Mississippi Resident Individual Income Tax Return Form

What is the Mississippi Resident Individual Income Tax Return

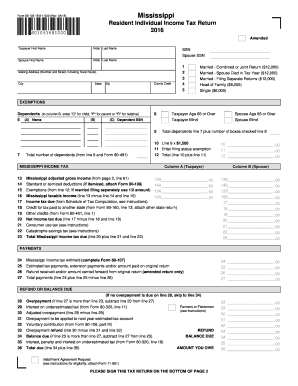

The Mississippi Resident Individual Income Tax Return is a crucial document for individuals residing in Mississippi who need to report their income and calculate their tax liability. This form is specifically designed for residents and is essential for ensuring compliance with state tax laws. It collects information about various income sources, deductions, and credits applicable to Mississippi taxpayers, allowing the state to assess the amount owed or any refund due.

Steps to complete the Mississippi Resident Individual Income Tax Return

Completing the Mississippi Resident Individual Income Tax Return involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which may include options such as single, married filing jointly, or head of household.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Review the completed form for accuracy and completeness to avoid any potential issues.

- Submit the form by the designated deadline, either electronically or via mail.

How to obtain the Mississippi Resident Individual Income Tax Return

The Mississippi Resident Individual Income Tax Return can be obtained through various channels. Taxpayers can download the form directly from the Mississippi Department of Revenue's website. Additionally, physical copies may be available at local tax offices or public libraries. For those who prefer digital solutions, many tax preparation software programs also include the option to complete this form electronically.

Legal use of the Mississippi Resident Individual Income Tax Return

The Mississippi Resident Individual Income Tax Return is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, the form must be signed and dated by the taxpayer. Electronic submissions are also recognized as legally binding, provided they comply with eSignature laws. It is important for taxpayers to understand their responsibilities and the legal implications of submitting this form accurately and on time.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the Mississippi Resident Individual Income Tax Return. Typically, the filing deadline coincides with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes or updates to these dates to avoid penalties for late submission.

Required Documents

To complete the Mississippi Resident Individual Income Tax Return, taxpayers need to gather various documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical bills or mortgage interest

- Any relevant tax credit documentation

Having these documents on hand will facilitate a smoother and more accurate filing process.

Form Submission Methods (Online / Mail / In-Person)

The Mississippi Resident Individual Income Tax Return can be submitted through multiple methods. Taxpayers have the option to file online using approved e-filing services, which often provide a faster processing time. Alternatively, forms can be mailed to the appropriate state tax office. For those who prefer a personal touch, in-person submissions may also be made at designated tax offices. Each method has its own advantages, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete mississippi resident individual income tax return 397985302

Effortlessly prepare Mississippi Resident Individual Income Tax Return on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents efficiently without delays. Manage Mississippi Resident Individual Income Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Mississippi Resident Individual Income Tax Return effortlessly

- Locate Mississippi Resident Individual Income Tax Return and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive data with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to share your form: by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Alter and eSign Mississippi Resident Individual Income Tax Return to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mississippi Resident Individual Income Tax Return?

The Mississippi Resident Individual Income Tax Return is a form used by residents of Mississippi to report their income and calculate their state tax obligations. It is essential for ensuring compliance with state tax laws and can affect your eligibility for refunds or credits. Understanding this return is crucial for managing your taxes efficiently.

-

How can airSlate SignNow help with submitting my Mississippi Resident Individual Income Tax Return?

AirSlate SignNow provides a streamlined and secure way to sign and send your Mississippi Resident Individual Income Tax Return electronically. With its user-friendly interface, you can easily send documents for eSignature to relevant parties, ensuring timely submission. This helps eliminate paperwork hassles and improves efficiency.

-

Is it cost-effective to use airSlate SignNow for my tax return needs?

Yes, using airSlate SignNow is a cost-effective solution for handling your Mississippi Resident Individual Income Tax Return. The platform offers competitive pricing plans that cater to individuals and businesses alike, allowing you to save on traditional tax preparation costs. The added convenience of digital signing further enhances its value.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides essential features for document management including automated workflows, eSigning, secure cloud storage, and templates specifically tailored for tax documents like the Mississippi Resident Individual Income Tax Return. These features make it easier to organize, access, and manage your tax forms efficiently, reducing the risk of errors.

-

Are there any integrations available with airSlate SignNow that support tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, which can help streamline the process of preparing your Mississippi Resident Individual Income Tax Return. These integrations facilitate data transfer and ensure all necessary forms are readily accessible. This connectivity enhances usability for tax professionals and individuals alike.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your Mississippi Resident Individual Income Tax Return offers numerous benefits including enhanced security through encryption, faster turnaround times with eSigning, and easier tracking of document status. This allows for a smoother tax preparation experience and minimizes the potential for delays in submission.

-

Can I store previous Mississippi Resident Individual Income Tax Returns using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to store and organize previous Mississippi Resident Individual Income Tax Returns securely. This archiving feature ensures that you can easily retrieve past tax documents whenever needed, simplifying future filing processes and audits.

Get more for Mississippi Resident Individual Income Tax Return

- Paving contract for contractor nebraska form

- Site work contract for contractor nebraska form

- Siding contract for contractor nebraska form

- Nebraska refrigeration contractor form

- Nebraska drainage form

- Foundation contract for contractor nebraska form

- Plumbing contract for contractor nebraska form

- Brick mason contract for contractor nebraska form

Find out other Mississippi Resident Individual Income Tax Return

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple