Nyc Att S Corp Form 2017

What is the Nyc Att S Corp Form

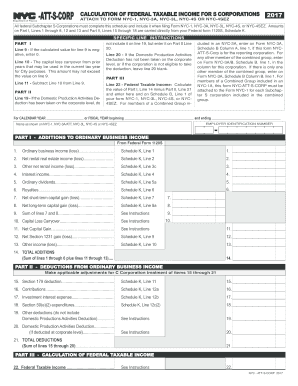

The Nyc Att S Corp Form is a tax document used by S corporations operating in New York City to report their income and calculate their tax obligations. This form is essential for ensuring compliance with local tax regulations and allows businesses to accurately report their earnings. It serves as a declaration of the corporation's income, deductions, and credits, facilitating the proper assessment of taxes owed to the city.

Steps to complete the Nyc Att S Corp Form

Filling out the Nyc Att S Corp Form involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Complete the form by entering all required information, such as business name, address, and tax identification number.

- Provide detailed information about income, deductions, and credits to ensure accurate reporting.

- Review the completed form for errors or omissions before submission.

- Sign and date the form to validate the information provided.

How to obtain the Nyc Att S Corp Form

The Nyc Att S Corp Form can be obtained through the official New York City Department of Finance website. It is available as a downloadable PDF, allowing businesses to print and fill it out manually. Additionally, businesses may access the form through various tax preparation software that includes New York City tax forms, providing an efficient way to complete the filing process.

Legal use of the Nyc Att S Corp Form

The Nyc Att S Corp Form must be completed accurately and submitted within the designated filing period to comply with New York City tax laws. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. It is crucial for S corporations to understand the legal implications of this form to avoid potential legal issues and ensure that they meet all local tax obligations.

Filing Deadlines / Important Dates

Timely filing of the Nyc Att S Corp Form is essential to avoid penalties. The typical deadline for submission is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. It is advisable to check for any updates or changes to deadlines that may occur annually.

Form Submission Methods (Online / Mail / In-Person)

The Nyc Att S Corp Form can be submitted through various methods to accommodate different preferences:

- Online submission through the New York City Department of Finance's e-filing system, which offers a convenient and secure way to file.

- Mailing the completed form to the designated address provided on the form itself, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, which may provide additional assistance for businesses needing help with the filing process.

Quick guide on how to complete nyc att s corp 2017 2019 form

Your assistance manual on how to prepare your Nyc Att S Corp Form

If you’re wondering how to generate and submit your Nyc Att S Corp Form, here are some straightforward guidelines on how to simplify tax declarations.

To begin, you simply need to register your airSlate SignNow account to transform your document management online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to alter, draft, and finalize your tax documents effortlessly. Using its editor, you can switch between text, checkboxes, and eSignatures, allowing you to revisit and modify responses as necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to achieve your Nyc Att S Corp Form in no time:

- Set up your account and start working on PDFs quickly.

- Utilize our directory to obtain any IRS tax form; browse through variants and schedules.

- Click Get form to access your Nyc Att S Corp Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that paper filing can lead to return errors and delay refunds. Naturally, before electronically filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc att s corp 2017 2019 form

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the nyc att s corp 2017 2019 form

How to generate an electronic signature for the Nyc Att S Corp 2017 2019 Form in the online mode

How to create an electronic signature for your Nyc Att S Corp 2017 2019 Form in Chrome

How to create an eSignature for signing the Nyc Att S Corp 2017 2019 Form in Gmail

How to create an eSignature for the Nyc Att S Corp 2017 2019 Form right from your smart phone

How to generate an electronic signature for the Nyc Att S Corp 2017 2019 Form on iOS

How to generate an electronic signature for the Nyc Att S Corp 2017 2019 Form on Android

People also ask

-

What is the NYC ATT S Corp Form?

The NYC ATT S Corp Form is a specific tax form required for S Corporations operating in New York City. This form is crucial for ensuring compliance with local tax regulations and accurately reporting income as an S Corporation. airSlate SignNow provides an easy way to prepare and eSign this form digitally.

-

How can airSlate SignNow assist with the NYC ATT S Corp Form?

AirSlate SignNow allows users to easily fill out and eSign the NYC ATT S Corp Form online. With a user-friendly interface, businesses can streamline the entire process, ensuring that the form is correctly completed and submitted on time. This eliminates the hassle of paper forms and reduces the chance of errors.

-

What are the pricing options for using airSlate SignNow for the NYC ATT S Corp Form?

AirSlate SignNow offers various pricing plans that accommodate different business needs, starting from a cost-effective entry-level plan. Each plan includes features suitable for handling the NYC ATT S Corp Form, such as document templates and eSigning capabilities. You can choose a plan that best fits your volume and usage requirements.

-

Are there any integration options available when using airSlate SignNow for the NYC ATT S Corp Form?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, allowing users to enhance their document management workflow. You can connect with tools like Google Drive, Salesforce, and more to access and generate the NYC ATT S Corp Form effortlessly. This integration maximizes efficiency for your business operations.

-

What benefits does airSlate SignNow offer for handling the NYC ATT S Corp Form?

AirSlate SignNow offers multiple benefits when managing the NYC ATT S Corp Form, including time-saving document automation and secure digital signatures. This ensures that your forms are processed quickly while maintaining compliance with regulations. Additionally, the platform provides tracking features to monitor the status of your document.

-

Is it easy to eSign the NYC ATT S Corp Form using airSlate SignNow?

Absolutely! Using airSlate SignNow, eSigning the NYC ATT S Corp Form is simple and straightforward. Users can electronically sign the document from any device, saving time and eliminating the need for printing or physical mail, thus ensuring a smooth process.

-

Can multiple users collaborate on the NYC ATT S Corp Form in airSlate SignNow?

Yes, airSlate SignNow supports collaboration by allowing multiple users to work on the NYC ATT S Corp Form simultaneously. This feature is valuable for teams that need to review and edit the form together, ensuring everyone is on the same page before finalizing the document.

Get more for Nyc Att S Corp Form

- California dissolution fillable online form corporations

- Finance brokers association of australia ltd continuing fbaa form

- Form 1099 g internal revenue service

- Printable u s constitution study guide form

- Request for amendment to medical record form nephrology

- F31 diversity guide for reviewers form

- Newswise medical news and science news what drives brain changes in macular degeneration form

- Microsoft word tc600 form

Find out other Nyc Att S Corp Form

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself