Full Year ResidentShort Form Dfaarkansasgov

What is the Full Year ResidentShort Form Dfaarkansasgov

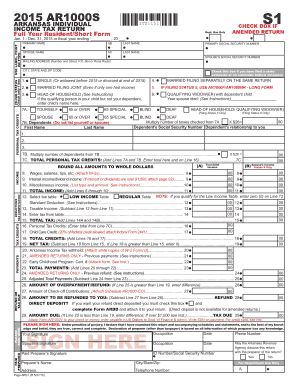

The Full Year ResidentShort Form Dfaarkansasgov is a specific tax form utilized by residents of Arkansas to report their income and calculate their tax obligations for the year. This form is designed for individuals who have maintained residency in the state for the entire year and need to file their state income taxes accordingly. It simplifies the filing process by allowing full-year residents to report their income, deductions, and credits in a streamlined manner.

Steps to complete the Full Year ResidentShort Form Dfaarkansasgov

Completing the Full Year ResidentShort Form Dfaarkansasgov involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Provide personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid penalties.

- Claim any deductions or credits for which you are eligible, such as education or healthcare expenses.

- Review the completed form for errors before submission.

How to use the Full Year ResidentShort Form Dfaarkansasgov

Using the Full Year ResidentShort Form Dfaarkansasgov effectively requires understanding its sections and how to fill them out correctly. Start by entering your personal information at the top of the form. Next, accurately report your income in the designated sections. Follow this by claiming any applicable deductions and credits. Finally, ensure that you sign and date the form before submitting it, either electronically or by mail.

Legal use of the Full Year ResidentShort Form Dfaarkansasgov

The Full Year ResidentShort Form Dfaarkansasgov is legally binding when filled out correctly and submitted in accordance with Arkansas state tax regulations. To ensure its legal validity, it is essential to provide accurate information and retain copies of all submitted documents. Compliance with state tax laws protects taxpayers from potential audits or penalties.

Required Documents

To successfully complete the Full Year ResidentShort Form Dfaarkansasgov, you will need several key documents:

- W-2 forms from all employers for the year.

- 1099 forms for any freelance or additional income.

- Receipts or documentation for any deductions you plan to claim.

- Previous year’s tax return for reference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Full Year ResidentShort Form Dfaarkansasgov. Typically, the deadline for submission is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also keep in mind any potential extensions they may wish to file for if they cannot meet the standard deadline.

Quick guide on how to complete full year residentshort form dfaarkansasgov

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly, without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Full Year ResidentShort Form Dfaarkansasgov

Create this form in 5 minutes!

How to create an eSignature for the full year residentshort form dfaarkansasgov

The best way to make an e-signature for a PDF document online

The best way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Full Year ResidentShort Form Dfaarkansasgov?

The Full Year ResidentShort Form Dfaarkansasgov is a specific document required by residents in Arkansas to ensure they meet tax obligations. airSlate SignNow simplifies the process of sending and eSigning this form, offering a user-friendly experience for efficient document management.

-

How can airSlate SignNow help with the Full Year ResidentShort Form Dfaarkansasgov?

airSlate SignNow provides tools to easily send, receive, and eSign the Full Year ResidentShort Form Dfaarkansasgov. Users can streamline their document workflows and ensure timely submissions, reducing the chances of delays or errors.

-

Is there a cost associated with using airSlate SignNow for the Full Year ResidentShort Form Dfaarkansasgov?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Utilizing this service for the Full Year ResidentShort Form Dfaarkansasgov can save time and reduce expenses compared to traditional methods of handling documents.

-

What features does airSlate SignNow offer for the Full Year ResidentShort Form Dfaarkansasgov?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning capabilities. These features ensure you can manage the Full Year ResidentShort Form Dfaarkansasgov efficiently and securely.

-

Can I integrate airSlate SignNow with other applications while handling the Full Year ResidentShort Form Dfaarkansasgov?

Absolutely! airSlate SignNow offers seamless integrations with various productivity tools and applications. This allows you to manage the Full Year ResidentShort Form Dfaarkansasgov alongside your existing workflows, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the Full Year ResidentShort Form Dfaarkansasgov?

Using airSlate SignNow for the Full Year ResidentShort Form Dfaarkansasgov provides numerous benefits, including an intuitive interface and reduced document turnaround times. The ability to eSign documents securely online also enhances convenience for users.

-

Is the airSlate SignNow platform secure for handling the Full Year ResidentShort Form Dfaarkansasgov?

Yes, airSlate SignNow prioritizes security, employing robust encryption methods to protect your data. This ensures that any information related to the Full Year ResidentShort Form Dfaarkansasgov is kept confidential and secure.

Get more for Full Year ResidentShort Form Dfaarkansasgov

- Special transport permit larimer county co larimer co form

- Colorado dr 2704 form

- Larimer county affidavit and motion for deffered sentence review form

- Cvpi 4 3x generic motion and affidavit latah county latah id form

- Community service tracking sheet maricopa county maricopa form

- Sample daily recordkeeping log for rule 310 maricopa county maricopa form

- Mclennan county care package form

- Application for general hauler permit miami dade portal miamidade form

Find out other Full Year ResidentShort Form Dfaarkansasgov

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy