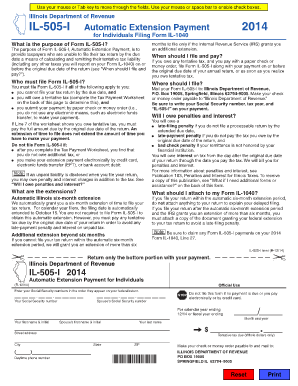

IL 505 I, Automatic Extension Payment for Individuals Filing Tax Illinois Form

What is the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

The IL 505 I form is a tax document used by individuals in Illinois to request an automatic extension for filing their state income tax return. This form allows taxpayers to extend their filing deadline by six months, providing additional time to prepare their tax returns without incurring late filing penalties. It is essential for individuals who may need extra time due to various circumstances, such as complex financial situations or personal obligations. The automatic extension does not extend the deadline for payment of taxes owed, which must still be submitted by the original due date.

Steps to complete the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

Completing the IL 505 I form involves several straightforward steps:

- Gather necessary information, including your Social Security number, total income, and estimated tax liability.

- Fill out the form with your personal details and the amount you are paying with the extension request.

- Ensure that the payment method is clearly indicated, whether by check or electronic payment.

- Review the completed form for accuracy to avoid any errors that could delay processing.

- Submit the form by the original tax due date to ensure that you qualify for the extension.

Legal use of the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

The legal use of the IL 505 I form is governed by Illinois tax regulations. When properly completed and submitted, the form serves as a formal request for an extension of time to file your state income tax return. It is crucial to adhere to the guidelines set forth by the Illinois Department of Revenue to ensure that the extension is recognized legally. This includes making any required payments by the original due date to avoid penalties and interest.

Filing Deadlines / Important Dates

The deadlines for filing the IL 505 I form are critical for taxpayers. The form must be submitted by the original due date of the tax return, typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be adjusted accordingly. It is important to keep track of these dates to ensure compliance and avoid any penalties associated with late submissions.

Required Documents

To complete the IL 505 I form, certain documents and information are necessary. Taxpayers should have:

- Their previous year’s tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Records of any deductions or credits that may apply.

- Information regarding any payments made towards estimated taxes for the current year.

Examples of using the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

Using the IL 505 I form can be beneficial in various scenarios. For instance, a self-employed individual may find themselves needing more time to gather all necessary financial documents to accurately report income and expenses. Similarly, a taxpayer who has recently experienced a major life change, such as a divorce or relocation, may require additional time to ensure their tax return reflects their current financial situation. In both cases, submitting the IL 505 I allows for an extension without incurring penalties for late filing.

Quick guide on how to complete 2014 il 505 i automatic extension payment for individuals filing tax illinois

Complete IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without setbacks. Manage IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois with ease

- Locate IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2014 il 505 i automatic extension payment for individuals filing tax illinois

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois?

The IL 505 I is a form used for requesting an automatic extension for filing individual income tax returns in Illinois. By submitting this form, taxpayers can receive an additional six months to file their return, allowing for more time to gather necessary documents. It's beneficial for individuals needing extra time without incurring penalties.

-

How does airSlate SignNow facilitate the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois?

airSlate SignNow offers a streamlined platform for eSigning and submitting the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois. Our solution reduces the hassle of paperwork by allowing users to fill out and sign the form electronically, ensuring a faster and more efficient process for tax extensions.

-

What are the features of airSlate SignNow related to tax document processing?

airSlate SignNow provides features such as secure eSigning, customizable templates for tax forms like the IL 505 I, and real-time tracking of document status. Our platform enhances user experience with a user-friendly interface, ensuring seamless completion of tax-related documentation.

-

Is there a cost associated with using airSlate SignNow for filing the IL 505 I?

Yes, airSlate SignNow offers various pricing plans that include access to features for processing tax documents, including the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois. Our cost-effective subscriptions are designed to provide value to both individuals and businesses managing their tax submissions.

-

What benefits does airSlate SignNow provide for individuals filing the IL 505 I?

Using airSlate SignNow simplifies the filing process for the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois with its easy-to-use platform. Benefits include the ability to eSign documents from anywhere, save time on traditional filing, and maintain compliance with Illinois tax requirements effortlessly.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security and compliance, utilizing advanced encryption protocols to protect sensitive data, including the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois. Our platform ensures that your documents are securely stored and transmitted, maintaining confidentiality and trust.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Yes, airSlate SignNow offers integrations with various tax preparation software and business tools. This flexibility allows users to streamline their workflow and manage the IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois alongside other essential applications seamlessly.

Get more for IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles north carolina form

- Letter from tenant to landlord about landlords failure to make repairs north carolina form

- Nc landlord rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession north carolina form

- Letter from tenant to landlord about illegal entry by landlord north carolina form

- Letter from landlord to tenant about time of intent to enter premises north carolina form

- Letter landlord rent template 497316924 form

- Letter from tenant to landlord about sexual harassment north carolina form

Find out other IL 505 I, Automatic Extension Payment For Individuals Filing Tax Illinois

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors