1 Limitation on Itemized Deductions for Taxpayers with an Adjusted Gross Income Which Form

What is the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which

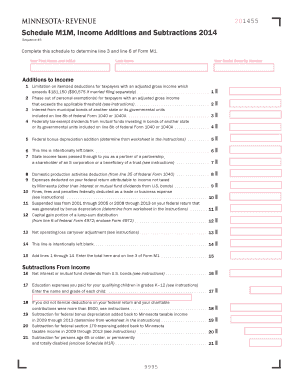

The 1 limitation on itemized deductions for taxpayers with an adjusted gross income is a crucial aspect of U.S. tax law. This limitation applies to taxpayers whose adjusted gross income (AGI) exceeds a specific threshold, which can vary from year to year. When AGI exceeds this threshold, the total amount of itemized deductions that a taxpayer can claim is reduced by a certain percentage. This reduction is aimed at ensuring that higher-income individuals do not benefit disproportionately from itemized deductions. Understanding this limitation is vital for accurate tax planning and compliance.

Steps to complete the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which

Completing the 1 limitation on itemized deductions involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and records of deductible expenses. Next, calculate your adjusted gross income by summing all sources of income and subtracting any adjustments. After determining your AGI, compare it to the current year's threshold to see if the limitation applies. If it does, proceed to calculate the allowable itemized deductions, applying the percentage reduction based on your AGI. Finally, accurately report these figures on your tax return, ensuring all calculations are documented for reference.

IRS Guidelines

The IRS provides specific guidelines regarding the 1 limitation on itemized deductions for taxpayers with an adjusted gross income. These guidelines outline the income thresholds, the percentage by which deductions are reduced, and the types of deductions that are subject to this limitation. Taxpayers should refer to the IRS publications relevant to the current tax year for the most accurate and up-to-date information. Following these guidelines is essential for compliance and to avoid potential penalties during tax filing.

Required Documents

To effectively complete the 1 limitation on itemized deductions, taxpayers need to gather several key documents. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses, such as medical costs, mortgage interest, and charitable contributions

- Documentation of any adjustments to income, such as retirement account contributions

Having these documents organized will facilitate the calculation of AGI and the determination of allowable itemized deductions.

Penalties for Non-Compliance

Failing to adhere to the 1 limitation on itemized deductions can lead to significant penalties for taxpayers. If the IRS determines that a taxpayer has incorrectly claimed deductions exceeding the allowable limit, they may face back taxes, interest on unpaid amounts, and additional penalties. It is crucial for taxpayers to accurately calculate their AGI and apply the limitation correctly to avoid these consequences. Regularly reviewing IRS guidelines and seeking professional tax advice can help mitigate the risk of non-compliance.

Quick guide on how to complete 1 limitation on itemized deductions for taxpayers with an adjusted gross income which

Manage [SKS] with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related task today.

How to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools provided to complete your form.

- Select relevant sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Decide how you would like to share your form, whether by email, text (SMS), using an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Edit and electronically sign [SKS] and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which

Create this form in 5 minutes!

People also ask

-

What is the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which should I be aware of?

The 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which refers to the phase-out of certain deductions for individuals with higher incomes. This means that taxpayers with an adjusted gross income exceeding specific thresholds may have to limit their itemized deductions, which can signNowly affect their overall tax liability.

-

How can airSlate SignNow assist me in managing tax-related documents affected by the 1 Limitation On Itemized Deductions?

airSlate SignNow offers an efficient solution for managing tax-related documents, ensuring that you can easily eSign and send important files. With streamlined workflows, you can focus on understanding the implications of the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which while ensuring timely submission of essential documents.

-

What are the pricing options for airSlate SignNow for businesses considering the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Whether you're a solo entrepreneur or a larger entity navigating the complexities of tax limitations such as the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income, our plans provide value and accessibility tailored to your needs.

-

Can airSlate SignNow integrate with my existing systems to accommodate tax regulations like the 1 Limitation On Itemized Deductions?

Yes, airSlate SignNow seamlessly integrates with leading applications, making it simple to manage your workflows. By incorporating tools that help address the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which, you can streamline tax document management directly within your existing systems.

-

What features does airSlate SignNow provide that are beneficial for handling deductions and taxes?

airSlate SignNow provides features such as document templates, automated workflows, and secure eSigning. These tools are essential for ensuring that you can efficiently navigate tax requirements, including the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which, helping you to maintain compliance and save time.

-

How does airSlate SignNow ensure compliance with tax-related deductions?

With airSlate SignNow, you can be confident in your document compliance through features like audit trails and secure storage. This is particularly important when addressing the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which, as maintaining accurate records is crucial for tax reporting.

-

Is there customer support available to help understand tax limitations, including the 1 Limitation On Itemized Deductions?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with queries, including those related to tax limitations like the 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which. Our team is here to guide you through any challenges you may face while using our platform.

Get more for 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which

Find out other 1 Limitation On Itemized Deductions For Taxpayers With An Adjusted Gross Income Which

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple