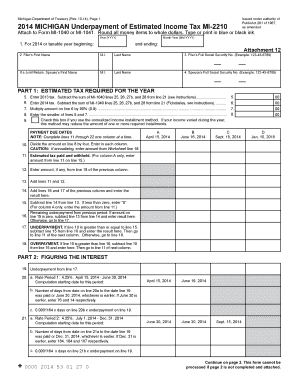

MICHIGAN Underpayment of Estimated Income Tax MI 2210 MICHIGAN Underpayment of Estimated Income Tax MI 2210 Michigan Form

What is the MICHIGAN Underpayment Of Estimated Income Tax MI 2210?

The MICHIGAN Underpayment Of Estimated Income Tax MI 2210 is a tax form used by individuals and businesses in Michigan to report and calculate any underpayment of estimated income tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated payments. The form helps determine if a penalty is owed due to underpayment and calculates the amount of that penalty. Understanding this form is crucial for compliance with Michigan tax laws and avoiding unnecessary penalties.

Steps to complete the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

Completing the MICHIGAN Underpayment Of Estimated Income Tax MI 2210 involves several key steps:

- Gather your income information, including wages, interest, dividends, and any other sources of income.

- Determine your total tax liability for the year. This includes all taxes owed based on your income.

- Calculate the estimated tax payments made throughout the year. This includes any withholding and estimated payments.

- Use the form to compare your total tax liability with the estimated payments to determine if there is an underpayment.

- If applicable, calculate the penalty for underpayment as instructed on the form.

Legal use of the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

The MICHIGAN Underpayment Of Estimated Income Tax MI 2210 is legally binding when completed accurately and submitted on time. It must be filed with the Michigan Department of Treasury to ensure compliance with state tax laws. The information provided on this form is used to assess any penalties for underpayment, making it important to ensure all calculations are correct. Failure to file or inaccuracies may lead to penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the MICHIGAN Underpayment Of Estimated Income Tax MI 2210. Typically, the form should be filed along with your annual tax return by April 15 of the following year. If you are self-employed or have other specific circumstances, be sure to check for any additional deadlines that may apply to your situation. Timely submission helps avoid penalties and interest on unpaid taxes.

Required Documents

To complete the MICHIGAN Underpayment Of Estimated Income Tax MI 2210, you will need several documents:

- Your previous year’s tax return for reference.

- Documentation of all income sources, including W-2s and 1099s.

- Records of estimated tax payments made throughout the year.

- Any correspondence from the Michigan Department of Treasury related to tax payments or liabilities.

Penalties for Non-Compliance

Failure to comply with the requirements of the MICHIGAN Underpayment Of Estimated Income Tax MI 2210 can result in significant penalties. Taxpayers may face a penalty based on the amount of underpayment, which can accumulate interest over time. Additionally, ongoing non-compliance may lead to further legal action by the Michigan Department of Treasury. It is advisable to address any underpayment issues promptly to mitigate potential penalties.

Quick guide on how to complete 2014 michigan underpayment of estimated income tax mi 2210 2014 michigan underpayment of estimated income tax mi 2210 michigan

Effortlessly complete [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact confidential information with the tools specifically offered by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan

Create this form in 5 minutes!

How to create an eSignature for the 2014 michigan underpayment of estimated income tax mi 2210 2014 michigan underpayment of estimated income tax mi 2210 michigan

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is the MICHIGAN Underpayment Of Estimated Income Tax MI 2210?

The MICHIGAN Underpayment Of Estimated Income Tax MI 2210 is a form used by taxpayers in Michigan to calculate penalties for underpayment of estimated tax. It helps individuals determine if they owe any penalties for not paying enough taxes throughout the year. Understanding this form is crucial for staying compliant with Michigan tax regulations.

-

How can airSlate SignNow assist with MICHIGAN Underpayment Of Estimated Income Tax MI 2210?

airSlate SignNow can enhance your experience with MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan by allowing you to easily create, send, and eSign the necessary documents. With a user-friendly interface, you can streamline your tax documentation process efficiently. This not only saves you time but also ensures that your forms are completed accurately.

-

Are there any fees associated with submitting the MI 2210 form?

Yes, while airSlate SignNow offers competitive pricing for its document management services, any applicable fees for submitting the MICHIGAN Underpayment Of Estimated Income Tax MI 2210 will depend on your tax situation. It's important to check with your tax advisor or the Michigan Department of Treasury for potential penalties or interest on underpayments.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow offers features like eSignature, document templates, and secure storage specifically designed for tax-related documents including the MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan. These features simplify the process of preparing and submitting tax forms, ensuring that you can focus on what matters most—your business. Additionally, our platform provides reminders for important deadlines.

-

Can I integrate airSlate SignNow with other software for my tax needs?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software. This makes it easier to manage your MICHIGAN Underpayment Of Estimated Income Tax MI 2210 and other related documents without switching between platforms. Integrating allows for greater efficiency and accuracy in your tax preparation.

-

What benefits does using airSlate SignNow offer for tax documentation?

Using airSlate SignNow for your MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan provides numerous benefits including enhanced security, faster processing times, and the convenience of electronic signatures. Our platform is designed to ensure that your documents are secure and accessible anytime, anywhere. This means you can submit your tax documents without the hassle of physical paperwork.

-

How do I ensure compliance with the Michigan tax laws using airSlate SignNow?

To comply with Michigan tax laws, it's essential to accurately complete the MICHIGAN Underpayment Of Estimated Income Tax MI 2210. airSlate SignNow helps ensure compliance by providing templates and tips to assist in proper form completion. Regularly updating your knowledge on tax requirements and utilizing our platform will help you stay compliant and avoid penalties.

Get more for MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan

- Form 1099 2010 omb 1545 0115 fillable

- What is form 10140 for 2010

- Irs form 1098 c 2010

- Us individual income tax return 2010 income adjusted irs form

- 2009 ss 8 form

- Form 4506t ez october 2009 short form request for individual tax return transcript makinghomeaffordable

- 2009 form 1120

- Fincen form 107 2008

Find out other MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210 Michigan

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple