S Corp 2018

What is the S Corp

An S Corporation, or S Corp, is a special type of corporation that meets specific Internal Revenue Code requirements. This designation allows profits, and some losses, to be passed through directly to the owners’ personal income without facing corporate income tax. S Corps are popular among small business owners as they provide the benefits of limited liability while allowing for pass-through taxation. This means that the income is only taxed at the individual level, avoiding the double taxation that traditional corporations face.

Key elements of the S Corp

Understanding the key elements of an S Corp is crucial for business owners. Some of the essential features include:

- Eligibility Criteria: To qualify as an S Corp, a business must meet specific requirements, including being a domestic corporation, having only allowable shareholders, and having no more than one hundred shareholders.

- Shareholder Restrictions: Shareholders must be individuals, certain trusts, or estates. Partnerships and corporations cannot hold shares in an S Corp.

- One Class of Stock: An S Corp can only issue one class of stock, although differences in voting rights are allowed.

Steps to complete the S Corp

Completing the S Corp process involves several important steps. Here’s a simplified outline:

- Choose a Business Name: Ensure the name complies with state regulations and is not already in use.

- File Articles of Incorporation: Submit the necessary documents to your state’s Secretary of State office to establish your corporation.

- Obtain an Employer Identification Number (EIN): Apply for an EIN through the IRS, which is essential for tax purposes.

- File Form 2553: Submit Form 2553 to the IRS to elect S Corp status, ensuring it is filed on time to avoid delays.

IRS Guidelines

The IRS provides specific guidelines for S Corps that must be followed to maintain compliance. These include:

- Filing annual tax returns using Form 1120S.

- Providing Schedule K-1 to shareholders, detailing their share of income, deductions, and credits.

- Adhering to deadlines for tax filings to avoid penalties.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is essential for S Corps. Key dates include:

- Form 2553 Deadline: Must be filed within two months and fifteen days of the beginning of the tax year.

- Form 1120S Deadline: Generally due on the fifteenth day of the third month after the end of the tax year.

- Estimated Tax Payments: S Corps may need to make estimated tax payments based on income projections.

Required Documents

To successfully establish and maintain S Corp status, several documents are required, including:

- Articles of Incorporation.

- Bylaws of the corporation.

- Form 2553 for S Corp election.

- Form 1120S for annual tax filings.

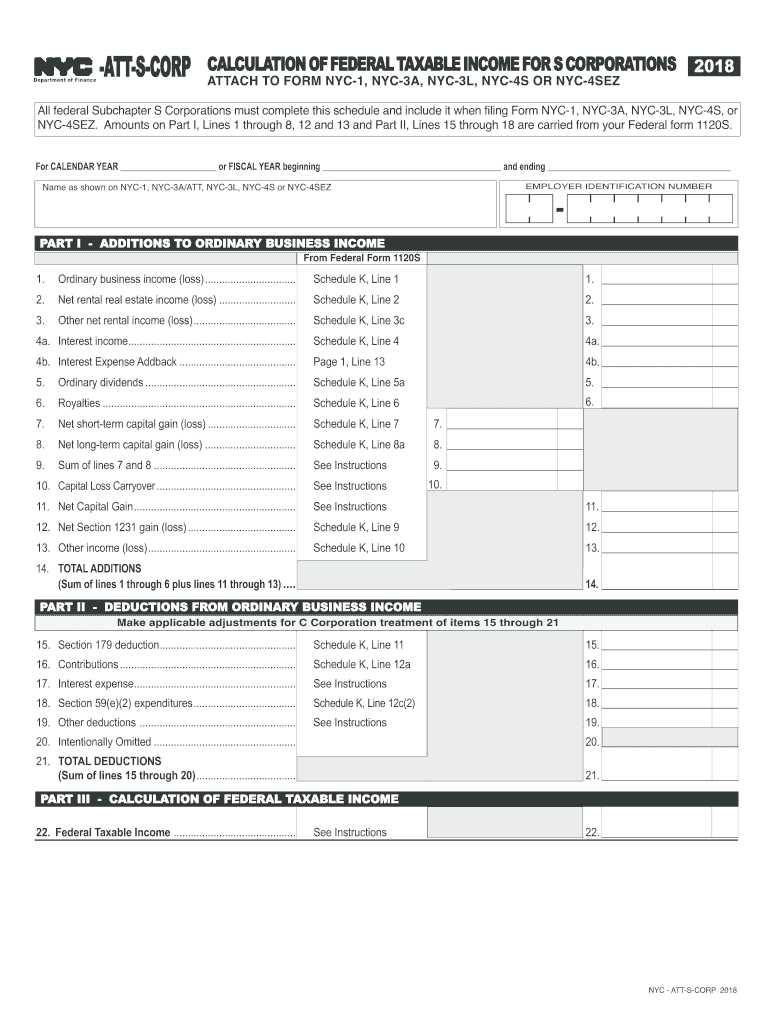

Quick guide on how to complete nyc att s corp 2018 2019 form

Your assistance manual on how to prepare your S Corp

If you’re interested in understanding how to finalize and submit your S Corp, here are a few concise recommendations to facilitate tax processing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax documents with ease. By utilizing its editing tool, you can alternate between text, checkboxes, and electronic signatures and go back to modify information as necessary. Streamline your tax administration with advanced PDF editing, electronic signing, and seamless sharing.

Follow the instructions below to finalize your S Corp within minutes:

- Create your account and start working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to open your S Corp in our editing tool.

- Complete the essential fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized electronic signature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, check the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc att s corp 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the nyc att s corp 2018 2019 form

How to create an eSignature for your Nyc Att S Corp 2018 2019 Form online

How to make an electronic signature for the Nyc Att S Corp 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the Nyc Att S Corp 2018 2019 Form in Gmail

How to make an eSignature for the Nyc Att S Corp 2018 2019 Form from your smart phone

How to make an electronic signature for the Nyc Att S Corp 2018 2019 Form on iOS devices

How to make an eSignature for the Nyc Att S Corp 2018 2019 Form on Android

People also ask

-

What is an S Corp 2016, and how does it benefit my business?

An S Corp 2016 is a tax designation that allows your business to avoid double taxation on corporate income. By electing S Corp status, shareholders report income, deductions, and credits on their tax returns, leading to potential tax savings. This can enhance your overall profitability and simplify your tax filing process.

-

How can airSlate SignNow assist with S Corp 2016 documentation?

airSlate SignNow provides a seamless platform to create, send, and eSign important S Corp 2016 documents. Whether it's filing election forms or operational agreements, our user-friendly interface ensures that you can manage these processes quickly and efficiently. This eliminates delays and helps you maintain compliance.

-

What are the pricing options for using airSlate SignNow for S Corp 2016-related tasks?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options ideal for managing S Corp 2016 documents. Our solutions are designed to be cost-effective, enabling you to access necessary features without breaking the bank. Review our pricing page to identify the best plan for your business.

-

Is it easy to integrate airSlate SignNow with other software I use for my S Corp 2016?

Yes, airSlate SignNow easily integrates with many popular business tools and systems. This ensures that you can streamline your S Corp 2016 documentation processes without having to overhaul your existing workflows. Our integrations enhance productivity and facilitate smoother operations.

-

What features does airSlate SignNow offer that are beneficial for S Corp 2016 filings?

airSlate SignNow offers essential features such as customizable templates, bulk sending capabilities, and real-time tracking for S Corp 2016 filings. These tools facilitate efficient management of your documents, ensuring that all necessary signatures are collected quickly and in compliance with regulations.

-

How secure is airSlate SignNow when handling sensitive S Corp 2016 information?

Security is a top priority at airSlate SignNow. We implement rigorous data encryption, secure servers, and stringent access controls to protect your S Corp 2016 information. You can trust that your sensitive documents and data remain safe and confidential throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for my S Corp 2016 needs?

Absolutely! airSlate SignNow is fully accessible on mobile devices, allowing you to manage your S Corp 2016 documentation on-the-go. This flexibility ensures you can send and sign documents anytime and anywhere, promoting efficiency and responsiveness in your business operations.

Get more for S Corp

- Pcsdma form

- Literature circle title because of winn dixie by kate dicamillo form

- Qualified illinois domestic relations order municipal employees annuity and benefit fund of chicago pdf form

- Visualizing and analyzing the visualizing and analyzing the mappingideas sdsu form

- Penndot commonwealth of pennsylvania drivers accident report form

- Commercial lease application form 62655

- Athletic contract template 787749872 form

- Auction contract template 787749877 form

Find out other S Corp

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online