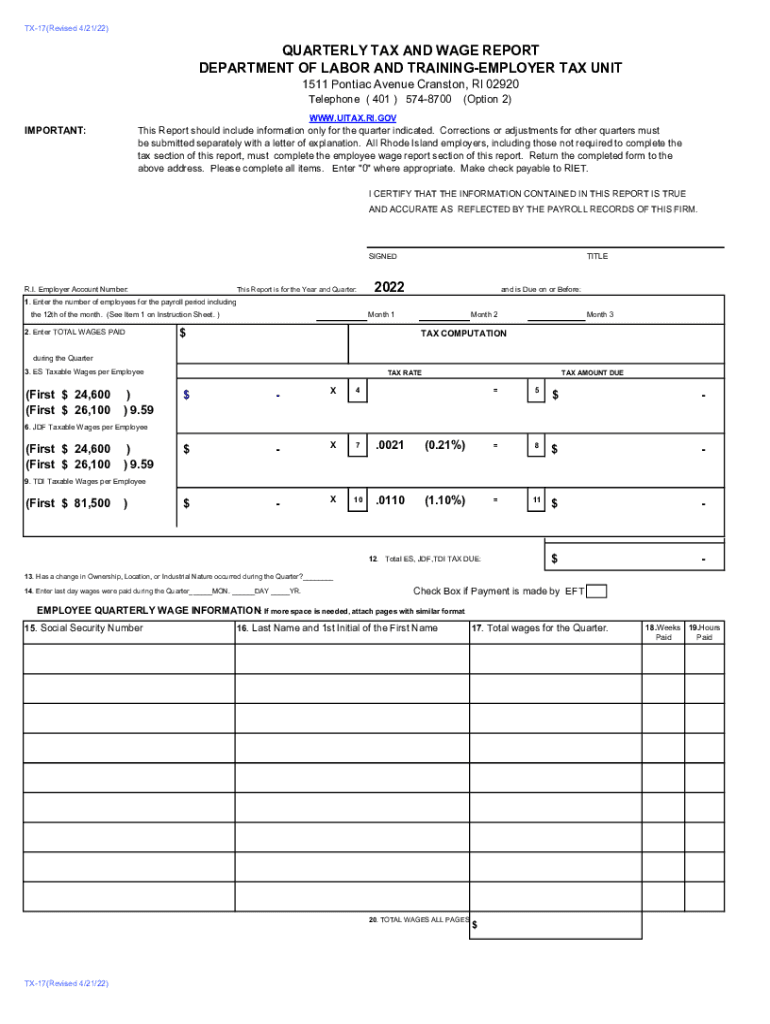

The Quarterly Tax and Wage Report, often referred to as the TX 17 form in Rhode Island, is a crucial document for employers. It is used to report employee wages and the associated taxes withheld during a specific quarter. This report is essential for compliance with state labor laws and tax regulations. Employers must accurately complete this form to ensure proper tax reporting and to avoid potential penalties.

Steps to Complete the Quarterly Tax and Wage Report

Completing the TX 17 form involves several key steps:

- Gather Employee Information: Collect all necessary data, including employee names, Social Security numbers, and total wages paid during the quarter.

- Calculate Taxes Withheld: Determine the total amount of state and federal taxes withheld from each employee's wages.

- Fill Out the Form: Accurately input the gathered information into the TX 17 form, ensuring all fields are completed correctly.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: File the completed TX 17 form by the specified deadline, either online or via mail.

Legal Use of the Quarterly Tax and Wage Report

The TX 17 form is legally required for all employers in Rhode Island. It serves as an official record of wages and taxes, which can be reviewed by state authorities. Proper completion of this form ensures compliance with the Rhode Island Department of Labor and Training regulations. Employers must retain copies of submitted forms for their records, as they may be required for audits or other legal inquiries.

Filing Deadlines and Important Dates

Employers must adhere to specific deadlines for submitting the TX 17 form. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31

Missing these deadlines can result in penalties and interest on unpaid taxes.

Submission Methods for the Quarterly Tax and Wage Report

Employers have several options for submitting the TX 17 form:

- Online Submission: Many employers prefer to file electronically through the Rhode Island Department of Labor and Training's online portal.

- Mail: Employers can also print the completed form and send it via postal mail to the appropriate state office.

- In-Person: Submissions can be made in person at designated state offices, providing an opportunity for immediate confirmation of receipt.

Key Elements of the Quarterly Tax and Wage Report

The TX 17 form includes several critical components that must be accurately reported:

- Employer Information: Name, address, and employer identification number (EIN).

- Employee Details: Information for each employee, including total wages and taxes withheld.

- Tax Calculations: Total state and federal taxes owed based on reported wages.

Each section must be completed thoroughly to ensure compliance and avoid discrepancies.

Quick guide on how to complete quarterly tax and wage report department of labor

Complete QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to edit and electronically sign QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR with ease

- Obtain QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly tax and wage report department of labor

Create this form in 5 minutes!

How to create an eSignature for the quarterly tax and wage report department of labor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ri tx 17 and how does it relate to airSlate SignNow?

RI TX 17 refers to a specific document type or format that can be managed using airSlate SignNow. With airSlate SignNow, you can seamlessly send, sign, and store RI TX 17 documents, streamlining your workflow and enhancing productivity.

-

What are the pricing options for using airSlate SignNow for RI TX 17 documents?

AirSlate SignNow offers competitive pricing plans tailored for businesses managing RI TX 17 documents. Whether you're a small business or a larger enterprise, there are cost-effective solutions available that fit your needs and budget.

-

How can airSlate SignNow benefit my business when handling RI TX 17 documents?

Using airSlate SignNow for RI TX 17 documents helps simplify the signing process, reduces paperwork, and accelerates transactions. This not only saves time but also minimizes errors, allowing your business to operate more efficiently.

-

Does airSlate SignNow integrate with other software for RI TX 17 document management?

Yes, airSlate SignNow integrates smoothly with numerous third-party applications, enhancing your ability to manage RI TX 17 documents. This flexibility ensures you can incorporate it easily into your existing business processes.

-

Is it easy to eSign RI TX 17 documents with airSlate SignNow?

Absolutely! AirSlate SignNow offers an intuitive interface that makes eSigning RI TX 17 documents straightforward. Users can electronically sign from any device, ensuring a quick and hassle-free signing experience.

-

Can I track the status of my RI TX 17 documents in airSlate SignNow?

Yes, airSlate SignNow provides tracking features for RI TX 17 documents. You can easily monitor the status of your documents in real-time, giving you peace of mind and allowing for better follow-up.

-

What security measures does airSlate SignNow implement for RI TX 17?

AirSlate SignNow prioritizes security with advanced encryption and compliance standards for RI TX 17 documents. Your sensitive information is safeguarded, ensuring secure transactions and peace of mind for your business.

Get more for QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR

Find out other QUARTERLY TAX AND WAGE REPORT DEPARTMENT OF LABOR

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple