Instructions for Form CT 3 a Tax NY Gov 2022

Understanding the Nebraska 1040N

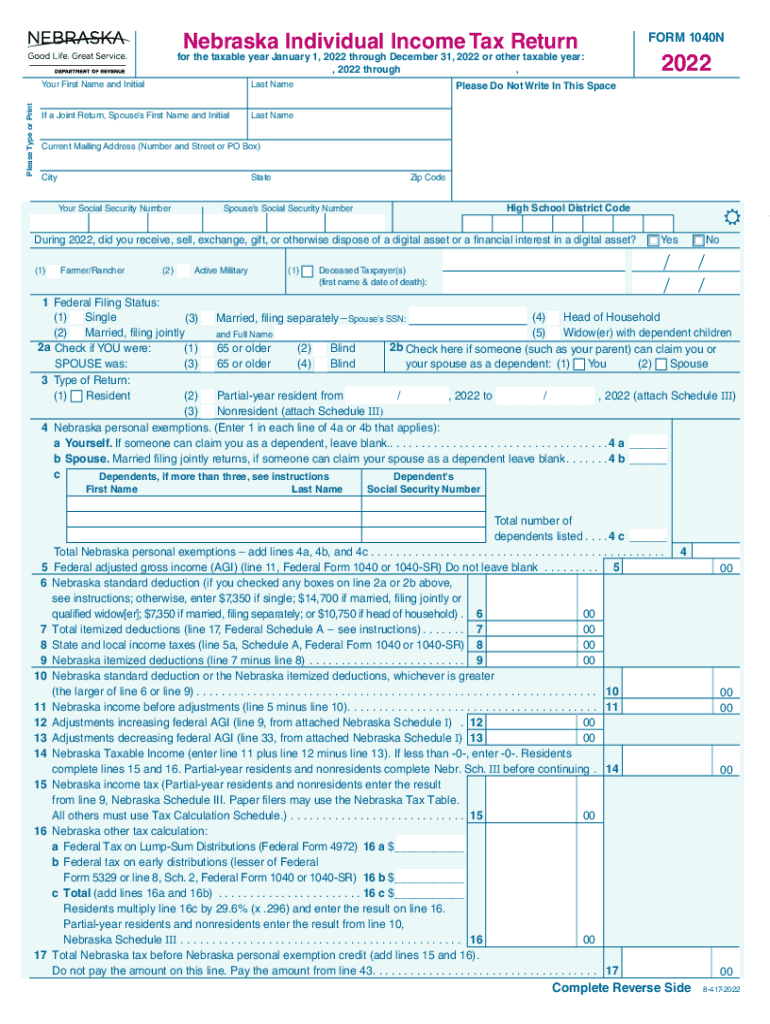

The Nebraska 1040N is the state income tax form used by residents of Nebraska to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and are required to file taxes. The 1040N form collects information about various income sources, deductions, and credits that may apply to the taxpayer's situation. It is important to accurately complete this form to ensure compliance with Nebraska tax laws.

Steps to Complete the Nebraska 1040N

Completing the Nebraska 1040N involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Calculate deductions and credits to determine your taxable income.

- Compute your tax liability based on the tax tables provided by the Nebraska Department of Revenue.

- Sign and date the form before submission.

Filing Deadlines for the Nebraska 1040N

It is important to be aware of the filing deadlines for the Nebraska 1040N. Typically, the deadline for filing your state income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure their forms are submitted on time to avoid penalties and interest on any owed taxes.

Required Documents for the Nebraska 1040N

To successfully complete the Nebraska 1040N, you will need several documents, including:

- W-2 forms from employers showing your annual wages.

- 1099 forms for any freelance or contract work.

- Documentation for any other income sources, such as rental income or investments.

- Receipts for deductible expenses, if applicable.

Form Submission Methods for the Nebraska 1040N

Taxpayers have several options for submitting the Nebraska 1040N. You can file the form electronically through approved e-filing software, which often provides a streamlined process and immediate confirmation of receipt. Alternatively, you may choose to print the completed form and mail it to the Nebraska Department of Revenue. Ensure that you send it to the correct address and allow sufficient time for delivery.

Penalties for Non-Compliance with Nebraska Tax Laws

Failure to file the Nebraska 1040N or pay any taxes owed can result in penalties and interest. The state imposes a late filing penalty, which can increase the longer the return is overdue. Additionally, interest accrues on any unpaid taxes from the due date until the balance is paid in full. It is advisable to file your return even if you cannot pay the full amount owed to minimize penalties.

Quick guide on how to complete instructions for form ct 3 a taxnygov

Complete Instructions For Form CT 3 A Tax NY gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow offers all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form CT 3 A Tax NY gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The easiest method to modify and electronically sign Instructions For Form CT 3 A Tax NY gov with ease

- Obtain Instructions For Form CT 3 A Tax NY gov and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form CT 3 A Tax NY gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 3 a taxnygov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 3 a taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska 1040N form?

The Nebraska 1040N form is the state's individual income tax return for residents of Nebraska. It is used to report income earned and calculate taxes owed to the state. By understanding how to properly fill out the Nebraska 1040N, you can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with the Nebraska 1040N filing process?

airSlate SignNow simplifies the eSigning process, making it easy to collect signatures on your Nebraska 1040N document. With its intuitive platform, you can send the form to recipients for signature without any hassle. This streamlines filing, allowing you to focus more on your finances and less on paperwork.

-

What features does airSlate SignNow offer for eSigning the Nebraska 1040N?

airSlate SignNow provides a range of features for efficient signing of the Nebraska 1040N, including document templates, a user-friendly interface, and mobile accessibility. You can track the status of your documents in real-time and receive notifications when the Nebraska 1040N is signed. This ensures a faster and more organized filing process.

-

Is there a cost associated with using airSlate SignNow for the Nebraska 1040N?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning, pricing varies based on the subscription plan you choose. Each plan provides different features suitable for individual or business needs, ensuring that filing your Nebraska 1040N remains affordable while maintaining high efficiency.

-

What are the benefits of eSigning the Nebraska 1040N with airSlate SignNow?

eSigning the Nebraska 1040N with airSlate SignNow offers several benefits, including increased speed, enhanced security, and improved accessibility. You'll be able to complete your tax documents anytime and from anywhere. This convenience allows you to ensure timely submission without the stress of traditional paperwork.

-

Does airSlate SignNow integrate with other tax preparation tools for the Nebraska 1040N?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software and tools, making it easier to draft and sign your Nebraska 1040N. This integration helps streamline your workflow by allowing you to manage all your tax documents in one place. Experience a more cohesive tax filing experience with these powerful integrations.

-

How secure is airSlate SignNow for signing my Nebraska 1040N?

Security is a top priority for airSlate SignNow when it comes to signing documents like the Nebraska 1040N. The platform employs advanced encryption methods to protect your personal data and ensure that your documents remain confidential. Trust airSlate SignNow to handle your sensitive information with the utmost care.

Get more for Instructions For Form CT 3 A Tax NY gov

- Compliance subpoena form

- On this day of 20 the undersigned lienor in consideration of the sum of does hereby waive and release his or her lien and right form

- Mississippi release lien form

- 497314094 form

- On this day of 20 the undersigned lienor in consideration of the final payment in the amount of hereby waives and releases his form

- Assignment of lien individual mississippi form

- Mississippi lien 497314097 form

- Mississippi lis pendens form

Find out other Instructions For Form CT 3 A Tax NY gov

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe