Revenue Nebraska Govtax Forms2020Nebraska Individual Income Tax Return FORM 1040N for the 2021

Understanding the Nebraska Individual Income Tax Return Form 1040N

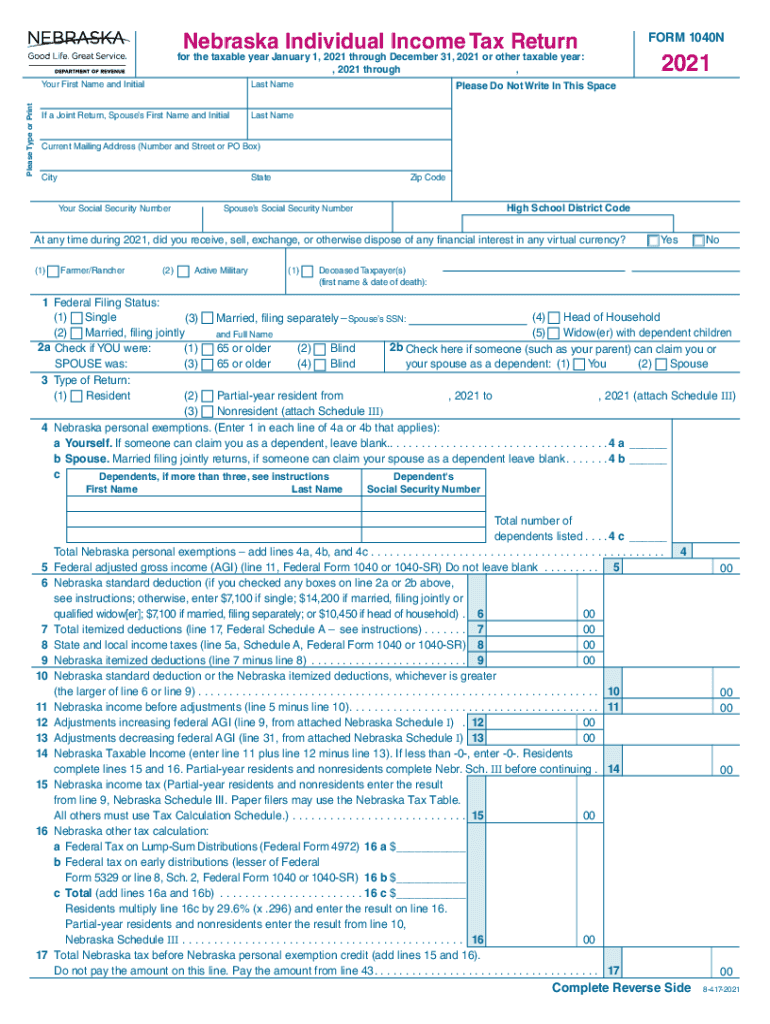

The Nebraska Individual Income Tax Return Form 1040N is a crucial document for residents of Nebraska who need to report their income and calculate their state tax liability. This form is specifically designed for individuals and must be completed accurately to ensure compliance with state tax regulations. It includes sections for reporting various types of income, deductions, and credits available to taxpayers. Understanding the structure and requirements of this form is essential for a smooth filing process.

Steps to Complete the Nebraska Form 1040N

Completing the Nebraska Form 1040N involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources in the appropriate sections.

- Claim any deductions or credits you are eligible for to reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Sign and date the form before submission.

Each step is vital to ensure that your tax return is accurate and complete, minimizing the risk of errors that could lead to penalties.

Legal Use of the Nebraska Form 1040N

The Nebraska Form 1040N is legally binding when completed and submitted according to state regulations. To ensure its validity, the form must be signed by the taxpayer, confirming that all information provided is true and complete. Additionally, compliance with state tax laws is crucial, as failure to file or inaccuracies can result in penalties or legal repercussions. Utilizing a reliable eSigning platform can enhance the security and legitimacy of your submission.

Filing Deadlines for the Nebraska Form 1040N

Timely filing of the Nebraska Form 1040N is essential to avoid penalties. The standard deadline for filing is typically April 15 of each year, coinciding with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or extensions that may apply to your situation.

Form Submission Methods for the Nebraska Form 1040N

Taxpayers have several options for submitting the Nebraska Form 1040N:

- Online Submission: Many taxpayers choose to file electronically through state-approved e-filing services.

- Mail: The form can also be printed and mailed to the Nebraska Department of Revenue.

- In-Person: Some individuals may opt to deliver their forms directly to local tax offices.

Each method has its advantages, such as speed and convenience for online submissions, while mailing may require additional time for processing.

Required Documents for the Nebraska Form 1040N

To accurately complete the Nebraska Form 1040N, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Prior year tax returns for reference

Having these documents readily available can streamline the filing process and help ensure that all necessary information is included.

Quick guide on how to complete revenuenebraskagovtax forms2020nebraska individual income tax return form 1040n for the

Prepare Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without holdups. Manage Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The seamlessly

- Locate Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuenebraskagovtax forms2020nebraska individual income tax return form 1040n for the

Create this form in 5 minutes!

How to create an eSignature for the revenuenebraskagovtax forms2020nebraska individual income tax return form 1040n for the

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the Nebraska form, and how does airSlate SignNow help with it?

The Nebraska form refers to various documents that may require electronic signatures to streamline processes. airSlate SignNow simplifies the completion and signing of these Nebraska forms by providing an intuitive platform that ensures compliance and security.

-

How much does airSlate SignNow cost for handling Nebraska forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focusing on Nebraska forms. You can choose a plan that fits your budget, with features designed to assist businesses in managing their documents efficiently.

-

What features does airSlate SignNow provide for Nebraska form e-signing?

airSlate SignNow includes features such as customizable templates, drag-and-drop signing, and real-time tracking to manage Nebraska forms effectively. These tools enhance the signing experience, making it faster and more efficient for all parties involved.

-

Can I integrate airSlate SignNow with other applications to manage Nebraska forms?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and CRM systems to streamline the management of Nebraska forms. This integration allows users to import and export documents seamlessly.

-

What are the benefits of using airSlate SignNow for Nebraska forms?

Using airSlate SignNow for your Nebraska forms can greatly improve efficiency, reduce paperwork, and ensure that all documents are signed securely. The electronic process saves time and resources, allowing businesses to focus on their core operations.

-

Is airSlate SignNow compliant with Nebraska e-signature laws?

Absolutely! airSlate SignNow complies with Nebraska's electronic signature laws, ensuring that all your Nebraska forms are signed legally and securely. This compliance gives users peace of mind when handling sensitive information.

-

How does airSlate SignNow enhance document security for Nebraska forms?

airSlate SignNow employs advanced security measures, including encryption and audit trails, to protect the integrity of your Nebraska forms. These features ensure that your documents are safe from unauthorized access and tampering.

Get more for Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The

Find out other Revenue nebraska govtax forms2020Nebraska Individual Income Tax Return FORM 1040N For The

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal