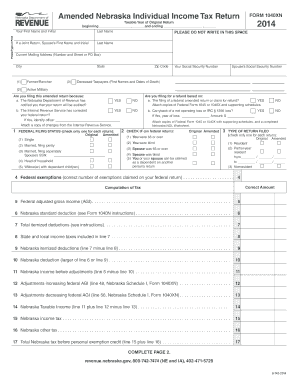

RESET Amended Nebraska Individual Income Tax Return FORM 1040XN Taxable Year of Original Return Beginning , and Ending , Last Na

Understanding the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

The RESET Amended Nebraska Individual Income Tax Return FORM 1040XN is designed for taxpayers who need to amend their previously filed Nebraska individual income tax returns. This form allows individuals to correct errors, claim additional deductions, or report changes in income. It is essential for ensuring that your tax records are accurate and up to date, which can affect your tax liability and potential refunds.

Steps to Complete the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

Completing the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN involves several steps:

- Gather all necessary documents, including your original tax return and any supporting documentation for the changes you are making.

- Fill out the form by entering your personal information, including your last name, first name, and initial. If applicable, include your spouse's information for joint returns.

- Clearly indicate the taxable year of the original return you are amending, specifying the beginning and ending dates.

- Detail the changes you are making, ensuring that all adjustments are clearly documented and justified.

- Review the completed form for accuracy before submitting it.

Legal Use of the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

The legal validity of the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN hinges on its proper completion and submission. This form must be filed in accordance with Nebraska state tax laws. It is crucial to ensure that all information is accurate and that any necessary signatures are included. Failure to comply with these requirements may result in delays or penalties from the Nebraska Department of Revenue.

Filing Deadlines for the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

Filing deadlines for the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN are typically aligned with the state’s tax return deadlines. Generally, you should file your amended return within three years from the original due date of the return you are amending. It is important to check for any specific deadlines that may apply to your situation to avoid penalties.

Key Elements of the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

Key elements of the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN include:

- Your personal information, including name and address.

- The taxable year of the original return.

- Details of the changes being made.

- Signatures of all parties involved, if applicable.

How to Obtain the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN

The RESET Amended Nebraska Individual Income Tax Return FORM 1040XN can be obtained from the Nebraska Department of Revenue's website or through authorized tax preparation services. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete reset amended nebraska individual income tax return form 1040xn taxable year of original return beginning and ending last name

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle [SKS] on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

The most efficient way to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to finalize your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

The RESET Amended Nebraska Individual Income Tax Return FORM 1040XN is a form used to correct any errors or changes on your original tax return for a specific taxable year. It allows individuals to provide updated information regarding their income and deductions while ensuring compliance with Nebraska state tax laws. This form is essential for taxpayers who need to amend their previous filing.

-

How do I fill out the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

To fill out the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN, start by gathering all relevant financial documents and your previous tax returns. Follow the provided instructions carefully, filling out your adjusted income along with any applicable deductions. Make sure to include your last name, first name, initials, and details about your spouse if filing jointly.

-

What are the benefits of using airSlate SignNow for filing the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

Using airSlate SignNow to file the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN streamlines the process by allowing you to electronically sign and send your document securely. This not only saves time but also minimizes the risk of errors common in manual submissions. The user-friendly interface ensures that you can complete and manage your returns efficiently.

-

Is there a cost associated with using airSlate SignNow for the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

Yes, there is a cost associated with using airSlate SignNow services, but we offer various pricing plans to suit different business needs. This cost effectively covers features such as electronic signatures, advanced security measures, and integration capabilities. You can choose a plan that fits your requirements while ensuring an efficient filing of the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN.

-

Can I integrate airSlate SignNow with other software for filing my taxes?

Absolutely! AirSlate SignNow offers seamless integrations with several software applications commonly used for tax preparation. This allows you to easily access your documents, automate workflows, and enhance productivity when preparing your RESET Amended Nebraska Individual Income Tax Return FORM 1040XN. Integration helps streamline the filing process, making it simpler and faster for users.

-

What support does airSlate SignNow provide while completing the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

AirSlate SignNow provides comprehensive customer support options, including extensive documentation and tutorials to assist users in filing the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN. If you encounter any issues, you can also signNow out to our customer service team for personalized assistance. We are committed to helping you navigate the process smoothly.

-

How long does it take to process the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN?

The processing time for the RESET Amended Nebraska Individual Income Tax Return FORM 1040XN can vary based on the Nebraska Department of Revenue’s workload. Generally, it may take anywhere from a few weeks to several months. Using airSlate SignNow not only speeds up your submission but also provides tracking capabilities to monitor the status of your amendment.

Get more for RESET Amended Nebraska Individual Income Tax Return FORM 1040XN Taxable Year Of Original Return Beginning , And Ending , Last Na

- Quadrennial exempt status form m 3 city of bridgeport ct bridgeportct

- Application for admission to practice as an attorney nycourts form

- Form 3 38

- New york information sheet

- Change name on ny state form

- Alarms administration appeals request form city of stamford

- City of waterbury employee personal data change form waterburyct

- Bonfire permit form city of lewes

Find out other RESET Amended Nebraska Individual Income Tax Return FORM 1040XN Taxable Year Of Original Return Beginning , And Ending , Last Na

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile