Nyc Att S Corp Form 2013

What is the Nyc Att S Corp Form

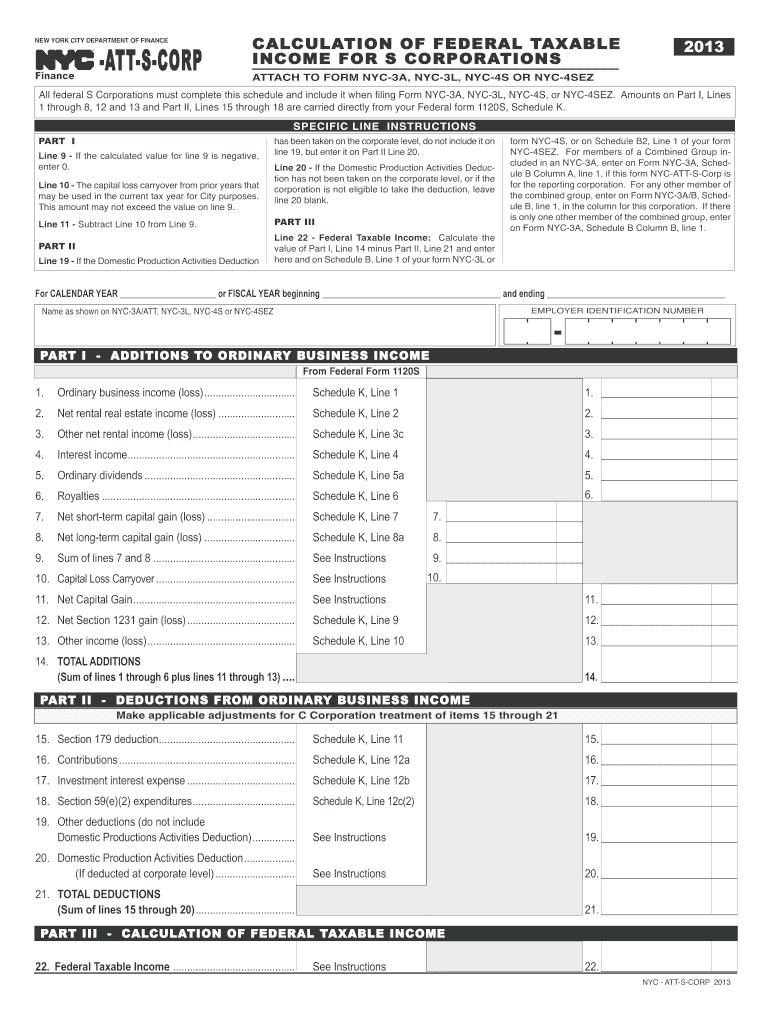

The Nyc Att S Corp Form is a tax document specifically designed for S corporations operating in New York City. This form is crucial for businesses that have elected S corporation status, allowing them to report income, deductions, and credits accurately. It ensures compliance with local tax regulations while facilitating the proper allocation of tax responsibilities among shareholders. Understanding this form is essential for S corporations to maintain their tax-exempt status at the federal level and to comply with New York City tax requirements.

How to use the Nyc Att S Corp Form

Using the Nyc Att S Corp Form involves several key steps. First, ensure that your business qualifies as an S corporation under IRS guidelines. Next, gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Fill out the form accurately, providing detailed information about your corporation's income and deductions. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Utilizing an electronic signature solution can streamline this process, making it easier to manage and submit your form securely.

Steps to complete the Nyc Att S Corp Form

Completing the Nyc Att S Corp Form requires careful attention to detail. Follow these steps for a successful submission:

- Verify your eligibility as an S corporation.

- Collect all necessary financial records and documentation.

- Access the form through the appropriate tax authority's website.

- Fill in the required fields, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the form by the designated deadline, either electronically or by mail.

Key elements of the Nyc Att S Corp Form

The Nyc Att S Corp Form contains several key elements that must be accurately completed. These include:

- Business identification information, such as the corporation's name and tax identification number.

- Details regarding income, including gross receipts and other sources of revenue.

- Deduction information, covering business expenses that can reduce taxable income.

- Shareholder information, detailing the ownership structure and distribution of income.

- Signature section, where the authorized representative must sign and date the form.

Legal use of the Nyc Att S Corp Form

The legal use of the Nyc Att S Corp Form is essential for compliance with New York City tax laws. This form must be filled out accurately and submitted on time to avoid penalties. It serves as an official record of the corporation's financial activities and tax obligations. Failure to use the form correctly can lead to legal repercussions, including fines or loss of S corporation status. Therefore, it is crucial to understand the legal implications of this form and ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc Att S Corp Form are critical to avoid penalties. Typically, S corporations must file their forms by the fifteenth day of the third month following the end of their fiscal year. For those following the calendar year, this means the deadline is March 15. It is advisable to stay informed about any changes in deadlines or requirements by regularly checking the New York City Department of Finance website. Marking these dates on your calendar can help ensure timely compliance.

Quick guide on how to complete nyc att s corp 2013 form

Your assistance manual on how to prepare your Nyc Att S Corp Form

If you're wondering how to create and submit your Nyc Att S Corp Form, here are some concise guidelines to simplify tax declaration.

To start, you merely have to set up your airSlate SignNow profile to alter how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify information as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Nyc Att S Corp Form in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Nyc Att S Corp Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Employ this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to increased return errors and delays in refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc att s corp 2013 form

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the nyc att s corp 2013 form

How to make an electronic signature for the Nyc Att S Corp 2013 Form in the online mode

How to make an eSignature for the Nyc Att S Corp 2013 Form in Chrome

How to generate an electronic signature for signing the Nyc Att S Corp 2013 Form in Gmail

How to create an electronic signature for the Nyc Att S Corp 2013 Form right from your smartphone

How to create an electronic signature for the Nyc Att S Corp 2013 Form on iOS

How to create an electronic signature for the Nyc Att S Corp 2013 Form on Android devices

People also ask

-

What is the Nyc Att S Corp Form?

The Nyc Att S Corp Form is a document required for S Corporations operating in New York City to comply with local tax regulations. It outlines the corporation's financial details and is essential for ensuring proper tax treatment under New York City law.

-

How can airSlate SignNow help with completing the Nyc Att S Corp Form?

airSlate SignNow provides a user-friendly platform to easily fill out, sign, and send the Nyc Att S Corp Form digitally. With its eSignature feature, you can ensure that your documents are legally binding while saving time on traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for the Nyc Att S Corp Form?

Yes, airSlate SignNow offers various pricing plans suitable for businesses of all sizes. Our plans include features tailored for efficiently managing the Nyc Att S Corp Form and other essential documents, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for the Nyc Att S Corp Form?

airSlate SignNow offers features like customizable templates, advanced eSignature capabilities, and secure document storage, all designed to streamline the process of preparing and submitting your Nyc Att S Corp Form. Our platform ensures that every step is efficient and straightforward.

-

Can I integrate airSlate SignNow with other tools for managing the Nyc Att S Corp Form?

Absolutely! airSlate SignNow can be easily integrated with various business applications such as Google Drive, Dropbox, and more. This integration allows for seamless document management and enhances your workflow when dealing with the Nyc Att S Corp Form.

-

What are the benefits of using airSlate SignNow for the Nyc Att S Corp Form?

Using airSlate SignNow for the Nyc Att S Corp Form accelerates your document workflow, reduces paper usage, and provides a secure way to obtain electronic signatures. These benefits help businesses save time and ensure compliance with New York City regulations.

-

How secure is airSlate SignNow when handling the Nyc Att S Corp Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards. This ensures that your information related to the Nyc Att S Corp Form is protected during transmission and storage.

Get more for Nyc Att S Corp Form

- Alberta health services forms

- Moving checklist provided by matt amp meredith johnson of remax form

- Inter hospital transfer form

- What is wi tax form 5k

- Polymer matrix form

- P1500 compliance definition and form

- Form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 772082768

- Athletic sports contract template form

Find out other Nyc Att S Corp Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document