Quarterly Tax and Wage Report Division of Taxation Rhode Island 2017

What is the Quarterly Tax And Wage Report Division Of Taxation Rhode Island

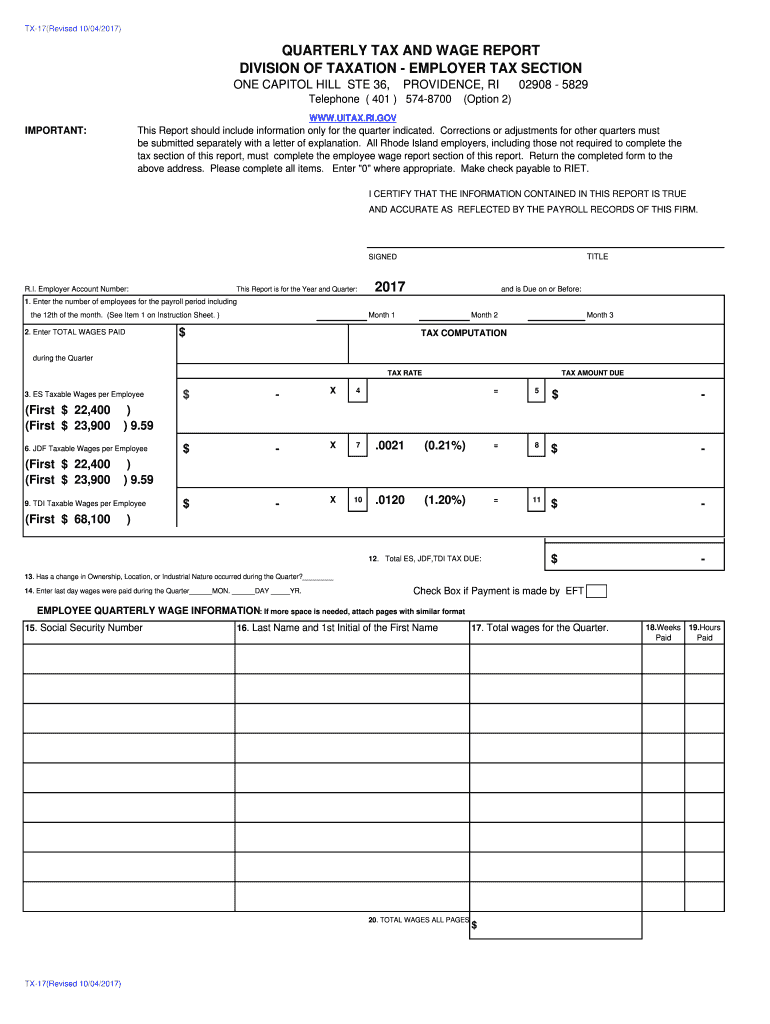

The Quarterly Tax And Wage Report Division Of Taxation Rhode Island is a crucial document for employers in the state. It serves as a means for businesses to report wages paid to employees and the associated tax liabilities. This form is essential for compliance with state tax regulations and ensures that employers meet their obligations regarding unemployment insurance and employee withholding taxes. By accurately completing this report, employers contribute to the funding of state programs that support workers and their families.

Steps to complete the Quarterly Tax And Wage Report Division Of Taxation Rhode Island

Completing the Quarterly Tax And Wage Report involves several key steps. First, gather all necessary payroll records for the reporting period, including total wages paid and the number of employees. Next, accurately fill out the form, ensuring all fields are completed with the correct information. It is important to double-check calculations for accuracy, as errors can lead to penalties. Once completed, the form can be submitted online, by mail, or in person, depending on the preferences of the employer.

Filing Deadlines / Important Dates

Employers must be aware of the specific filing deadlines for the Quarterly Tax And Wage Report in Rhode Island. Typically, the report is due on the last day of the month following the end of each quarter. For example, the report for the first quarter, covering January to March, is due by April 30. Missing these deadlines can result in late fees and penalties, so it is crucial for employers to mark these dates on their calendars and ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Quarterly Tax And Wage Report in Rhode Island. The form can be completed and submitted online through the Division of Taxation's website, which is often the most efficient method. Alternatively, employers may choose to print the form and submit it by mail. In-person submissions are also accepted at designated tax offices. Each method has its own advantages, and employers should select the one that best fits their needs.

Key elements of the Quarterly Tax And Wage Report Division Of Taxation Rhode Island

Key elements of the Quarterly Tax And Wage Report include essential information such as the employer's identification number, total wages paid during the quarter, and the amount of taxes withheld. Additionally, the report requires details about the number of employees and any adjustments for previous quarters. Accurate reporting of these elements is vital for compliance and helps ensure that employers fulfill their tax obligations effectively.

Legal use of the Quarterly Tax And Wage Report Division Of Taxation Rhode Island

The legal use of the Quarterly Tax And Wage Report is governed by state tax laws and regulations. Employers are required to submit this report as part of their tax compliance obligations. Failure to file or inaccuracies in the report can lead to legal repercussions, including fines and penalties. Understanding the legal framework surrounding this report is essential for employers to avoid potential issues and maintain compliance with state laws.

Quick guide on how to complete quarterly tax and wage report division of taxation rhode island

Your assistance manual on how to prepare your Quarterly Tax And Wage Report Division Of Taxation Rhode Island

If you're curious about how to generate and submit your Quarterly Tax And Wage Report Division Of Taxation Rhode Island, here are a few straightforward directions on how to facilitate tax processing.

To commence, you only need to sign up for your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to alter, create, and finalize your tax documents with simplicity. With its editor, you can toggle between text, checkboxes, and eSignatures and revise information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Quarterly Tax And Wage Report Division Of Taxation Rhode Island in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Quarterly Tax And Wage Report Division Of Taxation Rhode Island in our editor.

- Complete the required fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for claiming rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct quarterly tax and wage report division of taxation rhode island

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

Why did the colonists fight the American Revolution?

The causes of the American Revolution revolve around one central issue: taxation. I will also focus on some other issues though. This is going to be a very in-depth answer, so I hope you have the patience to stick around.1763You see, before 1763, British administration of the American colonies was very hands-off, and the colonies were allowed large degrees of autonomy, with most state functions (including taxation) being delegated to local assemblies such as the Virginia House of Burgesses.After the end Seven Years War in 1763, the new Prime Minister George Grenville had three major issues to deal with.How to defend Britain’s overseas holdings.How to check the colonists’ unceasing claims on Native American lands.How the fuck are we supposed to get money?The plan for point one was to have British regular troops man a line of forts from Canada to Florida, to protect the colonies from enemies on all sides. While this was ostensibly for the colonists’ protection, the colonists themselves felt like the troops were more of an occupation force. Their thought process was “Well, we just won a war against the French, so the biggest threat to us is gone. Now you station troops in our lands?” The whole thing reeked of despotism, and the colonists didn’t like it one bit.The second point was addressed by George III, who announced the Proclamation Line of 1763, which was a line drawn down the Appalachian Mountains. It restricted the colonists to the east side, and left the western side to the American Indians. Unfortunately, all this really did was stir up resentment for Britain, as land was becoming a rarer and more expensive commodity in the colonies.The third point was the big one. Britain had accumulated over £120,000,000 in debt by the end of the war with the French. Grenville needed to pay for this somehow, so he resolved to raise taxes on the people of the empire. At this point, he did not tax the colonists too hard; he merely thought that they should send more tax back to the mother country than the meager amount they were currently paying in tax to the central government. So the Prime Minister passed the Sugar Act.1764The colonists had been evading the six pence duty on molasses by bribing the agents who were supposed to monitor it with one and a half pence, so they would keep quiet. Grenville thought that by cutting the tax in half, that the colonists would be encouraged to use their money for paying the tax, rather than bribing the agents tasked with collecting it. They were not expecting any sort of pushback whatsoever.They were wrong in this assumption. The formerly lax tax collectors were replaced with incorruptible and diligent agents. This made the bribery (yes, the colonists still planned to do that) nearly impossible, and the colonists were stuck with paying twice what they used to be able to bribe the tax collectors with. On top of this, the Sugar Act signNowed the colonies during a post-war economic recession. This further angered the colonists who had little money to spare.The colonists began urging Parliament to repeal the Act. Some did so on purely economic terms, but others began arguing that Parliament did not have the right to tax the colonies, because the colonists were not represented in Parliament. The idea that your property should not be unjustly taxed went all the way back to the English Civil Wars. Where property rights existed, there was liberty. Where property rights did not exist, tyranny reigned. The colonists believed that they had the right to not be unfairly taxed, because, after all, they were proud Englishmen.1765Grenville’s ministry didn’t really pay much attention to the opposition, and decided to go ahead with phase two of their revenue plan: the Stamp Act. It was a tax on paper. The paper would be distributed by officials from Britain, and it was required that most printed materials would be printed on the stamped paper. The act was scheduled to take effect November 1, 1765.Opposition to this Act was strong, however, and dissidence rang throughout the Thirteen Colonies. In the Virginia House of Burgesses, Patrick Henry made his first appearance on the revolutionary stage with a vehement speech opposing Parliament’s taxes, and the next day, the Virginia Resolves were passed by the House of Burgesses. They stated, as follows:Resolved, that the first adventurers and settlers of His Majesty's colony and dominion of Virginia brought with them and transmitted to their posterity, and all other His Majesty's subjects since inhabiting in this His Majesty's said colony, all the liberties, privileges, franchises, and immunities that have at any time been held, enjoyed, and possessed by the people of Great Britain.Resolved, that by two royal charters, granted by King James I, the colonists aforesaid are declared entitled to all liberties, privileges, and immunities of denizens and natural subjects to all intents and purposes as if they had been abiding and born within the Realm of England.Resolved, that the taxation of the people by themselves, or by persons chosen by themselves to represent them, who can only know what taxes the people are able to bear, or the easiest method of raising them, and must themselves be affected by every tax laid on the people, is the only security against a burdensome taxation, and the distinguishing characteristic of British freedom, without which the ancient constitution cannot exist.Resolved, that His Majesty's liege people of this his most ancient and loyal colony have without interruption enjoyed the inestimable right of being governed by such laws, respecting their internal policy and taxation, as are derived from their own consent, with the approbation of their sovereign, or his substitute; and that the same has never been forfeited or yielded up, but has been constantly recognized by the kings and people of Great Britain.Resolved, therefor that the General Assembly of this Colony have the only and exclusive Right and Power to lay Taxes and Impositions upon the inhabitants of this Colony and that every Attempt to vest such Power in any person or persons whatsoever other than the General Assembly aforesaid has a manifest Tendency to destroy British as well as American Freedom.The Virginia Resolves (coming from the largest and most influential colony) circulated throughout the colonies during the summer, and many colonies passed similar resolves. The first signs of colonial unity began to show.In Massachusetts, the opposition took a more violent approach. An effigy of a stamp distributor was hanged from a tree, and when a sheriff tried to take it down, he was stopped by an angry mob. That night, a shoemaker led a crowd down to the stamp distributor’s offices by the docks. They smashed the offices to splinters. Then they went down to the distributor’s home, carrying the effigy. They beheaded it in front of the house, and then stamped it into the ground (hahaha, these guys are a riot). They then smashed up the distributor’s house, before retiring for the night.The next day, a delegation from the mob contacted the stamp distributor and said “Why don’t you just resign?” and the distributor said “Yeah, I think that would be good.”In August, the mob reconvened. They managed to get themselves very drunk, and decided to attack the house of the local governor, Thomas Hutchinson. They gave it the same treatment as they did to all the other houses they systematically dismantled. The destruction, however, was highly organized and disciplined. This stoic opposition to a law that wasn’t even going into effect for months shocked and startled the politicians back in Britain.Grenville was replaced by Lord Rockingham as Prime Minister in July, and Rockingham quickly started looking for a way out from under the policies of Grenville. In October, the Stamp Act Congress met in New York City, with delegates from nine of thirteen colonies in attendance. They met to discuss a joint response to both the Sugar and Stamp acts.They concluded that Parliament did not have the right to levy “internal taxes” (taxes to raise revenue), but that they did have the right to levy “external taxes” (taxes to regulate trade). At the same time that the Stamp Act Congress was meeting, the first signs of non-importation were brewing. Non-importation agreements would grow to become a crucial building block of colonial opposition to Britain.Parliament convened in December, but while they wanted to repeal the Stamp Act itself, they also wanted to assert their right to tax the colonies however they saw fit.1766By February, they had signNowed a decision. They repealed the Stamp Act and the Sugar Act, but they also passed the Declaratory Act. It stated that “[Parliament] ought to have full power and authority to make laws and statutes of sufficient force and validity to bind the colonies and people of America, subjects of the crown of Great Britain, in all cases whatsoever.”Only a few colonial leaders really saw what the Declaratory Act foreshadowed. Mostly, celebrations for the repeal of the Stamp Act ran rampant throughout the colonies. In the first major showdown between the colonies and Britain, the colonies had won.1767Back in July of 1766, Rockingham had been dismissed as Prime Minister, and replaced by William Pitt, a strong advocate for the colonies. But Pitt was old, and frequently absent from Parliament. So his divided ministers battled it out for control. The most influential among them was Chancellor of the Exchequer Charles Townshend.He used his position to pass what are now called the Townshend Acts. These were actually five interconnected bills, but the most important to the American colonies was the Revenue Act. It stipulated import duties on commodities such as lead, paper, printer ink, glass, and tea. If you recall, the Stamp Act Congress had conceded that Parliament had the authority to levy external taxes for regulating trade: exactly the kinds of taxes stipulated in the Revenue Act. Well, turns out they were just saying that.A Board of Customs was formed to enforce the paying of these taxes, so even more British agents would be running around in the colonies (something the colonists had shown their dislike for). On top of that, the government agents would be paid with the revenue from the duties, rather than by the colonial assemblies. Before, the colonies had been able to exert a degree of influence over the agents, (they were paying them, after all) but not anymore.Charles Townshend himself would not live to see the blowback to his Acts, however, as he died in September 1767. The power vacuum left by his death was filled by some guy who you don’t need to know about because he’s not important. Opposition in the colonies was slow to get started as I mentioned, as everyone was still weary from the opposition to the Stamp Act.Opposition was somewhat muted, as the Stamp Act riots had been exhausting to the colonists and they didn’t have much energy to continue resisting. However, John Dickinson’s Letters from a Farmer in Pennsylvania, which began circulation in December, gave the colonial opposition a second wind. The letters reinforced the idea that Parliament did not have the right to tax the colonists at all, internal or external.1768By February, Samuel Adams had been able to drum up enough support in the Massachusetts House of Representatives to push through a petition to Britain to repeal the Revenue Act. He followed this up with a Circular Letter to the other colonies, urging them to send similar petitions to Parliament.While the news of the Circular Letter was making its way to Britain and back, the Board of Customs launched a series of attacks on John Hancock, both of which backfired. First, they sent an agent onboard one of his ships to search it. He went below deck where his search warrant did not extend; thus, he was thrown off the ship by Hancock, and his actions were upheld by a local court.The second attack was when the Board seized one of his ships and held it on a technicality. When the Navy tried to move the ship out of port, a mob coalesced and managed to stop Hancock’s ship from being taken away. The mob, like the one during the Stamp Act Riots, was disciplined and under control.Back in Britain, news of the Circular Letter finally signNowed Britain. The new Colonial Secretary had no way of knowing that affairs in Boston had already progressed to organized mob violence. He ordered the governor, Francis Bernard, to order the House of Representatives to rescind the Circular Letter or be dissolved.The House of Representatives voted 92–17 not to rescind. Bernard, in turn, dissolved the House.The merchants of the colonies were starting to get pretty pissed about the new taxes and custom agents, and they began discussing a new non-importation agreement. However, each city was afraid to make the first move, because they feared that if they did, that business would simply move down to the next city who didn’t join the agreement. Non-importation, it seemed, was an all or nothing kind of deal.Massachusetts proposed the first successful non-importation pact on August 1, which was to commence on January 1, 1769. New York and Pennsylvania quickly followed suit, and Rhode Island signed on too, with a little “persuasion-not-a-trade-embargo.”Remember the mob violence that took place over John Hancock’s seized ship? Well, the administration in Boston had called 4000 troops down from Halifax to keep the mob under control. The Massachusetts Assembly tried to reconvene, but were shut down by the governor. An unofficial convention of towns met in Boston a week later, to try to urge the governor to reconsider. It was ineffective however, and on October 1, British soldiers began disembarking onto the docks of Boston.The radicals in Boston decided to cease overt resistance, but there was still resistance. That was evidenced by the fact that the soldiers could find no one willing to rent them lodgings. It took them weeks to get suitable winter quarters in some leased warehouses.1769In Boston, tensions continued to boil between the civilians and the loitering soldiers, who were a constant pain in the neck for the commoner in Boston. They did all the things that soldiers do: get drunk, flirt with the girls, etc. All they did was stir up further resentment among the colonists for the central government in London.In the rest of the colonies, the non-importation agreement adopted last year was expanded to Virginia, and thus the rest of the southern colonies. George Washington (yes, that George Washington) and George Mason helped push the pact through the Virginia House of Burgesses.The Townshend Acts, like the Stamp Act before them, seemed to be becoming more trouble than they were worth.1770In January, George III finally relieved that one guy whose name doesn’t matter of his duties as Prime Minister, and replaced him with Lord North, who had previously been Chancellor of the Exchequer. This guy will be around for a while, so I no longer have to try to stick in awkwardly worded paragraphs about British politics.In Boston, an 11-year-old boy had been shot and killed in February, and a crowd of thousands turned out for his funeral, which was more a show of political force than in memorial to the boy. Over the next few weeks, tensions rose rapidly, with fights between civilians and soldiers a common sight on the street.On March 5, the culmination of months of frustration, anger, and brewing enmity finally took place. The Boston Massacre.A sentry named Hugh White was talking with some of his comrades near the Customs House, when a civilian made a joke about his commanding officer. He punched the guy in the face, and his comrades ran off, leaving him to deal with the mob himself. He backed up against the Customs House with his gun drawn.Captain Preston of the Customs House garrison quickly saw that the situation would not resolve itself, and led his eight soldiers through the crowd. He had them form a semicircle facing the crowd. Guns drawn.For fifteen minutes, taunts, heckling, snowballs, and ice rained down on the soldiers, who were growing more and more jumpy by the moment. Finally, a private at the end of the line was hit, slipped on ice, and when he pulled himself back up, he fired his musket into the crowd.The whole group of soldiers was soon firing into the crowd. 11 men were hit; five died, and six were wounded. The mob fell back, but was only dispersed when Thomas Hutchinson, the acting governor, promised a full inquiry, and Preston and his men were arrested the next morning.John Adams defended the soldiers in court, and he got almost all of the soldiers acquitted with his eloquent defense. A propaganda war was waged between the conservative and radical presses in Boston, each trying to spin the story to suit their own ends.The Townshend Acts were finally repealed in April 1770. However, Parliament opted to leave the duty on tea in effect. This was to keep in place the precedent that Parliament could, should, and would tax the colonists whenever they saw fit. This was a nice impasse, really. The colonists were free of Britain’s incessant money grubbing, and Parliament maintained their right to tax the colonies. This ushered in a period of relative calm.1771Not much to say here. Non-importation ceased, and both sides of the crisis seemed to think that this was the beginning of a return to normalcy.1772Nothing to report until June, when a ship called the Gaspee ran aground while chasing smugglers off the coast of Rhode Island. A mob of patriots quickly boarded the ship, seized it by force, and burned it. This was a sign that hostilities had not yet ceased.Remember when Parliament took the right to pay the governors away from the colonial assemblies? Well, that hadn’t been repealed with the rest of the Townshend Acts, and later that year, Parliament decided to expand this to all the judges in the colonies. The colonists were, of course, enraged at the judiciary becoming a mere puppet of the Crown. Committees of Correspondence were again formed to discuss a response.1773In January, Thomas Hutchinson started off the year by making things ten times worse. He made inflammatory declarations that Parliament’s authority was supreme, that the Committees were completely wrong and should never have convened, and, most signNowly of all, he said that “no line can be drawn between the supreme authority of Parliament and total independence of the colonies.”See, he thought that independence was so absurd even to the most radical of radicals that the supreme authority of Parliament would be the only logical option left to them. However, all he did with this statement was legitimize the small independence movements beginning to take shape.In May of 1773, the years of calm in the colonies finally ended, with Parliament passing the Tea Act. This act would allow the floundering British East India Company to import their tea directly into the colonies, totally bypassing the colonial merchants who made their living as middlemen.This shouldn’t have made such a large impact in the colonies, but then again, nothing else that Parliament did should have, so of course it had lots of opposition right off the bat. The greatest fear of the colonists was that this was only the start of other British companies being able to import directly into the colonies. This might be better for the consumer, but long-term, it would destroy the colonial economy, and reduce them to manual laborers harvesting raw materials.Around this time, some secret letters from Thomas Hutchinson and his conservative allies to someone in Britain were leaked by Samuel Adams and one of Benjamin Franklin’s friends. The letters contained explicit recommendations from Hutchinson that certain civil liberties be suspended in the colonies. These letters all but confirmed every conspiracy theorist’s wild theories, which, once regarded as nothing but wild speculation, now seemed like the truth.Opposition to the Tea Act spread through the port cities of the colonies. Spearheaded by John Dickinson, the Philadelphia merchants led a resistance campaign, and convinced the merchants of several major port cities to stop any tea from being unloaded.On November 28, the cargo ship Dartmouth arrived in Boston, carrying assorted cargo. Among that cargo: East India Company tea. They were planning to unload, take on some more cargo, and sail away. The Sons of Liberty, however, were not planning to allow the tea to be unloaded. Giant “public meetings” congregated in Boston daily, with a sole objective of preventing the Dartmouth from offloading its cargo. The mob gave the ship one choice: get the fuck out of here.The poor owner of the Dartmouth had no way of knowing that he wouldn’t be able to unload his tea, however, and so he requested permission from Hutchinson to leave. Hutchinson responded with “no, you haven’t cleared customs yet.” But of course, to do that… the cargo had to be unloaded, and the owner couldn’t exactly do that. So this poor owner is stuck in the middle of the conflict between Hutchinson and the Sons of Liberty, and has no way of getting out.The Sons of Liberty, out of necessity, began considering drastic measures. There was a law stipulating that if a ship spent 20 days in port without paying customs, the ship would be seized and have its cargo unloaded. They couldn’t have that, of course. Just as the Sons were considering their options, two more tea-carrying ships sailed into port.On December 16, a public meeting was convened, where it was decided that the Sons of Liberty would board the ships and dump the tea into the ocean. So, of course, that’s what they did. 90,000 pounds of tea was dumped into Boston Harbor. This would become known as the Boston Tea Party.1774When news of this incident signNowed Parliament in late January… boy, were they pissed. They summoned Franklin to the Privy Council to defend the actions of his countrymen. They attacked him viciously and tore down his reputation. He stayed silent. After this incident, he swung decisively into the independence camp.In response to the Boston Tea Party, four bills were passed by Parliament between March and May, dubbed the “Coercive Acts” in Britain, but which were called the “Intolerable Acts” in the colonies.Boston Port Act: Trade in Boston was blockaded, and nothing but a few necessary commodities were allowed into the city. The blockade would remain in effect until the East India Company was reimbursed for the lost tea.Massachusetts Government Act: Massachusetts’ charter was taken away and the colony was placed under direct control of the British crown. Nearly all administrative posts would be appointed by the governor, Parliament, or the King.Administration of Justice Act: Royal officials accused of crimes could be tried in Britain if the governor ordered, and not by the local colonial courts.Quartering Act: The governor was given the authority to order civilians to house soldiers in their residence if suitable quarters could not be found.There was also another bill, technically separate but often lumped in with the previous four bills: the Quebec Act. This act extended the province of Quebec southwest down the Proclamation Line, and it cut off the colonies’ ability to expand further west.The colonists began to debate what they should do in response. There was divisive debate, but conservatives and radicals alike thought that representatives from all the colonies should meet and discuss a joint response.The First Continental Congress convened on September 5. 56 delegates from twelve colonies (not Georgia, they actually wanted British troops to help with an uprising) met at Carpenter Hall at Philadelphia. While they deliberated, meetings of the Committees of Correspondence in Boston passed the Suffolk Resolves on September 9. These resolves:Urged the citizens to boycott British goodsEncouraged the citizens to ignore the new taxes altogetherSuggested that the colonists acquaint themselves with the local militias, and be seen under arms at least once per week.The Resolves were endorsed by the Congress on September 17, which basically guaranteed that the radicals would be steering the ship from this point forward. The Massachusetts delegation felt secure enough in their position to propose a new step in opposing Britain: non-exportation.Debate was heated all through late September and October, but a blanket non-exportation pact was pushed through, with only two exceptions: Virginia would get to ship out its latest tobacco harvest, and rice would be exempted for South Carolina. Non-importation was scheduled to begin December 1, and non-exportation would begin September 10, 1775.The enforcement of the boycotts would be overseen by the Continental Association, which formed local committees to oversee that no one disobeyed the boycott. These committees would become a crucial part of colonial organization when the war finally broke out in the spring of 1775.The response in Britain was apoplectic, as Lord North began discussing plans for a continental blockade, to prevent the colonies from trading with anyone. Thomas Gage saw how badly the Intolerable Acts had backfired, and sent dispatches to Parliament urging them to repeal the Intolerable Acts. Parliament responded by sending three generals to act as his advisers, because they thought he wasn’t the best man for the job. These three generals, Howe, Clinton, and Burgoyne, would become the leaders of the British side in the coming Revolutionary War.1775On April 18, Joseph Warren received intelligence that British troops were on the move. This was confirmed by another source, and so Warren sent Paul Revere and William Dawes to Lexington to warn Samuel Adams and John Hancock that they were about to be arrested.Revere sent some men to the Old North Church to light a signal, so that there would be a horse for him on the other side of the Charles River. He arrived at Lexington around midnight, and he told Hancock and Adams to run the fuck away, before moving on to Concord with Dawes and another rider, Samuel Prescott.The three were ambushed by a British cavalry patrol on the road to Concord. Prescott and Dawes escaped, Prescott managing to ride on to Concord. Revere was captured, and told the British troops exactly who he was, what he was doing, and also that five hundred militiamen were massing in Lexington. (That was bullshit.)The British led Revere back to Lexington to test his bluff, but as they approached, they heard gunshots. They ran to inform the main British force that an army of militiamen was massing in Lexington.Revere raced back to Adams’ and Hancock’s house to check that they had gotten safely away, but was shocked to find that they were still just sitting around. With some more urging, they finally decided to leave, and were able to evade capture when the redcoats arrived in force the next day.The next day, the British regulars arrived in Lexington, and they had an intense staring contest with the militiamen. The commanding officer of the redcoats ordered the militiamen to disperse, and after a few seconds, they did.And then, someone fired a shot.No one knows who, and no one knows why.But one thing was for sure: The American Revolution was on.

Create this form in 5 minutes!

How to create an eSignature for the quarterly tax and wage report division of taxation rhode island

How to create an eSignature for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island in the online mode

How to create an eSignature for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island in Google Chrome

How to generate an electronic signature for putting it on the Quarterly Tax And Wage Report Division Of Taxation Rhode Island in Gmail

How to generate an electronic signature for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island straight from your smartphone

How to make an eSignature for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island on iOS devices

How to generate an electronic signature for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island on Android devices

People also ask

-

What is the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

The Quarterly Tax And Wage Report Division Of Taxation Rhode Island is a requirement for employers to report wages and taxes withheld for their employees each quarter. This report is crucial for compliance with state tax laws and helps ensure that you are meeting your obligations as an employer.

-

How can airSlate SignNow help with the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

airSlate SignNow provides a streamlined solution for sending, signing, and storing your Quarterly Tax And Wage Report Division Of Taxation Rhode Island documents, making the process easy and efficient. With our platform, you can electronically sign documents and ensure that they are submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

Yes, airSlate SignNow offers various pricing plans, designed to cater to different business needs. Our cost-effective solutions make it affordable for businesses of all sizes to manage their Quarterly Tax And Wage Report Division Of Taxation Rhode Island requirements without breaking the bank.

-

What features does airSlate SignNow offer for managing the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

airSlate SignNow includes features such as templates, secure cloud storage, and real-time collaboration tools. These features enable you to efficiently create, manage, and sign your Quarterly Tax And Wage Report Division Of Taxation Rhode Island documents.

-

Can airSlate SignNow be integrated with other software for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, allowing you to automate the process of generating and submitting your Quarterly Tax And Wage Report Division Of Taxation Rhode Island. This integration simplifies your workflow and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for my Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

Using airSlate SignNow for your Quarterly Tax And Wage Report Division Of Taxation Rhode Island offers numerous benefits, such as improved efficiency, enhanced accuracy, and secure storage of your important documents. Additionally, you can save time and resources by streamlining the signing process.

-

How can I get started with airSlate SignNow for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island?

Getting started with airSlate SignNow for the Quarterly Tax And Wage Report Division Of Taxation Rhode Island is simple. Just sign up for an account, explore our features, and start creating your documents. Our easy-to-use platform ensures a smooth onboarding experience.

Get more for Quarterly Tax And Wage Report Division Of Taxation Rhode Island

- Infection control assessment tool form

- Louisiana r 1029 form

- Signed applicant declaration form

- Pdf 1040 ss tax form

- Material issue form 12733308

- Window and door affidavit window and door affidavit form

- New zealand traveller declaration new zealand traveller declaration form

- Gift contract template form

Find out other Quarterly Tax And Wage Report Division Of Taxation Rhode Island

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple