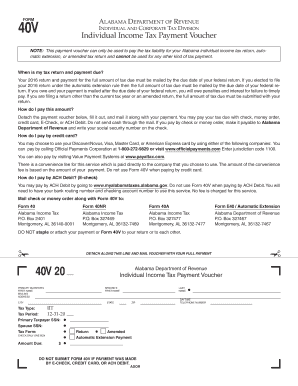

NOTE This Payment Voucher Can Only Be Used to Pay the Tax Liability for Your Alabama Individual Income Tax Return, Automatic Ext Form

Understanding the Payment Voucher for Alabama Individual Income Tax

The payment voucher is a specific document designed exclusively for settling tax liabilities associated with your Alabama Individual Income Tax Return, automatic extension, or amended tax return. This voucher cannot be utilized for any other tax payments, ensuring that it serves a focused purpose within Alabama's tax framework. It is essential for taxpayers to recognize that using this voucher for unauthorized payments may lead to complications in their tax filings.

Steps to Use the Payment Voucher

To effectively use the payment voucher, follow these steps:

- Obtain the payment voucher from the Alabama Department of Revenue or an authorized source.

- Fill in the required information accurately, including your name, address, and tax identification details.

- Specify the amount you are paying towards your tax liability.

- Submit the completed voucher along with your payment, ensuring it is sent to the correct address as indicated on the form.

Obtaining the Payment Voucher

You can obtain the payment voucher directly from the Alabama Department of Revenue's website or through their office. It is important to ensure you have the most current version of the voucher to avoid any issues during submission. Additionally, some tax preparation software may include the voucher as part of their tax filing services.

Legal Considerations for the Payment Voucher

The payment voucher is a legally binding document when filled out and submitted according to the guidelines set forth by the Alabama Department of Revenue. It is crucial to understand that any discrepancies or errors in the voucher may lead to delays in processing your tax payment or potential penalties. Therefore, ensure all information is accurate and complete before submission.

Key Elements of the Payment Voucher

Several key elements must be included in the payment voucher to ensure its validity:

- Your full name and address.

- Your Social Security number or tax identification number.

- The tax year for which the payment is being made.

- The specific amount being paid.

Filing Deadlines for the Payment Voucher

Timely submission of the payment voucher is critical to avoid penalties. The Alabama Department of Revenue sets specific deadlines for tax payments, which typically align with the filing deadlines for individual income tax returns. It is advisable to check the latest dates to ensure compliance and avoid any late fees.

Quick guide on how to complete note this payment voucher can only be used to pay the tax liability for your alabama individual income tax return automatic

Complete [SKS] with ease on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers swiftly without interruptions. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] without effort

- Locate [SKS] and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for that intent.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Ext

Create this form in 5 minutes!

How to create an eSignature for the note this payment voucher can only be used to pay the tax liability for your alabama individual income tax return automatic

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is the purpose of the payment voucher for Alabama Individual Income Tax?

The payment voucher is specifically designed to facilitate tax payments for your Alabama Individual Income Tax Return, Automatic Extension, or Amended Tax Return. NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

-

How do I use the payment voucher for my tax payments?

To use the payment voucher, simply complete it with the necessary details indicating your tax liability. NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama. Then, submit it along with your payment to ensure proper processing.

-

What happens if I use the voucher for the wrong tax payment?

It's crucial to use the payment voucher exclusively for the indicated tax liabilities. If the voucher is used for any other type of tax payment, it may lead to processing delays or rejection of your payment. Remember, NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

-

Are there any fees associated with using the payment voucher?

There are no additional fees for using the payment voucher itself; however, standard payment processing fees may apply. Ensure that you are aware of any associated costs when making payments for your Alabama Individual Income Tax. NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

-

Can I use airSlate SignNow to eSign my tax documents?

Absolutely! airSlate SignNow allows you to securely eSign your tax documents, making the process quick and efficient. Leverage this feature alongside the payment voucher to manage your Alabama tax liabilities effectively. Just remember, NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

-

What are the benefits of using airSlate SignNow for tax payments?

Using airSlate SignNow for tax payments offers convenience and professionalism through seamless eSigning and document management. You can efficiently handle your Alabama tax filings and payments in one place. Keep in mind, NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

-

Is my payment information secure when using the voucher?

Yes, your payment information is secure when you use the payment voucher through approved channels. Always ensure you submit payments via verified methods to protect your sensitive data. Remember, NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Extension, Or Amended Tax Return And Cannot Be Used For Any Other Kind Of Tax Payment Revenue Alabama.

Get more for NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Ext

- Hill request form

- 2012 2013 financial aid information form quincy college

- Emergency grant in aid stanford financial aid stanford university form

- Emergency grant in aid form

- To bamsi staff from professional development and training bb bamsi form

- Licensed vendor directory umass amherst form

- My 4 h pet and small animal project record book ag ndsu form

- Orono me 04469 5781 form

Find out other NOTE This Payment Voucher Can Only Be Used To Pay The Tax Liability For Your Alabama Individual Income Tax Return, Automatic Ext

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast