Ifta Registration 2018-2026

What is the IFTA Registration

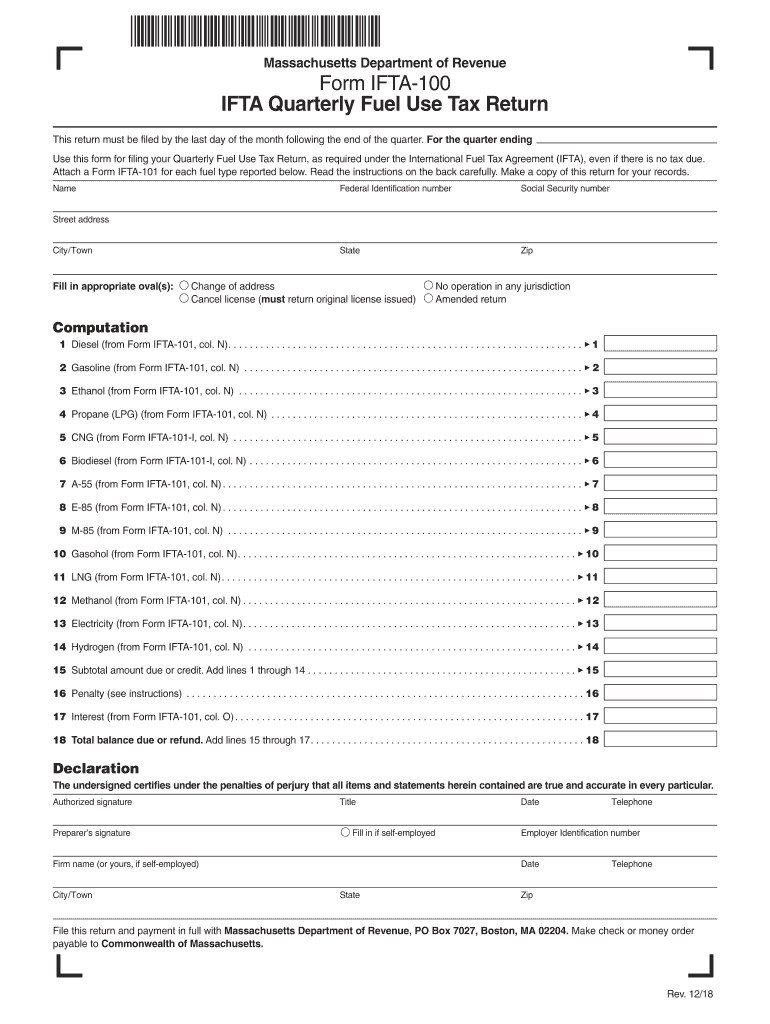

The International Fuel Tax Agreement (IFTA) registration is a crucial requirement for commercial motor carriers operating across multiple states in the United States and provinces in Canada. This agreement simplifies the reporting of fuel use taxes by allowing carriers to file a single quarterly fuel tax report instead of separate reports for each jurisdiction. By registering for IFTA, carriers can streamline their tax compliance process, ensuring they pay the appropriate fuel taxes based on their actual fuel consumption in each state or province.

Steps to complete the IFTA Registration

Completing the IFTA registration involves several key steps to ensure compliance and accuracy. First, gather necessary information about your business, including your legal business name, address, and the type of vehicles you operate. Next, fill out the IFTA application form, which may vary by state but generally requires details about your fleet and fuel usage. After completing the form, submit it to your state’s Department of Revenue or equivalent authority, along with any required fees. Once approved, you will receive an IFTA license and decals for your vehicles, which must be displayed as mandated.

Required Documents

When applying for IFTA registration, certain documents are typically required to verify your business and vehicle information. These may include:

- Proof of business registration, such as a business license or articles of incorporation.

- Vehicle identification information, including VINs and license plate numbers.

- Documentation of your fuel purchases and usage, which may be reviewed during audits.

- Payment for any applicable registration fees.

Ensure that all documents are accurate and complete to avoid delays in the registration process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for IFTA is essential for maintaining compliance and avoiding penalties. IFTA quarterly reports are typically due on the last day of the month following the end of each quarter. The quarters are defined as follows:

- First Quarter: January 1 - March 31, due April 30

- Second Quarter: April 1 - June 30, due July 31

- Third Quarter: July 1 - September 30, due October 31

- Fourth Quarter: October 1 - December 31, due January 31

It is important to mark these dates on your calendar to ensure timely submission and avoid late fees.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties for carriers. Common penalties include:

- Fines for late filing or underpayment of taxes.

- Revocation of your IFTA license, which can hinder your ability to operate across state lines.

- Increased scrutiny and audits from tax authorities, leading to potential further penalties.

Maintaining accurate records and adhering to filing deadlines is crucial to avoid these consequences.

Legal use of the IFTA Registration

The legal use of IFTA registration is vital for ensuring that all fuel tax obligations are met according to state and federal laws. Carriers must accurately report fuel consumption and taxes owed for each jurisdiction in which they operate. Misrepresenting information or failing to report can lead to serious legal repercussions, including fines and potential criminal charges. It is essential for businesses to maintain transparent and accurate records to support their IFTA filings and to comply with all applicable regulations.

Quick guide on how to complete ifta 100 2018 2019 form

Your assistance manual on how to prepare your Ifta Registration

If you’re interested in learning how to finalize and submit your Ifta Registration, here are some concise instructions on how to simplify tax processing.

To get started, all you need to do is create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a highly user-friendly and powerful document management solution that allows you to edit, draft, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures while also going back to modify information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Ifta Registration in just a few minutes:

- Create your account and start working on PDFs almost immediately.

- Utilize our catalog to find any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Ifta Registration in our editor.

- Complete the necessary fillable fields with your data (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Note that filing on paper may lead to increased return errors and delays in refunds. Additionally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ifta 100 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the ifta 100 2018 2019 form

How to create an electronic signature for the Ifta 100 2018 2019 Form online

How to create an electronic signature for your Ifta 100 2018 2019 Form in Google Chrome

How to create an electronic signature for putting it on the Ifta 100 2018 2019 Form in Gmail

How to generate an eSignature for the Ifta 100 2018 2019 Form straight from your smart phone

How to generate an electronic signature for the Ifta 100 2018 2019 Form on iOS

How to create an electronic signature for the Ifta 100 2018 2019 Form on Android devices

People also ask

-

What is Ifta Registration and why do I need it?

Ifta Registration, or International Fuel Tax Agreement registration, is essential for commercial vehicle operators who travel across multiple states or provinces. It simplifies fuel tax reporting and payment, ensuring compliance with tax regulations. By obtaining Ifta Registration, you can save time and avoid penalties associated with fuel tax filings.

-

How can airSlate SignNow help with Ifta Registration?

airSlate SignNow streamlines the Ifta Registration process by allowing you to electronically sign and send documents quickly and securely. Our platform simplifies the paperwork involved in Ifta Registration, making it easier for you to stay compliant and focus on your business operations. Experience the convenience of eSigning your Ifta documents from anywhere.

-

What features does airSlate SignNow offer for managing Ifta Registration?

airSlate SignNow offers features that enhance the Ifta Registration process, including customizable templates and cloud storage for easy access to your documents. You can track the status of your Ifta Registration paperwork in real-time and collaborate with your team seamlessly. These features ensure that your Ifta Registration remains organized and compliant.

-

Is there a cost associated with Ifta Registration through airSlate SignNow?

While airSlate SignNow does not charge directly for Ifta Registration itself, there is a subscription fee for using our eSigning services. Our pricing plans are cost-effective and designed to fit various business needs, ensuring that the benefits of streamlined Ifta Registration justify the investment.

-

Can I integrate airSlate SignNow with other software for Ifta Registration?

Yes, airSlate SignNow integrates easily with various accounting and fleet management software, making Ifta Registration more efficient. By integrating our platform with your existing tools, you can automate document workflows related to Ifta Registration, reducing manual entry and improving accuracy.

-

What are the benefits of using airSlate SignNow for Ifta Registration?

Using airSlate SignNow for Ifta Registration offers several benefits, including time savings, enhanced compliance, and reduced paperwork. Our eSigning solution allows you to complete Ifta Registration documents swiftly, ensuring timely submissions and preventing delays in your operations.

-

How secure is airSlate SignNow for handling Ifta Registration documents?

airSlate SignNow prioritizes security for all documents, including those related to Ifta Registration. Our platform employs industry-standard encryption and security protocols to protect your sensitive information throughout the signing process, giving you peace of mind while managing your Ifta Registration.

Get more for Ifta Registration

- Annual consumer reporting form crf delaware health and dhss delaware

- Iu health fmla department form

- Application for terminal inspection chp 365 chp ca form

- Erivedge enrollment form

- Visa application 2220 form

- Form 1125 a 100020600

- Instructions for use of resale certificates for non new jersey form

- Request for re evaluation independent students form

Find out other Ifta Registration

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors