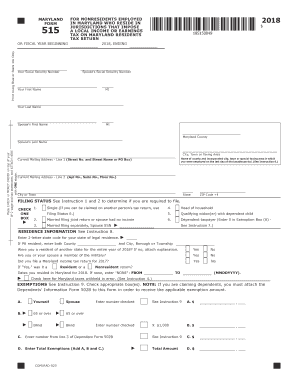

Form 515 2018

What is the Maryland Form 515

The Maryland Form 515 is a tax document used by non-residents and part-year residents to report income earned in Maryland. This form is essential for individuals who have income sourced from Maryland but do not reside in the state for the entire tax year. It allows taxpayers to calculate their Maryland tax liability based on their income earned within the state. Understanding the purpose and requirements of Form 515 is crucial for compliance with Maryland tax laws.

How to Use the Maryland Form 515

Using the Maryland Form 515 involves several steps to ensure accurate reporting of income. Taxpayers must first gather all relevant income documentation, including W-2 forms and 1099s. Once the necessary documents are collected, individuals can fill out the form by entering their income details, deductions, and credits applicable to their situation. It is important to carefully follow the instructions provided with the form to avoid errors that could lead to delays or penalties.

Steps to Complete the Maryland Form 515

Completing the Maryland Form 515 requires a systematic approach:

- Gather all income statements, including W-2 and 1099 forms.

- Download or access the Form 515 from the Maryland Comptroller's website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your Maryland-source income in the designated section.

- Calculate your deductions and credits based on eligibility.

- Review all entries for accuracy before signing the form.

- Submit the completed form by the appropriate deadline, either online or by mail.

Legal Use of the Maryland Form 515

The Maryland Form 515 is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer or their authorized representative. The form serves as an official declaration of income and tax liability to the state of Maryland. Failure to file this form can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the Maryland Form 515 is crucial to avoid penalties. The typical deadline for submitting this form aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or state-specific announcements.

Form Submission Methods

Taxpayers have multiple options for submitting the Maryland Form 515:

- Online Submission: Many taxpayers opt to file electronically through the Maryland Comptroller's e-file system.

- Mail: Completed forms can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also visit local tax offices to submit their forms directly.

Quick guide on how to complete place check or money order on top of your

Your assistance manual on how to prepare your Form 515

If you're curious about how to finalize and submit your Form 515, here are a few concise tips to simplify your tax filing process.

To start, you just need to set up your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document management solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify details as necessary. Enhance your tax oversight with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form 515 in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our library to obtain any IRS tax form; explore various editions and schedules.

- Click Get form to access your Form 515 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return mistakes and delay refunds. Obviously, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct place check or money order on top of your

FAQs

-

Why do nice guys get friend-zoned?

Why ‘Nice Guys’ Get Friend-ZonedOr… In Defence of Bad BoysI used to be a nice guy.Actually, I still am. I just don’t always act like it. But more on that later.For a while there, I was the nicest guy you’d ever meet.When a girl cancelled a date on me, I would kindly ask her for another one.If she didn’t respond to my messages, I was nice enough to message her again, reminding her I still existed.If a girl spent half our date staring at her phone, well… I would ask her out again anyway!You’d never seen a guy so nice. And you know what it got me? A lot of time in the dreaded friend-zone, and a whole lot of girls giving me equally ‘nice’ rejections.Being a nice guy and getting rejected taught me a lot, most importantly that being nice is rarely the cause of your dating problems.The real reason you get friend-zoned is more likely that you act a bit too weak, a bit too needy, and a bit like you don’t deserve to be there.You act like a pleaser, and mistake it for being ‘nice.’You’ve probably heard that a lot of girls go for ‘bad boys.’ You may even have had your girlfriend stolen by one.The so-called bad boy can usually be seen in the movies riding a motorcycle, wearing badass clothes, and generally not caring about anyone’s opinion of him. Sound appealing? Now you understand how some girls feel.There’s a reason so many girls like bad boys, and it’s not because they ride motorcycles or flunk out of high school. It’s because they’re strong, centered, and they live life on their own terms. They don’t change who they are in hopes of making anyone like them, because they really do believe they’re good enough.Their attitude is you either you like me, or see ya later.This is the essence of being a ‘bad boy,’ not the leather jacket and frequent run-ins with the law. They know that if a girl walks away, they can go on being exactly who they are and still meet a new girl before long.That’s attractive to some women for the very reason you feel intimidated by it:He’s a challengeHe’s sure of himself. A woman knows she won’t be able to push this guy around or get her way all the time, which is actually a good thing. A woman can feel comfortable and safe around a guy like that. Sounds counter-intuitive when you consider the motorcycle, but women know intuitively that a guy like that will stand up for her if she needs it, that he won’t fall to pieces at the first sign of trouble.‘Nice guys’ on the other hand, are usually in a big hurry to change who they are to meet a girl’s needs. They go begging for a woman’s time when she seems barely interested. They order salad for dinner because it’s what she ordered, when they really wanted the 8oz sirloin.When you act like this, you look about as stable as a bowl of jelly on a hot Sunday in July.If you’re willing to change who you are at the drop of a hat just to please a woman, it tells her one thing:You think you’re not good enough the way you are, so you have to change it somehow to please her.You’re afraid to be yourself. You feel unworthy of her presence.How can a woman feel safe, excited, or challenged by a guy like that?If you want to improve your chances of keeping a girl interested and staying out of the friend-zone, here are three things you need to start doing right now.1. Act like yourself, and be proud of itThe whole point of dating is to find someone you like spending time with. You’re never going to do that if you’re pretending to be someone else. And if you do find someone, there’s a good chance you’ll lose them eventually, because you can’t hold up that façade forever. Being proud of who you are is among the most attractive traits you can have. It communicates that you believe in yourself, that you know you’re good enough. That speaks confidence and strength to any potential partner.There’s no need to fit some proto-masculine mold where the only acceptable hobbies are crushing beers and watching UFC. Don’t believe the hype. If you love those things, great. But if not, it’s totally fucking okay.You can be figure skating’s biggest fan and still be attractive to your ideal woman, so long as you are totally confident owning that and would never lie about it just to impress a girl.Be yourself. Own it. Act like who you are and what you love are totally worth the attention you give them, that they’re every bit as cool as the guy who loves watching UFC and crushing beers. And if a woman, or a dude, or anyone doesn’t like who you are, let them walk. But remember…2. Don’t be a jerkA lot of guys think that if being too nice is the problem, they should go in the other direction and act like a jerk.Usually they’re wrong.A lot of bad boys do turn out to be jerks, or deadbeats, or career criminals. That isn’t the goal here. Those guys often do well in high school, decent in university, but their star fades quickly once girls leave their rebellious stage and realize what they actually want is a life partner.Don’t get all excited though, softy. You know who replaces ‘bad boys’ as the ideal mate?Strong, centred men, with a good sense of purpose.They may or may not ride a motorcycle, but they always handle their business. And they don’t act like pleasers just to get a date, get attention, or get a girl to like them. They’re way too busy living life on their terms and accomplishing goals.In that way, they actually have a lot in common with the ‘bad boy’ type. The difference is…They’re gentlemen about it. They’re never rude or short-tempered with a girl, which is yet another sign of weakness. They treat women with respect, but they never let a woman waste their time. They show a girl they’re interested, but they never chase her around hoping she’ll maybe, one day, possibly agree to go out with them.They are, in a word, nice about it. What they are not, is pleasers.Bad Boys and their evolved counterpart, Centred Men, don’t have time for all that.Neither should you.And finally…3. Stop over messaging, over talking, and over-pursuing womenBecause in essence, you’re chasing them all away. When you give a woman too much attention too early on, you talk all the excitement out of dating you. She knows exactly what to expect, and there is zero challenge for her in learning about who you are. You suck all the mystery out of the courtship.You know what a girl does when she first meets you, no matter how into you she might be?She puts you on probation.Until you prove yourself, you are a big fat maybe in her eyes. Now ask yourself this – why wouldn’t you be doing the exact same thing to her? Are you willing to let just any girl walk into your life and claim a space there, just because she has nice hair and did a good job on her make-up? Is that really all it takes?Unless you want to wake up one morning next to a girl who collects shrunken heads and has a mental meltdown every time she burns the toast, you need to be filtering girls out.You’re looking for a partner after all, so you should probably set a few reasonable standards. Women are already doing this, and when they realize you’re not, they tend to get a little worried.They suddenly realize it’s very easy to get into your life, which frankly lowers your value. It’s kind of like a nightclub that lets people in even when they’re underdressed, over-inebriated, and publicly insulting the doorman. Women who value themselves don’t go to those clubs. Likewise they want a guy who screens women before giving them a decision making role in his life.When you don’t do that, it screams is neediness, and it’s the opposite of attractive.A woman can sense when you’re needy. She knows you don’t really believe you’re good enough for her. They can smell it like a shark smells blood, only instead of swimming in for the kill, they flee in the opposite direction.Usually what happens next is a woman gets bored, uninterested, and packs you safely away into friend-zone.In ConclusionToo often guys equate becoming a pleaser, a chaser, and changing who they are with being ‘nice.’ But those aren’t the same thing at all.The kind of centred, confident men who get lots of attention and wind up with their dream girls never over-contact, because that takes all the mystery out of dating.They never change who they are to impress a woman. It’s either you’re interested, or let’s move on.And they are rarely, if ever, jerks. They simply move on when they stop seeing potential, or reciprocal interest. They know their own worth, and they value their time too much to waste it on women who aren’t interested.But being nice is rarely the problem.

-

How can I cash a money order if I fill it out wrong?

If it is a US PS Money order there should be no problem . The issuing Post office has a record of what was paid for the Money Order. If you bought the Money Order , your receipt will have the amount you paid. If it is a matter of the wrong name or information written on the Money order. Again bring it to the Post office they will issue a new one.

-

What are the common mistakes that seed-funded startup founders make?

I raised $500,000 at 19. I was on my way to change the world. Three years later everything burned down.This post is not about how to shoot for the stars or run a company. Others are better at that.This is about what not to do.I’ve made every mistake possible. But ironically, I’m constantly meeting teams doing the exact same things that caused my first startup to implode. Everything I’m writing about I’ve experienced first hand through my own startups as well as various businesses I’ve been involved in. It’s been all my fault and this is my story.Some of you will disagree with me. Others will have things to add. I’m happy to discuss in the comments.Here’s my attempt.ZUCKERBERG SYNDROMMy girlfriend didn’t know what I was working on for nine months. I slept with a chair blocking the front door. My phone was tapped. Corporate America and Uncle Sam were listening. Someone was going to kill me to steal the idea.I really believed this. So I did everything possible (literally) to avoid getting feedback out of the fear of having our idea stolen.Ultimately, secrecy and stupidity killed us. Three years and hundreds of thousands later, we released an alpha version to a modest 30 people for the first time. Everyone hated it. Our capital was gone. Our morale: zero.I see this all the time. Startup founders hiding their ideas because of the fear that someone will steal it. Remember: no one cares about you. Your biggest issue is getting discovered. If someone steals your idea, that means you’re doing something right.Because of this syndrome, most startups are wasting their time and money building products no one wants. Why? Lack of testing. The biggest mistake a company can make (product wise) is to avoid talking to and testing with potential and current users. Every day. It’s also one of the main reasons startup’s fail.If you’re not constantly releasing and looking for feedback you’re either a) delusional (me) thinking too many people will sign up/buy your product and you won’t be able to scale b) scared that it’s not good enough (me) or c) someone will steal your idea (as I was).A. SCALING“Your priority, in short, is proving that people will use your product at all. If they won’t, then it won’t matter if you can’t scale. If they will, then you will figure out a way to scale. I’ve never seen a startup die because it couldn’t scale fast enough. I’ve seen hundreds of startups die because people refused to embrace their product.” — Guy Kawasaki [Emphasis mine]I’ve done this and I’ve experienced this in the past three startups I’ve worked in. It’s completely delusional. If five out of five people tell you that they wouldn’t use your product (before you build), quit. If eight out of ten people tell you that they hate this feature and you empirically see that they’re not using it, kill it. Don’t assume. Always be testing.More on feedback below.b. TESTINGSee point A.C. STEALING(!)No one will steal your idea. It takes time, money, skills and immorality to steal. Not everyone is born that lucky.Most importantly, no one cares about your idea.They’ll only start caring when there’s a massive amount of initial traction (50,000+ users). By then, you’ve already established a strong user/customer base and it’s too late for the others.HIRING FOR WEAKNESSOnly hire for a strength that needs to be filled in your company. Never for a weakness.Not once did any of the startups I worked in hire for a strength. I repetitively recommended hiring people purely out of loneliness, fear and scarcity repetitively. Each time it sunk us deeper.But what does that mean?Hiring for a weakness means that you attempt to fill a weakness in the fundamenetals in your company by hiring for a weakness. Example: If you’re building a product and it’s not gaining traction and your company doesn’t have inherent fundamentals, hiring Ryan Holiday to sell your product won’t help. You can’t fight weakness with weakness.However, if you have a rockstar engineering team and you want to add a marketing person to help take the product get to another level, then you’re adding a strength.Hiring for weakness also means:a. You hire a B+ player instead of a A+ player.b. You hire people so that they go through the struggle with you, so that they share your fears and paranoia. Not so they execute on what’s needed.c. Hiring someone to fill a position. Not to compliment the rest of the company.d. Hiring someone and not having any idea of what the hell you want them to do.e. It means hiring someone because you think there’s no one else. Scarcity.f. Hiring a client’s friend. Because you’re scared.It’s ultimately about the fundamentals. If the fundamentals of the product and the team aren’t there, adding someone is just adding a weakness. It won’t help, because it’s not a strength.PAINTER’S DILEMMAApproving emails? One week treks. Our first wireframes? $40K and four months. Did we have a working product after all this? No. We failed.The Painter’s Dilemma is when you’re so deep in the details of your project that you don’t even know what the idea is anymore. You’re blind. When you’re too deep you need help.How to solve it? Stop. Talk to people. Get feedback. Iterate and build. Release. Breathe.Repeat the loop.The more feedback you get the healthier you and your product are.FEEDBACK*I can’t emphasize this enough. If you don’t get feedback (everyday) you will die. I never got feedback. EVER. Well, until the cash ran out. Oops.If you’re not getting qualitiative and quantitive feedback/data everyday, the cancer will start.It’s easy: speak to people, Google Analytics, send surveys. Just don’t hide from it.*This is the crucial and worth a dedicated blog post in the future.COMMUNICATE“Don’t talk to him, he doesn’t understand. He’s out of the picture next funding round anyways.” I hid everything internally. It was easy, we were in 5 different countries! Our developers were remote (I’ll get to that) and Basecamp was our only means of communication. In other startups, I wouldn’t included people from discussions because “it isn’t necessary. That isn’t their job”New features, awful designs, conniving plans were all pushed through a funnel. I was the leader of the deceiving. Architecting a blue print to push my own delusional “never test and succeed” agenda. My style? The longer the email the less likely someone important will read it. What a strategy. As always, the CEO is the biggest idiot.I don’t care if you’re a church, a tech startup or a non-profit. If you don’t have a system of communication in place that keeps everyone aware of what everyone is doing in the company, in real-time, for every milestone, everyday, you will die very soon.Lesson: Live and breath Scrum.SCREW LAWYERSLawyers are criminals.I spent $15,000 on legal documents/fees we never used. Every entrepreneur/startup I’m involved with thinks lawyers are the first step to success. Bullshit.DOCSAll the legal documents you ever need are available online. If you’re B2B, all companies that you’ll work with have their own standard LOEs, NDAs, etc., that they anyways steal from Fortune 500 companies. Request it. Then use it. B2C? Here.BUT I NEED A TRADEMARK!Unless you have 10,000 clients you don’t need to think about copyright or even the name. Prove the concept first. Worry later. If you do have to worry, those are very nice worries to have.PATENT IT!Patenting something that isn’t validated with at least 10,000 clients is moronic. Ironically, this is the only mistake my first startup didn’t follow through with (fully, at least).DECISION MAKINGI was traumatized from taking decisions. Most startups never take decisions. In other statups I work in, decisions took weeks. People join startups for the reason of avoiding bureaucracy but everyone still does it. Why? Lack of trust and overview of the team, so they choke the process (have I suggested Scrum?).The board should decide on the vision and the group should decide what to execute on by creating a backlog for the week. The team should then have the power to execute it. With a great communication process in place, teammates should be able to take decisions without reporting to anyone while keeping everyone updated with everything’s that going on, live. Have a flat structure to achieve this by using Scrum.Let people do their jobs. Trust them. Don’t have a tedious review process as most startups do. Don’t suffocate the system. Empower your people.Read Scrum by Jeff Sutherland on how to manage your team. Then read Team of Teams by General Stanley McChrystal for how to organize the information flow. Both books compliment each other perfectly.THE BOARDThe ideal board is 3–5 people maximum if you’re a startup. Anything above that means that either no decisions will ever be taken (my first company) or someone has a hidden agenda and profits from a discombobulated board.A business is not a democracy. Unanimous decisions don’t work and will never work.Who’s should I put on the Board?Only investors/shareholders who hold a large stake and are extremely active in the success of your venture.INVESTORSSmart Money vs Still MoneyJust because someone is offering you cash almost always means you shouldn’t accept it.Your investor can have the greatest contacts in the pharmecutical industry. She can be CEO of Merck. If she doesn’t have a massive network in whatever industry you’re in, it’s worthless. The money will be worth nothing. This is true 100% of the time.Always onboard investors that can help you in your niche industry.MEETINGSThis is my top 3 favorites. Most won’t agree with me on this.I’ve never been to a meeting that has made me money/funded my venture. I don’t think anyone has. Has anyone ever handed you a check at a meeting? I doubt it. Today, it usually happens by wire-transfer.Meetings are pointless. Every team I meet, consult for/work with all think that going to meetings is the most crucial part of business. Most importantly, the whole team should be there. Pick up the fucking phone. Travel is time and money expensive. Even if you’re taking a cab.I would fly 10,000 miles for a 3 hour meeting and then fly back to Europe that same day. $30K. Gone.“If you had to identify, in one word, the reason why the human race has not achieved, and never will achieve, its full potential, that word would be: ‘meetings.’” - Dave BarryMost of the discussion can be ironed out over email and FaceTime.Ok yes, I agree. Meeting in person is important. But not until it’s necessary. Most of the time, it’s unecessary. And even when it is, it shouldn’t always be an excuse to leave work for a business lunch or to Shanghai for the day.Avoid meetings. Get more done.It’s a waste of time 99% of the time.FOUNDING PARTNERS = YOUR SPOUSEYou will be married to your partners and investors for the next 7–10 years. Choose wisely.Know your team. Speak to your investor’s enemies. Get references for everyone.Don’t be a deceiver. Use Scrum.WORKING HOURSWe worked 16 hour days. Yey! Startup life!No. Work 8–10 hours and you’ll get more done than working 18 hours a day. Don’t believe me. It’s proven.Working 18 hour days leads to a burn out, which leads to painter’s dilemma, then delusion, then deceiving others around you, then depression. Then it’s too late.Ultimately, the more you work the more mistakes you’re prone to make. Mistakes made are mistakes that need to be corrected. Mistakes that aren’t correct can take up to 24x longer to correct than if they were corrected immediately.But you can’t see that. You’re burned out. You’re in Painter.PRODUCT / MARKET VALIDATIONAnother reason I refused to test in the three product startups I was involved in was because “the ideas work successfully elsewhere. They will also work here.” Doesn’t work like that.Just because you’re making a mishmash of several products that have product/market validation elsewhere doesn’t mean people are willing to use your product. I have yet to meet a new founder who hasn’t claimed this.In order for someone to switch to your product, your product needs to be at least 8x better.*Is your product really 8x better than your biggest competitor? If the answer isn’t a clear yes, quit.*Read Hooked by Nir Eyal and Ryan Hoover for how to build habit forming products.RECREATING THE WHEEL“God gave you eyes, so plagarize.” -Michael LewisNo need to re-create the wheel. Everything is out there already for a reason. Use APIs, read books (many books), steal functions, designs, ideas, marketing slogans, branding, on boarding processes, software, colors, clients, everything from other people/companies who are successful.This doesn’t mean that you shouldn’t test it in your own environment. You must validate every single function that you put out there. Use the Lean Startup KanBan by Ash Maurya for this.DILUTIONWe gave away 51% for our first funding round. How much did we plan to keep when we “exited?” Think about that. It doesn’t make sense.Startups do this all the time. If you retain 51% after the seed round, how much does the founding team plan to keep by Series B? 20%? If you take the average of what you got paid for equity after the exit + your salary you’ll be paying more in taxes with a minimum wage paycheck for the past 8 years it took you to exit. Might as well work in a shoe store.If you don’t have the bargaining power (a validated product) to raise money with, quit.GUYS IN SUITSOur tech partners wore suits. That made us comfortable. They ended up quoting $100k. We ended up with nothing.If you see tech people in suits, run.OUTSOURCINGI lost well over $100,000 for our first version that was outsourced. We were smart enough to not learn from our mistakes so we found another team to outsource with. Another hefty sum gone. Only myself to blame.I’ve had terrible experiences with outsourcing and great experiences with in-house development.However, many products (we all use everyday) have found great success in outsourcing. I also know many entrepreneurs who outsource and are extremely succesful. While there are massive benefits, there are also downfalls. If you plan to, find a free consulting company that has pre-screened teams.Either way, using Scrum increases your chances of success in-house or out.YOUR TEAMEntrepreneurs read about Steve Jobs’ management style and think he was a tyrant. So they curse at their employees and tell everyone that they are “shit.” They think that’s how a company should be run and that’s how teammates should be treated. Wrong. Treat your team like shit and you’ll get shit.Either way, that’s not how Steve Jobs did it. Steve Jobs empowered his team. He told them that what they’re outputting is shit because he knew that they could do better. Because they are the best in the industry. He made them feel good. He challenged them and today Apple is Apple because of that.On the other hand, I lied. Didn’t speak about the hard things and repressed whatever fear or worry we had. We were scared that someone would quit or that we would look bad if we showed our emotions in front of our investors.You should always be able to tell your teammates all the fears and worries you have. Chances are, if you’re worried about something, everyone is worried about the same thing. Bring it up. Talk about it. I keep mentioning Scrum* because it encourages team members telling each other what’s bothering them and what’s impending the growth progress. This is key to not failing.Not once, in any of the startups I was in, did I or others get credit for great work or for their ideas that ended up being implemented. Not once did anyone congratualte a teammate on a engineering triumph, a beautiful design or a new lead. Startups think “business is business. This isn’t a cute place to pat each other on the backs.”BUT THAT’S EXACTLY WHAT A BUSINESS SHOULD BE. You should be holding each other up, helping one another and listening to the problems in the team. Because ultimately, you’re on the same mission.The second the negativity flows in people become scared. They stop raising issues, telling you how they feel and how to improve the business. When that happens you start to slowly die because you’ve fell into dillusion that everything is working. Six months later, you’re on the street.Empower your team. Congratulate people. Love each other. When someone screws up, tell them that. But also tell them how to improve and ask them why they think they screwed up and how to make their job easier.You’re a team. Be one.*Believe it or not, I’m not affiliated with Scrum in anyway. I’m not even a Scrum Master.—When I reflect on all the stupidity I’ve personally done and the startups I’ve been involved in, I realize that the only thing I ever followed up through and executed with absolute perfection, were the things that eventually ended up killing us: not telling a soul what our idea was. Talking to lawyers. Partnering with bad teams. Hiring out of weakness. Going to too many meetings. No decision making system. Not using Scrum. Hiring people out of fear. Hiding from reality.Mistakes are simple to make but hard to correct. They’re usually the first option that pops up. But as entrepreneurs we do thing because they’re hard, not because they’re easy.Hard choices take a long time to get right. It takes guts, intuition, experience and lots of luck. But never settle. Never accept your situation.Life can always be better.…..This was originally posted on the NY Observer and our blog on Penta.Follow me @lukaivicev or contact me directly at luka@getpenta.com.

-

You have the chance to fill out the money amount in a blank check. But you will have to use it in order to improve your life, your family's life and your friends' life. How much money would you ask for?

Just like User, I am doing quite well already, even though I do have to work. Then again, the question asks to improve not only my life but the life of my family and friends as well. Why not go one further? I'd like to improve the life of humanity as a whole. I'd ask for 30,000 euros so I could easily live for the duration of one year and could still invest in some small things. Then I would try to set up the Dutch branch of Circle of Reason. I firmly believe that everyone's life becomes better by becoming just a bit more rational than we are already. I would add my knowledge of and experience with mindfulness to the mix. I would set up a good website or really pay someone else to help me with that. I would invest some small amount of money in publicity. On top of that, I would fill the hours I had left over with volunteer work, probably for the Red Cross, since I already work for them. I'm sorry I can't give you a breakdown of the total amount; it is a guesstimate. I don't need anything for myself so it was hard to think of exact numbers.

-

What Sources beyond television news do you check out in order to form your opinion on political events?

Beyond TV news, I check out newpapers and magazines I trust, a couple of radio news channels that I trust, and various honest comedians who cover the news.I do not agree with the opinions of everybody I watch, read or listen to. The New York Times and the Washington Post both have very solid reporting, but I don’t agree with all of their analyses or opinions. It would be impossible given the wide range they have on their pages. The Guardian is quite good. Mother Jones has an agenda, one I admit I generally agree with, but has rock-solid reporting.Daily Kos has some good stories and some good reporting, but it also has a lot of emotional appeals and some flawed analysis. As a result, I rarely go there anymore. Fox News I will look at when it’s what’s on the TV at the oil change place, and it generally makes me want to yell at the TV when they have their talking heads on. Even when they report actual news, they do it in a way that specifically favors right-wing radicalism. I cannot support that. A coworker of mine runs Rush Limbaugh on the radio every day. As much as possible, I tune that out.I generally get along with Stephen Colbert but have disagreed at rare points. I like watching Bill Maher but there are times when I shout at him through the TV—not that he listens to me. Samantha Bee makes me wince sometimes, but more because that dick punch was thoroughly justified. Wait, Wait, Don’t Tell Me makes me groan, sometimes because the puns are good, sometimes because I could have written better limericks.On the radio I generally listen to NPR. Sometimes they run BBC World Service Radio on one of my local stations (WBUR) and it’s quite good. On occasion I will listen to the local CBS affiliate (WBZ) after it’s done with the traffic and weather.However, the important part for me is that I am regularly checking back with bits of political and moral philosophy. This includes things like the US Constitution, the Gettysburgh Address, the UN Declaration on Human Rights and more, but also includes looking at a wider realm of art and culture and how it reflects on us as individuals and a society. What makes sense in terms of promoting the general Welfare? What makes sense promoting human dignity?Our ideas of justice can change over time and based on exposure to other ideas. My role as a citizen is to ensure that my sense of justice is fair and based on compassion, erring on the side of mercy. I need to do my best to ensure I do not falter in the face of what could be overwhelming waves of what I consider cruelty and injustice.

-

How is it to work at Google India?

EDIT: Please do not PM me about how to get a job at Google. There are a ton of brilliant Quora answers out there which will be able to guide you much better. Thank you.Disclaimers:1. All views listed are my own. Google doesn't endorse them. It may or may not be applicable to other Indian Googlers. Most points are based on my perception. Some one else may have perceived things differently. Let’s agree to disagree :)2. I worked in Hyderabad office. So some of the answers might be more applicable to Google Hyderabad vs Google Bangalore or say Mumbai. I have not worked in all the organisations at Google India. Most of them may be more applicable to my organisation than others.3. I am no longer employed with Google. I left to pursue higher education.What is it like to work at Google India? Let me share some of my experiences in form of short stories/snippets. I have divided the answer into 2 sections - Exceeds expectations (thing that Google India does really really well) and Needs Improvement (things that can be made better).EXCEEDS EXPECTATIONSa. PERKSOne fine Monday morning, I had a single ten rupee note in my wallet. I checked my wallet again on Friday evening and it still had that single ten rupee note in it. At Google I don't spend a dime during weekdays. I signNow office in an office provided cab, eat at the free Google cafes, have snacks and dinner at the office itself and then signNow home in one of the office cabs.One of my favorite perks of working at Google India was sleeping in the office cabs on my way to home after a hectic day at work. Also, the cab service is only offered in India. In US, Google provides a shuttle service but the cab service doesn’t exist in any other country (to the best of my knowledge).Talking about wallets, the security is pretty great. You can leave your wallet, watch, laptop etc. anywhere in the office and can expect to find it back in the same place the next day or with security. In my 2 years at Google, I never heard of anyone’s stuff getting stolen.Most roles allow for some overseas travel opportunities. I went on a business trip to Europe. I followed all the guidelines for daily allowances (which is pretty generous) and wasn't asked a single question about it. I had drinks when I wanted to and had all kinds of exotic food on the company's card. Some Companies are cost driven where as Google is Value driven. (The cost of asking for business justification for each & every bill is more expensive than letting the employee do some productive work in that time. See point no. 4 under culture)Google offers a generous dental and vision insurance on top of health insurance. I underwent LASIK surgery and it was covered by Google’s vision insurance completely. Generally LASIK is considered as a cosmetic surgery and is not covered in most insurances.I know a couple of Indian Googlers who will never leave Google just for the amazing health insurance that it provides to some of their family members who need permanent medical attention.During employment, if you undertake any professional course that is related to your job, then Google reimburses 2/3 of the total cost. In case of personal development, Google reimburses 1/3 of the cost. Guitar lessons, Dancing lessons, learning a new language etc. come under the purview of personal reimbursement. I have used personal reimbursement couple of times and it was a smooth process. (Upload the bills and fill a small form and done)Much has been said about Google’s food over the inter webs. I don’t have anything new to add to it, but you realise the importance of it during the weekends when you have to get your own food. (I am a bachelor who lives alone and doesn’t like to cook)Other perks that I have enjoyed during my tenure in Google India - On site Gym, playing table tennis, pool, xbox, foosball, concierge service which takes care of all your daily errands like dispatching a courier, paying bills etc. (not free but nominal), laundry service (not free), mail room where you can order all your Amazon and Flipkart goodies :D. Also, there is an in house coffee shop(free), library in the office, culture club, theatre club, football club, cricket club,basketball club (in Hyderabad at least).Google tries it best to care for you. They celebrate every employee’s work anniversary by decorating their work desk and offering them some massage points which in India translates to 60 minutes of free massage.This is how my desk looked like on my 2nd work anniversary. If it makes any difference, I was on my notice period on this day.9. Free Goodies. Team has extra budget? Great, let’s order some goodies. Organisation has some cash leftover from the annual budget? Great. Let’s order some goodies. I have received Google t-shirts (5–6) , couple of hoodies,external hard disk, wireless speakers, headphones, backpacks, selfie stick, neck pillow, keychains, pen drives, coffee mugs etc. in just 2 years. The amount of money Google spends on each employee is staggering.A lot of other companies would pat themselves in the back for saving some money from a party budget and carry it over to the next year. Not Google :)Talking about goodies, the grand daddy of them all - the annual Christmas gift awarded to each employee. I received a Nexus 5X last Christmas and an Android One phone the year before on Diwali.b. CULTUREGoogle allows you to be yourself. They don’t have a one screw fits all bolts policy. Come at what time you want & leave when you want to. There is no concept of attendance or normal office hours. One of my colleagues who got an exceptional rating last cycle had the habit of coming to office at 3 pm. (In his defense, he did work till 12 in the night.)You can wear whatever you want to. No dress code bullshit. You are not judged on how well your shirt is pressed.One of the unsaid rules of working at Google is - Be Nice and Be Respectful. People hold doors for you. You will hold doors for people. Expect to hear the word “Thanks” (or some variant) every other sentence.Elimination of bureaucratic bullshit. Google tries its best to eliminate hassles for its employees. There are proper channels for everything. Have a question about your latest payslip? Mail an email alias and get your concern addressed in 24 hours or less. Need to get some expenses reimbursed? Go to an internal portal and fill out a form and done. You don’t have to jump through the hoops to get things done. This is true for pretty much everything.There is an internal memes site ( check out Eric Schmidt’s book for more details) where you can criticise the CEO, senior VPs, management etc. without any repercussions. You can voice your disagreement and it is OK!. You can respectfully agree to disagree. Also, Googlers are the first to be up in arms against any decision taken by the company which may not be in the user’s best interests. ( Integrating G+ with Youtube was an unpopular decision internally and people weren’t shy when it came to expressing their disagreement)Google India celebrates multiple festivals every year by decorating the office and preparing special food on those days. It also has Bring your children to work multiple times a year where they install make shift slides & play houses in the office for children. Also, there are multiple initiatives organised by Googlers and for Googlers to give something back to society.c. WORKYour work will largely depend on which organisation you join and on your skill sets.Annual increments every year are quite generous. The only time people bitch about their increments is when they compare it against their neighbor. “I only got 20% while so and so got 30% last year blah blah”. Obviously, increments are dependent on your current base salary and your appraisals.You can say NO to projects. If the project doesn’t interest you, then you can decline to take it up. Obviously you need to convince your manager. Most managers will agree to not give you some project which you don’t want to undertake.Google has a pretty good internal mobility program. But the competition is very immense.( See point no.1 in Needs Improvement section)Needs ImprovementOne of my colleagues used to jokingly say that Google hires Ph.Ds to work as janitors. This is true to a large extent. Google hires CEOs to work as mid level managers. Most of the people who work at Google (and in India too) are way over-qualified for their jobs. If Google India wants to hire someone to write an email, they will go and hire a topper from DU. If they want to hire someone who can provide call support to users, they will go and hire an English hons. topper from DU (Do remember that you need some 99% in your boards to just clear DU’s cut off) . There are Ph.Ds at Google from IVY league colleges who just move data from one database to the other. You can see the pattern. This leads to immense competition.Most of the interesting roles are in Mountain View. The Engineering division in Hyderabad and Bangalore work on Google Apps for Work. It is a small team. I am not sure about the exact numbers but it is definitely less 1% of the total engineering workforce at Google. The two largest organisations at Google India are the sales org and the anti-abuse wing of Google which take down offensive content. If you come to work at Google India don’t expect to work on some cutting edge product like Driverless cars, Brain or Loon. Expect to work on something boring.Google India offers very limited scope for career growth. You obviously can’t become the CEO/SVP/VP working from India when more than 80% of your workforce is based out of Mountain View. The roles in India are very limited too since only a handful organisations are based out of India. Sooner than later, anyone, who has some iota of ambition and are not constrained by family, move to Mountain View. (The internal mobility is pretty great by the way minus the tons of competition for good roles. See point no. 1)Google runs a lot of programs to train its management and provides a lot of support to its employees to keep them stress free and remove all politics from the workplace. However, Google is a system run by people and at the end of the day people are flawed. Some politics does creep into the picture. It might be comparatively less than many other places but it does exist.Promotions in the non-tech organisations are very messy. It comes down to how much your manager is willing to push for your case. So, if you don’t have the best of relationships with your manager or your manager doesn’t like your face then find a new manager ASAP. If your manager is someone who backs down easily then say bye-bye to your promotion. I knew a guy on the floor who would stand behind his reportees like a wall (the noun, not Rahul Dravid). Multiple reportees in his team got promoted each cycle. Same cannot be said about the manager who had the reputation of backing down easily. It is not like there weren’t any hard-working or deserving candidates in the latter’s team. The scene is signNowly different and less messy for tech ladders.Talking about Promotions, the lack of transparency around the committee who sits down to evaluate your candidature for promotion can be unnerving. Google allows you to be yourself & disagree with the decisions of the upper management. But at the back of your mind, you are always scared of what you say because you never know at what stage it may come to bite you in your backside. Almost any senior person on the floor can get you screwed out of your promotion. You absolutely cannot afford to piss off anyone who sits in one of those promo committees. What if the senior manager whose XYZ decision you disagreed with says he is not happy with your work in one of those closed committee meetings. If your immediate manager doesn’t fight tooth and nail for you, your promotion is gone. This point is specially true for Google India. I don’t think Google India managers are good at taking criticisms from their reportees. Almost all the questions asked during town hall meetings are anonymous. If the management doesn’t allow anonymous questions for some town hall, no questions are asked in that town hall. There is a lot of mistrust between management and non-management.This needs to be FIXED ASAP.Google India takes an awfully long time to weed out bad managers. Managers with bad approval ratings are given multiple chances to become better at their job. It can take anywhere from 3 years to Never for Google to identify a bad manager and ask them to either become an individual contributor or find another role somewhere else. Problem with this is the following : A bad individual contributor screws up a project. A bad manager screws up the career of their multiple reportees, multiple projects, the entire team and relationship with stakeholders.That being said, Google does put in some checks through the internal culture & escalation mediums that ensures that your manager will show consideration for you as a human being (unlike the notorious Indian IT industry where you are addressed as a ‘resource’ and not a human being). However, some people are simply not cut out for people management. I don’t blame Google for any of this. I simply hope they get better at filtering out such candidates early on and removing them sooner. They should also change the annual Manager feedback survey to bi-annual and make it more actionable & hold the manager responsible. Currently, the manager feedback survey is useless and is only used for the manager to self-introspect. So, if a particular manager thinks along the lines of ‘Hey. I am a good manager. All of these people reporting under me who have given me an approval of only 30% are idiots. I don’t care about this survey’ then the survey becomes entirely meaningless. There is no accountability for a manger with a bad survey rating.This might be slightly controversial but - Google doesn’t fire anyone for low performance. How is this a con? Let me explain. Amazon has a policy of firing 10% of its staff every year after stack ranking them. Google rarely fires anyone for low performance. At best after multiple bad reviews, they are asked to find a new team or job and are given enough time to do so. Both Google and Amazon in my opinion are at the two extreme ends of the spectrum. One leads to slack while the other leads to stress over fear of losing your job. I think a middle path is a more suitable approach. My 2 cents. That being said, Google does provide incentives for you to work hard. Hard work leads to good ratings which leads to better pay, more equity, better & faster career growth. However, you will occasionally find some people who are content with putting in their absolute minimum at the job and are simply happy with their take home salary and flying under the radar of the management.Google India is notorious at hiring people at the wrong level. I know so many people who were hired one level below than they should have been. If you are offered a job at Google India, then definitely try to signNow out to an existing Indian Googler and evaluate which level is suitable for your profile and try to negotiate with your recruiter. Also, don’t let them push you around. Some recruiters think they have the birthright to hire you at the wrong level for a low salary because they are offering you a chance to work at Google.Again, this point is applicable only for non-tech ladders. Google uses internal tools for everything. You will learn a lot of skills during your job but most of them won’t translate to something that you can re-use in the industry. You will have to rely on your soft skills to get your next job.Open Work space: The floor can be very noisy at times (specially post 5 pm) and sometimes it can be impossible to work without your headphones on. For whatever reasons beyond my comprehension, a few folks used to take meetings from their desks and take 30 min+ personal calls sitting on their desk, happily oblivious of the amount of noise & annoyance they are causing to everyone in the bay. You either need to put on headphones or go up to them and request them to move somewhere else. Most often than not, it is you who will either put on the headphones or move somewhere else because you don’t want to appear rude.The amount of freebies & other perks can sometimes make you entitled. Some become more entitled than others. Some bad apples do treat the temporary employees (TVCs) with disrespect. Some engineering guys do look down on non-engineering guys. (Please notice the word - some. Some doesn’t mean all)Your work doesn’t speak for you. You need to spend a lot of time to market your work. This includes sending emails, signNowing out to upper management during their office hours and very subtly praise yourself and your work, speaking out during meetings and again talking about your work and so on. This can be difficult for introverts and for people who are uncomfortable with boasting about their work.Related to Promotions - The amount of work put by you is completely meaningless. To get promoted, you need to deliver on projects and show impact. If the management keeps flip flopping on the scope of the project or you are collaborating with someone who doesn’t care, then either you need to Superman up and deliver the project end to end all by yourself or forget about your promotion. Also, even if you successfully execute a very complex project but for whatever reason, the metrics gods aren’t favorable to you and the impact numbers don’t look good, then it won’t do you much good. On the other hand, it is quite possible for someone to land a super easy project and gain a lot of brownie points by showing some good numbers thanks to business requirements of that particular product.The Microsoft Problem. Google India, like Google is expanding at a fast rate. This means more competition and lesser budgets for everything. The budgets for parties, gifts, events, off sites have decreased over the years. Don’t get me wrong, the perks and budgets are still very high, but every time the number of coffee machines on the floor get reduced or your favorite expensive candy in the micro kitchen go missing or the size of the packets of cookies in micro kitchen go from large to small, a lot of old timers start speculating about the upcoming apocalypse. (Apocalypse here being end of perks and culture as we know it)Throw Nooglers in the ocean and let them either learn to swim or drown completely (metaphorical). This is more of a Google culture and less of a Google India culture. As a new joinee, and after a couple of short meetings explaining the role of your team, you are expected to fly on your own. You are given a span of 3- 6 months to ramp up and learn things on your own. If you run into a problem, you are expected to signNow out to someone and seek help. No body will come and ask you if you need help. I am not sure why I am including this in the needs improvement section. Google hires self-starters & ambitious people who like to get things done. However, in the beginning this can be very intimidating and you are expected to struggle a lot. Even basic things at Google from getting the right accesses and getting added to the correct groups to submitting a simple change in the codebase will require you to read some internal documentation or ask someone for help.Bottom line :You will come to work for Google India for the brand and leave to pursue better quality work elsewhere (either to Mountain View or to another company). Google India is a very good employer and treats you well but once the honeymoon period is over, it is the quality of work which will keep you satisfied (or dissatisfied) at the work place and no amount of free chocolates or other freebies will be able to compensate for it. So choose your role wisely and don’t expect flying unicorns or something. Do keep in mind that all the free stuff will cease to excite you..just like your cell phone isn’t exciting anymore and just like your last car or clothes stopped pleasing you after a couple of days/weeks.

-

Can the back of a check signed over to you have pay to the order of under your name instead of on top?

How to sign on the back portion of the cheque for the purpose of endorsement?There are no rules in this connectionNormally, the endorsements should be in an order - say from top to bottom. However, the holders either knowingly or unknowingly on account of some urgency used to sign the cheques at any empty space available in the chequeThe bank will not return the cheques and moreover, they cannot return or refuse payment for the cheque for the abovementioned reasonThe last holder should mark the endorsements by marking the serial numbers from 01 to ……………….09 against the endorsements using a pencil (only pencil marks)This will enable the bank to read the endorsements and they will be able to find out the first endorsement and the last endorsement and they will arrange to pay the amount to the last endorsee who is the holder for the cheque

Create this form in 5 minutes!

How to create an eSignature for the place check or money order on top of your

How to make an eSignature for the Place Check Or Money Order On Top Of Your in the online mode

How to create an eSignature for the Place Check Or Money Order On Top Of Your in Chrome

How to make an electronic signature for putting it on the Place Check Or Money Order On Top Of Your in Gmail

How to make an eSignature for the Place Check Or Money Order On Top Of Your from your smart phone

How to create an electronic signature for the Place Check Or Money Order On Top Of Your on iOS

How to create an eSignature for the Place Check Or Money Order On Top Of Your on Android

People also ask

-

What is Form 515 and how can airSlate SignNow help with it?

Form 515 is a specific document often used for tax purposes or other regulatory requirements. With airSlate SignNow, you can easily create, send, and e-sign Form 515 quickly and securely, streamlining your document management process and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for Form 515?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan allows you to manage and eSign documents like Form 515 efficiently, with transparent pricing that ensures you get the best value for your investment.

-

Can I customize Form 515 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Form 515 templates to meet specific requirements. You can add fields, modify layouts, and include branding elements to ensure your documents align with your business identity.

-

What features does airSlate SignNow offer for managing Form 515?

airSlate SignNow provides a robust set of features for managing Form 515, including document templates, e-signature capabilities, and secure cloud storage. You'll also benefit from advanced tracking and reporting features to monitor the status of your documents.

-

Does airSlate SignNow integrate with other software for Form 515 management?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing for efficient management of Form 515 alongside your other business tools. This integration helps streamline workflows, ensuring that your team can work more effectively.

-

What are the security measures for handling Form 515 in airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling Form 515, your documents are protected with advanced encryption, secure access controls, and compliance with industry standards, ensuring that your sensitive information remains safe.

-

Can I track the status of my Form 515 documents in airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Form 515 documents in real-time. You will receive notifications when documents are viewed, signed, or completed, helping you stay informed throughout the process.

Get more for Form 515

- Peter bought 8 hamburgers form

- Petition to seal to commissioner of probation one mass gov mass form

- Refusal of recommended treatment form

- Massey bedside swallowing screen form

- Stuy absence note form

- New jersey association of realtors standard form of residential lease new jersey association of realtors inc

- Ssa 159current gso website registration form

- Grievance form pdf nabet cwa

Find out other Form 515

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now