Arizona Form Underpayment of Estimated Tax by Individuals Include with Your Return

What is the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

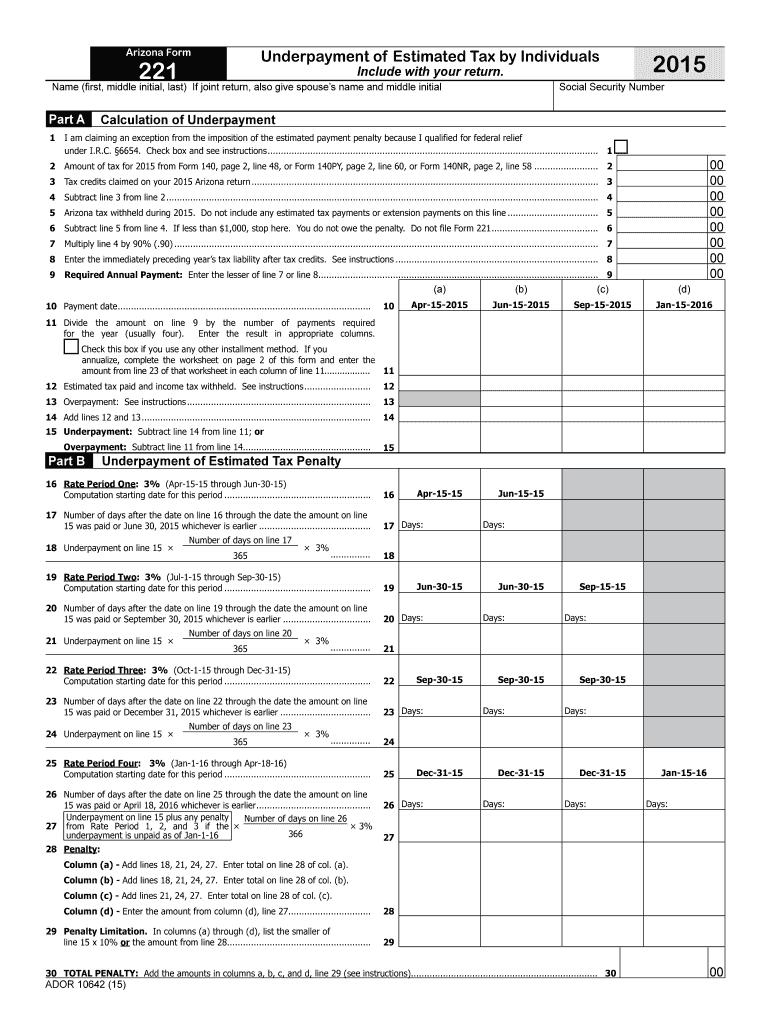

The Arizona Form Underpayment of Estimated Tax by Individuals is a specific tax form used by residents of Arizona to report any underpayment of estimated taxes owed to the state. This form is essential for individuals who may not have paid enough tax throughout the year, either through withholding or estimated tax payments. It helps ensure compliance with state tax laws and allows taxpayers to calculate any potential penalties for underpayment. The form is typically included with the individual's tax return, providing a comprehensive overview of their tax obligations.

Steps to Complete the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

Completing the Arizona Form Underpayment of Estimated Tax involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year based on your income.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Compare your total tax liability with the amount paid to identify any underpayment.

- Fill out the form with the calculated underpayment amount and any relevant personal information.

- Review the completed form for accuracy before submission.

Key Elements of the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

The Arizona Form Underpayment of Estimated Tax contains several key elements that taxpayers need to be aware of:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Estimated Tax Payments: Taxpayers must report the total estimated tax payments made during the year.

- Tax Liability Calculation: This part involves calculating the total tax owed based on income and deductions.

- Underpayment Amount: The form will require taxpayers to indicate the amount of underpayment, if any.

- Signature: A signature is necessary to validate the form, confirming the accuracy of the information provided.

Legal Use of the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

The Arizona Form Underpayment of Estimated Tax is legally binding when completed and submitted according to state regulations. It serves as an official record of an individual's tax obligations and any underpayment penalties. To ensure its legal standing, it is crucial that the form is filled out accurately and submitted by the appropriate deadlines. Compliance with Arizona tax laws is essential to avoid potential penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form Underpayment of Estimated Tax are crucial for taxpayers to avoid penalties. Typically, the form must be submitted along with the annual tax return by April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of quarterly estimated tax payment deadlines to prevent underpayment throughout the year.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form Underpayment of Estimated Tax can be submitted through various methods to accommodate taxpayer preferences:

- Online Submission: Taxpayers can complete and submit the form electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate state tax office address.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices in Arizona.

Quick guide on how to complete arizona form underpayment of estimated tax by individuals include with your return

Effortlessly Prepare Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and efficiently. Handle Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return on any device using the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

The Simplest Method to Edit and eSign Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return with Ease

- Find Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, a process that takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method of sharing your form: via email, SMS, invitation link, or download it to your PC.

Eliminate the concerns of lost or misplaced documents, tiring searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Edit and eSign Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form underpayment of estimated tax by individuals include with your return

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return?

The Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return is a necessary form for individuals who need to report any estimated tax underpayments. Completing this form ensures compliance with state tax regulations and helps prevent penalties.

-

How do I fill out the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return with our user-friendly platform. Simply upload the form, fill in the required fields, and follow the prompts to complete your submission.

-

What are the benefits of using airSlate SignNow for tax form submissions?

airSlate SignNow offers a convenient and secure way to handle all your tax form submissions, including the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return. Our platform streamlines the process, saving you time and ensuring your documents are accurately completed and securely stored.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return?

Yes, there is a subscription cost associated with using airSlate SignNow. However, we offer various pricing plans to fit different budgets, making it a cost-effective solution for completing your Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return.

-

Can I integrate airSlate SignNow with other software for managing taxes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage your documents efficiently. This integration can further simplify the process for completing the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return and other related forms.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents through advanced encryption and secure data storage practices. When you use our platform for the Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return, you can rest assured that your sensitive information is safeguarded.

-

Can I track the status of my Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return after submission?

Yes, once you submit your Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return through airSlate SignNow, you can track its status directly on our platform. This feature allows you to stay informed about your document's progress and ensures timely processing.

Get more for Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

- Siding contractor package mississippi form

- Refrigeration contractor package mississippi form

- Drainage contractor package mississippi form

- Tax free exchange package mississippi form

- Landlord tenant sublease package mississippi form

- Buy sell agreement package mississippi form

- Option to purchase package mississippi form

- Amendment of lease package mississippi form

Find out other Arizona Form Underpayment Of Estimated Tax By Individuals Include With Your Return

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement