SCHEDULE CR NAMES as SHOWN on the TAX RETURN *140006CR* Alabama Department of Revenue Credit for Taxes Paid to Other States SOCI Form

What is the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*?

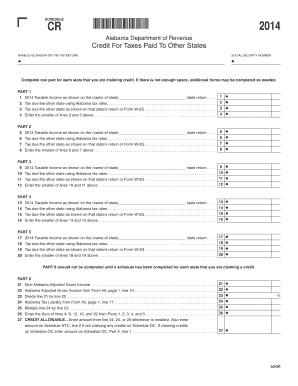

The SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* is a form used by residents of Alabama to claim a credit for taxes paid to other states. This form is essential for individuals who have earned income in multiple states and have paid taxes to those states. By completing this form, taxpayers can reduce their Alabama tax liability by the amount of tax paid to another state, ensuring they are not taxed twice on the same income. The form requires the taxpayer's Social Security number and must be filled out for each state from which the credit is being claimed.

Steps to complete the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*

Completing the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* involves several key steps:

- Gather necessary documentation, including tax returns from other states where taxes were paid.

- Fill in your Social Security number at the top of the form.

- Complete a section for each state from which you are claiming a credit, detailing the amount of tax paid.

- Ensure all calculations are accurate to avoid discrepancies.

- Review the completed form for any errors before submission.

Legal use of the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*

The legal use of the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* is governed by Alabama tax laws. This form must be submitted accurately to claim the credit for taxes paid to other states. It is important to ensure compliance with all state regulations to avoid penalties. The form serves as a legal document that can be reviewed by the Alabama Department of Revenue, making it crucial to maintain accurate records of taxes paid to other states.

State-specific rules for the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*

Each state has its own rules regarding the taxation of income and the credits available for taxes paid to other states. In Alabama, taxpayers must adhere to specific guidelines when completing the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*. This includes understanding the eligibility criteria for claiming the credit and ensuring that the taxes paid to other states are documented properly. Familiarity with these state-specific rules is essential for successful tax filing.

Required Documents for the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*

To complete the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*, taxpayers need to gather several documents:

- Tax returns from the other states where taxes were paid.

- Proof of payment for taxes paid to other states, such as W-2 forms or 1099s.

- Any correspondence from the other states regarding tax payments.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting.

Examples of using the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*

Examples of using the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* can help clarify its application. For instance, if a taxpayer works in Georgia but resides in Alabama, they may pay state taxes to Georgia. By completing this form, they can claim a credit for those taxes when filing their Alabama tax return. This prevents double taxation and ensures that the taxpayer is not unfairly penalized for earning income in another state.

Quick guide on how to complete schedule cr names as shown on the tax return 140006cr 2014 alabama department of revenue credit for taxes paid to other states

Complete SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI with ease

- Locate SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule cr names as shown on the tax return 140006cr 2014 alabama department of revenue credit for taxes paid to other states

How to generate an e-signature for a PDF document online

How to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is the purpose of the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*?

The SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States form is designed to help taxpayers claim credits for taxes they paid to other states. Completing this form accurately ensures you receive the appropriate tax credits, potentially reducing your overall tax liability.

-

How can I use airSlate SignNow to manage my SCHEDULE CR submissions?

airSlate SignNow provides an easy-to-use platform to send, sign, and manage your SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* documents efficiently. With electronic signature capabilities, you can streamline the submission process, ensuring all forms are completed and sent securely to the Alabama Department of Revenue.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for handling documents, including the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*. Plans cater to individuals, small businesses, and enterprise solutions, ensuring that you only pay for what you require.

-

What features does airSlate SignNow provide for tax form submissions?

With airSlate SignNow, you'll benefit from features like customizable templates, secure eSignatures, and the ability to create workflows specifically for the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR*. These tools facilitate easier document management and help ensure compliance with Alabama tax regulations.

-

How does airSlate SignNow ensure the security of my sensitive information?

airSlate SignNow employs advanced encryption and secure storage protocols to protect your sensitive information when completing the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue forms. Your SOCIAL SECURITY NUMBER and other personal data are safeguarded throughout the signing process.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow offers integrations with popular business tools to enhance your overall productivity. You can seamlessly connect with platforms like CRM systems, accounting software, and cloud storage services, allowing you to manage the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* and other documents more efficiently.

-

What benefits does airSlate SignNow provide for completing tax forms?

Using airSlate SignNow to complete tax forms like the SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* provides several benefits, including faster turnaround times, reduced paperwork errors, and easy tracking of document status. This ensures that you can claim your Alabama Department Of Revenue Credit for Taxes Paid To Other States promptly and accurately.

Get more for SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI

- Mississippi dismissal 497315354 form

- Mississippi motor vehicle 497315355 form

- Mississippi motion dismiss 497315356 form

- Answer mississippi 497315357 form

- Mississippi partial 497315358 form

- Motion summary judgment 497315359 form

- Motion summary judgment order 497315360 form

- Request for admissions mississippi 497315361 form

Find out other SCHEDULE CR NAMES AS SHOWN ON THE TAX RETURN *140006CR* Alabama Department Of Revenue Credit For Taxes Paid To Other States SOCI

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy