740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky Form

What is the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

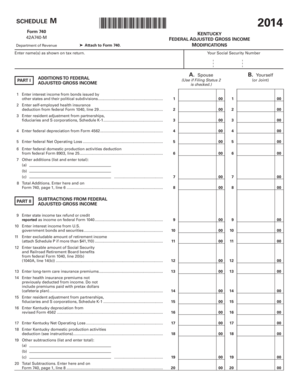

The 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form is a crucial document for taxpayers in Kentucky. It allows individuals to report modifications to their federal adjusted gross income, which can impact their state tax liability. This form is essential for accurately calculating state taxes owed, ensuring compliance with Kentucky tax laws, and potentially qualifying for various deductions or credits. Understanding the purpose of this form is vital for effective tax planning and compliance.

Steps to complete the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

Completing the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form involves several key steps:

- Gather necessary documentation, including your federal tax return and any relevant financial statements.

- Identify the specific modifications to your federal adjusted gross income, such as adjustments for retirement contributions or other deductions.

- Fill out the form accurately, ensuring all modifications are clearly stated and supported by documentation.

- Review the completed form for accuracy and completeness before submission.

- Submit the form via the appropriate method, whether electronically or by mail, according to Kentucky state guidelines.

How to obtain the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

Obtaining the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form is straightforward. Taxpayers can access the form through the Kentucky Department of Revenue's official website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, taxpayers may also request a physical copy by contacting their local tax office if they prefer to fill it out by hand.

Legal use of the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

The legal use of the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form is governed by Kentucky tax regulations. This form must be completed accurately to ensure compliance with state tax laws. Submitting incorrect information can lead to penalties or audits. It is important for taxpayers to understand their rights and responsibilities when using this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form typically align with the state income tax return deadlines. Generally, taxpayers must submit their forms by April fifteenth of each year. It is essential to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances. Marking important dates on your calendar can help ensure timely submission and compliance.

Required Documents

To complete the 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky form, taxpayers should gather several required documents:

- Your federal tax return, which serves as the basis for adjustments.

- Documentation supporting any income modifications, such as W-2s or 1099s.

- Records of any deductions or credits claimed that affect your adjusted gross income.

- Any other relevant financial statements that may impact your state tax calculations.

Quick guide on how to complete 740 kentucky federal adjusted gross income modifications revenue ky

Complete [SKS] seamlessly on any device

Digital document handling has become favored by both enterprises and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you'd like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

Create this form in 5 minutes!

How to create an eSignature for the 740 kentucky federal adjusted gross income modifications revenue ky

The way to make an e-signature for a PDF online

The way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What are the main benefits of using airSlate SignNow for managing 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

airSlate SignNow streamlines the process of managing 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky by providing a user-friendly platform for eSigning and document collaboration. Its robust features simplify tracking modifications and enhance compliance. This efficiency helps businesses reduce errors and save time.

-

How does airSlate SignNow ensure compliance with 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

airSlate SignNow ensures compliance with 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky through secure, legally binding eSignatures and audit trails. The platform adheres to the latest regulations, providing peace of mind that your documents meet legal standards. By integrating compliance into our processes, we help businesses navigate the complexities of tax modifications.

-

What pricing options are available for airSlate SignNow related to 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

airSlate SignNow offers a range of pricing plans tailored to different business needs, including those managing 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky. Our plans are designed to be cost-effective, allowing businesses to scale their document management solutions without overspending. For detailed pricing, visit our website or contact our sales team.

-

Can airSlate SignNow integrate with accounting software for 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky management?

Yes, airSlate SignNow can seamlessly integrate with various accounting software, making it easier to manage 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky. This integration ensures that your financial data flows smoothly, enhancing your document workflows. It enables better tracking of modifications and simplifies record-keeping.

-

What features does airSlate SignNow provide specifically for 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

airSlate SignNow includes features designed for handling 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky, such as customizable templates and automated workflows. These tools help streamline the document management process, ensuring that modifications are accurately captured and processed. Additionally, our platform offers real-time collaboration capabilities.

-

Is airSlate SignNow suitable for small businesses dealing with 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

Absolutely! airSlate SignNow is ideal for small businesses managing 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky, as it offers an affordable and user-friendly solution. The platform's scalability means that even small operations can benefit from its comprehensive features without the need for extensive resources.

-

How secure is airSlate SignNow when handling sensitive documents for 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents related to 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky. We use advanced encryption methods, secure servers, and regular security audits to protect your data. Our compliance with industry standards ensures that your information remains confidential and secure.

Get more for 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

- Complaint form utah division of real estate utahgov realestate utah

- July 10 2012 61med englishindd utah department of health health utah form

- Professional fund raiserprofessional fund raising counsel professional fund raising consultant permit application form utah

- Marriage license application washington county utah washco utah form

- Request reduction of retainage form anr state vt

- Aircraft request form pdf the virginia department of aviation doav virginia

- Vdss model form

- Enrollment response form

Find out other 740 Kentucky Federal Adjusted Gross Income Modifications Revenue Ky

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT