Married Filing Jointly or Separate IRS Tax Return Filing 2020

What is the Married Filing Jointly or Separate IRS Tax Return Filing

The Married Filing Jointly or Separate IRS Tax Return Filing is a tax classification that allows married couples to choose between filing their taxes together or separately. When filing jointly, both spouses report their combined income, deductions, and credits on a single tax return. This option often results in a lower tax liability due to various tax benefits and credits available to joint filers. Conversely, filing separately allows each spouse to report their income and deductions independently, which may be beneficial in certain situations, such as when one spouse has significant medical expenses or miscellaneous deductions.

Steps to Complete the Married Filing Jointly or Separate IRS Tax Return Filing

Completing the Married Filing Jointly or Separate IRS Tax Return Filing involves several important steps:

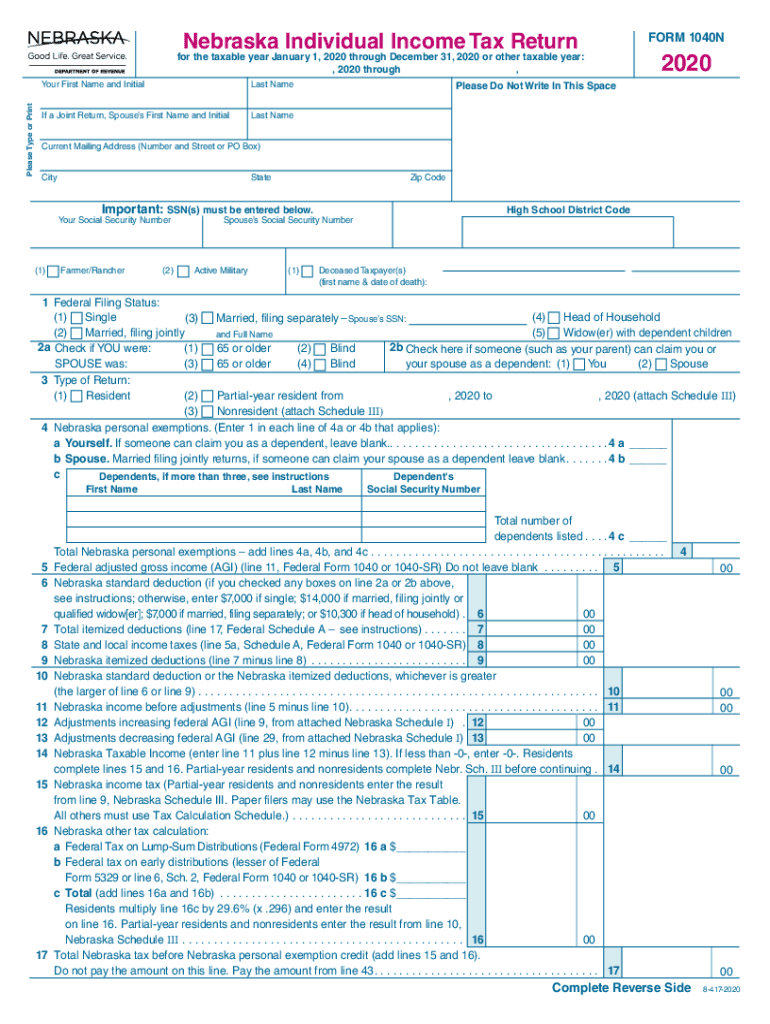

- Gather necessary documents, including W-2s, 1099s, and any relevant tax forms.

- Determine which filing status is most advantageous for your situation, considering tax benefits and liabilities.

- Fill out the appropriate IRS Form 1040, ensuring all income, deductions, and credits are accurately reported.

- If filing jointly, both spouses must sign the return. If filing separately, each spouse must sign their individual return.

- Submit the completed form either electronically or via mail, adhering to the IRS deadlines.

Required Documents

To successfully complete the Married Filing Jointly or Separate IRS Tax Return Filing, the following documents are typically required:

- W-2 forms from employers for both spouses.

- 1099 forms for any additional income, such as freelance work or investments.

- Records of deductible expenses, including medical bills, mortgage interest statements, and charitable contributions.

- Any other relevant tax documents, such as Form 1098 for mortgage interest or Form 8889 for Health Savings Accounts.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Married Filing Jointly or Separate IRS Tax Return Filing. Typically, the deadline for submitting your tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, allowing them to file up to six months later, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failing to comply with the requirements for the Married Filing Jointly or Separate IRS Tax Return Filing can result in significant penalties. These may include:

- Failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent.

- Failure-to-pay penalty, which is usually 0.5 percent of the unpaid tax for each month the payment is overdue.

- Interest on any unpaid taxes, which accrues daily until the balance is paid in full.

IRS Guidelines

The IRS provides specific guidelines regarding the Married Filing Jointly or Separate IRS Tax Return Filing. These guidelines outline eligibility criteria, allowable deductions, and tax credits available to each filing status. It is essential for taxpayers to familiarize themselves with these guidelines to ensure compliance and maximize potential tax benefits. Resources such as the IRS website and tax publications can offer valuable information and assistance in navigating the filing process.

Quick guide on how to complete married filing jointly or separate irs tax return filing

Prepare Married Filing Jointly Or Separate IRS Tax Return Filing seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and efficiently. Manage Married Filing Jointly Or Separate IRS Tax Return Filing across any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Married Filing Jointly Or Separate IRS Tax Return Filing effortlessly

- Locate Married Filing Jointly Or Separate IRS Tax Return Filing and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details carefully and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with a few clicks from any device of your choice. Modify and eSign Married Filing Jointly Or Separate IRS Tax Return Filing to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct married filing jointly or separate irs tax return filing

Create this form in 5 minutes!

How to create an eSignature for the married filing jointly or separate irs tax return filing

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is the process for filing my 2018 Nebraska tax return using airSlate SignNow?

To file your 2018 Nebraska tax return with airSlate SignNow, you can upload your completed tax documents and leverage our eSignature feature to ensure they are signed and sent securely. Simply create your document, add the necessary signers, and send it for eSigning. This streamlines the tax filing process, making it quick and efficient.

-

How can airSlate SignNow help me save time on my 2018 Nebraska tax return?

airSlate SignNow is designed to save you time with features that enable easy document management and electronic signatures. By digitizing your 2018 Nebraska tax return process, you can avoid printing, scanning, and mailing, ultimately reducing the time spent on paperwork.

-

Are there any costs associated with using airSlate SignNow for my 2018 Nebraska tax return?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that suits you best for filing your 2018 Nebraska tax return efficiently while also taking advantage of our powerful document management features.

-

What features does airSlate SignNow offer for managing my 2018 Nebraska tax return?

airSlate SignNow provides a range of features to streamline your 2018 Nebraska tax return process, including document templates, eSigning, and real-time status updates. These tools make it easier to manage your filings and ensure all documents are accounted for and signed on time.

-

Can I integrate airSlate SignNow with other platforms for my 2018 Nebraska tax return?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and financial software, allowing you to manage your 2018 Nebraska tax return alongside other vital business processes. This integration enhances efficiency by synchronizing your documents across platforms.

-

Is airSlate SignNow secure for submitting my 2018 Nebraska tax return?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all data transmitted during your 2018 Nebraska tax return filing is encrypted and protected. You can feel confident that your sensitive information is handled with the utmost care and confidentiality.

-

What types of documents can I use with airSlate SignNow for my 2018 Nebraska tax return?

You can use various document types with airSlate SignNow for your 2018 Nebraska tax return, including PDF, Word, and Excel files. This flexibility allows you to upload and manage your tax forms regardless of their original format, making it easier to complete your submission.

Get more for Married Filing Jointly Or Separate IRS Tax Return Filing

- Identity theft by known imposter package west virginia form

- Organizing your personal assets package west virginia form

- Essential documents for the organized traveler package west virginia form

- Essential documents for the organized traveler package with personal organizer west virginia form

- Postnuptial agreements package west virginia form

- Letters of recommendation package west virginia form

- Wv mechanics lien form

- West virginia mechanics form

Find out other Married Filing Jointly Or Separate IRS Tax Return Filing

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template