Nyc Att S Corp Form 2012

What is the Nyc Att S Corp Form

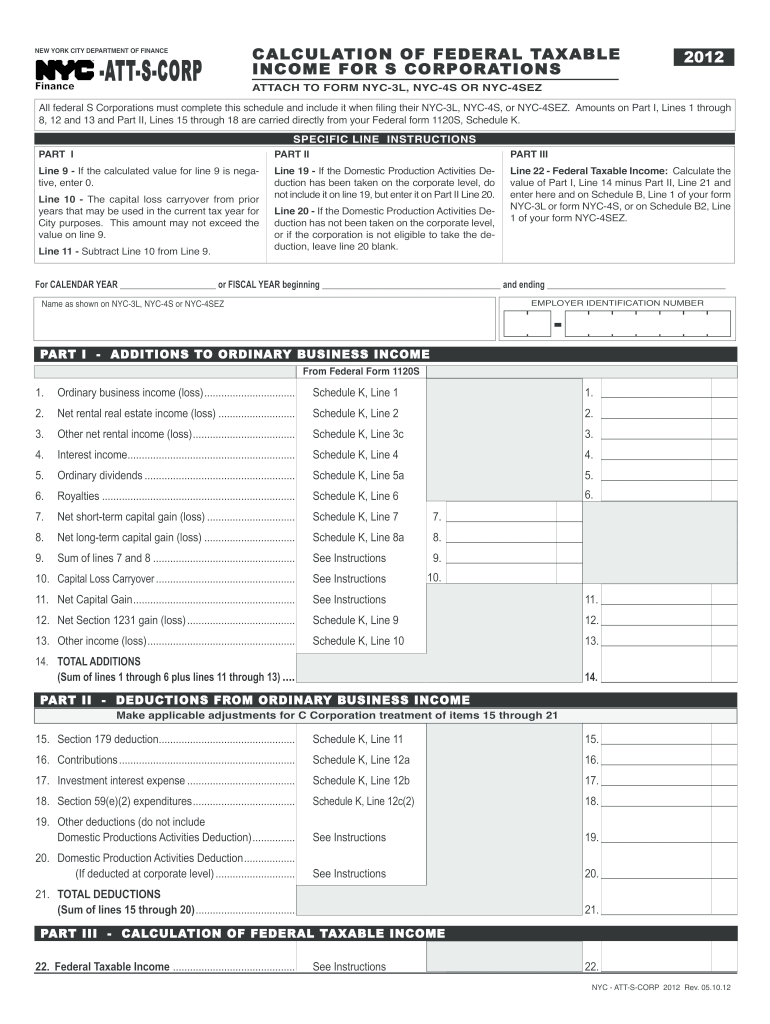

The Nyc Att S Corp Form is a tax document used by S corporations operating in New York City. This form is essential for reporting income and calculating taxes owed to the city. It enables S corporations to declare their income, deductions, and credits accurately. By completing this form, businesses ensure compliance with local tax regulations and contribute to the city's revenue.

How to use the Nyc Att S Corp Form

Using the Nyc Att S Corp Form involves several steps. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out the form, ensuring all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form electronically or by mail, following the specific submission guidelines provided by the New York City Department of Finance.

Steps to complete the Nyc Att S Corp Form

Completing the Nyc Att S Corp Form requires a systematic approach:

- Gather financial records, including income and expenses.

- Obtain the latest version of the form from the official website.

- Fill in the required fields, including business name, address, and tax identification number.

- Report total income and allowable deductions accurately.

- Calculate the tax owed based on the provided instructions.

- Review the form for accuracy before submission.

- Submit the completed form by the deadline.

Legal use of the Nyc Att S Corp Form

The Nyc Att S Corp Form must be used in accordance with New York City's tax laws. This form is legally binding and serves as an official record of an S corporation's tax obligations. Accurate completion and timely submission are crucial to avoid penalties. Businesses should maintain copies of submitted forms and supporting documentation for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc Att S Corp Form are typically aligned with the federal tax deadlines. Generally, S corporations must file their forms by the fifteenth day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is essential to stay informed about any changes to these dates, as they can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Nyc Att S Corp Form can be submitted through various methods. Businesses can file the form electronically via the New York City Department of Finance's online portal. Alternatively, the form can be mailed to the designated address provided on the form. In some cases, in-person submission may also be available at local tax offices. Each method has specific instructions, so it is important to choose the one that best suits the business's needs.

Quick guide on how to complete nyc att s corp 2012 form

Your assistance manual on how to prepare your Nyc Att S Corp Form

If you’re interested in learning how to finalize and submit your Nyc Att S Corp Form, below are several concise guidelines on how to make tax submission less challenging.

To start, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and effective document solution that enables you to modify, generate, and complete your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revert to adjust details as necessary. Optimize your tax organization with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finish your Nyc Att S Corp Form in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Nyc Att S Corp Form in our editor.

- Complete the necessary fillable fields with your details (text content, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting on paper can increase the likelihood of return errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc att s corp 2012 form

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the nyc att s corp 2012 form

How to generate an eSignature for your Nyc Att S Corp 2012 Form online

How to create an eSignature for the Nyc Att S Corp 2012 Form in Chrome

How to create an eSignature for signing the Nyc Att S Corp 2012 Form in Gmail

How to create an eSignature for the Nyc Att S Corp 2012 Form right from your smart phone

How to generate an electronic signature for the Nyc Att S Corp 2012 Form on iOS

How to make an electronic signature for the Nyc Att S Corp 2012 Form on Android

People also ask

-

What is the Nyc Att S Corp Form and why is it important?

The Nyc Att S Corp Form is a crucial document for corporations operating in New York City, enabling them to apply for S Corporation status for tax benefits. Filing this form correctly can lead to signNow tax savings and improved business efficiency.

-

How can airSlate SignNow assist with the Nyc Att S Corp Form?

airSlate SignNow provides a streamlined platform for businesses to eSign and send their Nyc Att S Corp Form efficiently. Our user-friendly solution reduces paperwork hassles, ensuring that your form is completed correctly and filed on time.

-

What are the costs associated with using airSlate SignNow for the Nyc Att S Corp Form?

Our pricing for using airSlate SignNow to handle the Nyc Att S Corp Form is competitive and based on subscription tiers. We offer different plans designed to meet the needs of various businesses, allowing you to choose the most cost-effective solution.

-

Are there any integrations available with airSlate SignNow for submitting the Nyc Att S Corp Form?

Yes, airSlate SignNow offers integrations with popular platforms allowing for seamless submission of the Nyc Att S Corp Form. This includes compatibility with CRM systems, cloud storage services, and other productivity tools to enhance your workflow.

-

What features does airSlate SignNow provide for eSigning the Nyc Att S Corp Form?

Our platform provides robust eSigning features, including customizable templates and secure signature workflows for the Nyc Att S Corp Form. You can easily track, manage, and store signed documents, ensuring you stay organized and compliant.

-

Is there customer support available for questions about the Nyc Att S Corp Form?

Absolutely! Our dedicated customer support team is ready to assist with any inquiries regarding the Nyc Att S Corp Form. Whether you need help with document preparation or understanding the filing process, we're here to help.

-

How does airSlate SignNow ensure the security of my Nyc Att S Corp Form documents?

airSlate SignNow prioritizes document security with encryption and compliance with industry standards. When handling your Nyc Att S Corp Form, we implement top-notch security measures to protect your sensitive information throughout the signing process.

Get more for Nyc Att S Corp Form

- Town of harrison mooring permit application form

- Wordpress plugin for fillable form and email it

- Po box 6367 frenchs forest nsw 2086 australia form

- Idaho aircraft registration form

- M0 07750 multiprotein complex formation at the myosin heavy jbc

- Clostridium difficile hospitalizations hcup agency for hcup us ahrq form

- Form 1040 sr 793950810

Find out other Nyc Att S Corp Form

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter