Tax Forms Nebraska Public Employees Retirement Systems 2023-2026

Understanding Nebraska Public Employees Retirement Systems Tax Forms

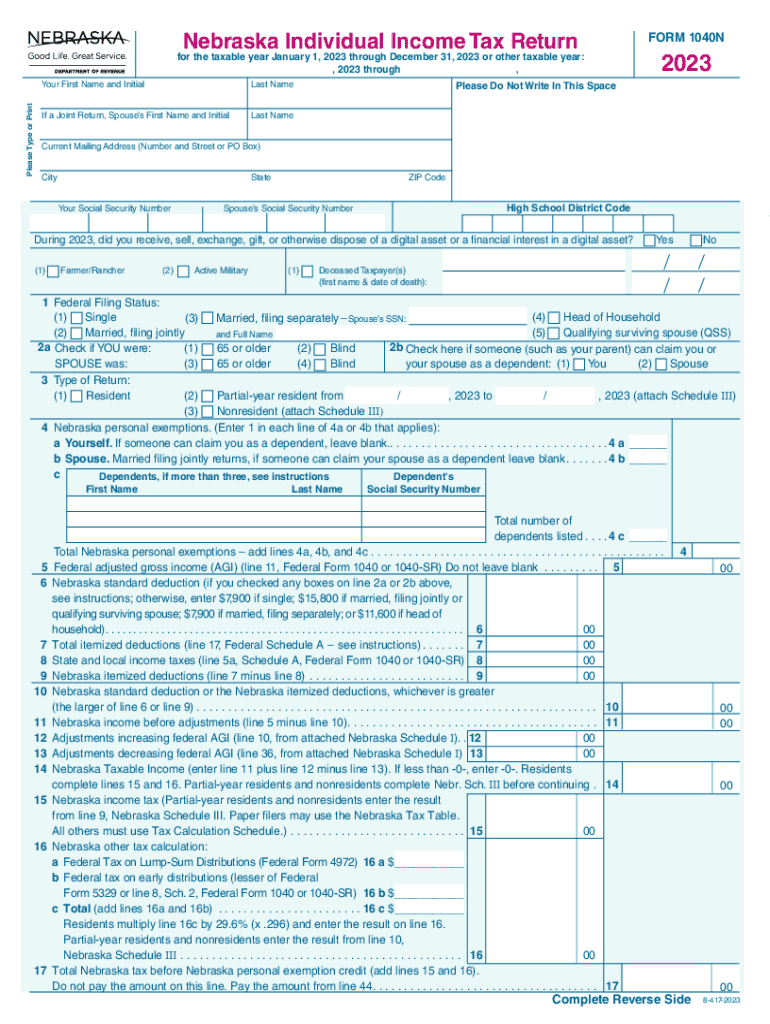

The Nebraska Public Employees Retirement Systems (NPERS) tax forms are essential for individuals involved in public employment in Nebraska. These forms help report income and contributions related to retirement benefits. Understanding these forms ensures compliance with state tax regulations and helps individuals accurately report their earnings.

How to Complete Nebraska Public Employees Retirement Systems Tax Forms

Completing the NPERS tax forms involves several key steps. First, gather all necessary documentation, including your W-2 forms and any relevant retirement contribution statements. Next, carefully fill out the Nebraska Form 1040N, ensuring that all income and deductions are accurately reported. Review the instructions for the NPERS forms to ensure compliance with specific requirements. Finally, double-check your entries for accuracy before submitting your forms.

Obtaining Nebraska Public Employees Retirement Systems Tax Forms

To obtain the NPERS tax forms, visit the official Nebraska Department of Revenue website or contact their office directly. The forms are typically available for download in PDF format, allowing for easy access and printing. Additionally, local government offices may provide physical copies of these forms for those who prefer to fill them out by hand.

Filing Deadlines for Nebraska Public Employees Retirement Systems Tax Forms

It is crucial to be aware of the filing deadlines for NPERS tax forms to avoid penalties. Generally, the deadline for submitting your Nebraska tax return is April 15 of the following year. However, if you need additional time, you may apply for an extension, which typically grants an additional six months. Ensure that all forms are submitted by the deadline to maintain compliance with state tax laws.

Required Documents for Nebraska Public Employees Retirement Systems Tax Forms

When filling out the NPERS tax forms, certain documents are required to support your claims. These include your W-2 forms, which report your annual income, and any 1099 forms if you have other sources of income. Additionally, documentation of retirement contributions and any deductions you plan to claim should be gathered to ensure a complete and accurate submission.

Submission Methods for Nebraska Public Employees Retirement Systems Tax Forms

You can submit your NPERS tax forms through various methods. The most common methods include filing online through the Nebraska Department of Revenue’s e-filing system, mailing the completed forms to the appropriate address, or delivering them in person to your local tax office. Each method has its advantages, so choose the one that best suits your needs.

Penalties for Non-Compliance with Nebraska Public Employees Retirement Systems Tax Forms

Failure to comply with the NPERS tax form requirements can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to file your forms accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help motivate timely and correct submissions.

Quick guide on how to complete tax forms nebraska public employees retirement systems

Complete Tax Forms Nebraska Public Employees Retirement Systems effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Tax Forms Nebraska Public Employees Retirement Systems on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Tax Forms Nebraska Public Employees Retirement Systems with ease

- Locate Tax Forms Nebraska Public Employees Retirement Systems and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Edit and eSign Tax Forms Nebraska Public Employees Retirement Systems and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax forms nebraska public employees retirement systems

Create this form in 5 minutes!

How to create an eSignature for the tax forms nebraska public employees retirement systems

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing Nebraska 2022 tax documents?

airSlate SignNow provides a range of features specifically designed to streamline the management of Nebraska 2022 tax documents. Users can easily upload, sign, and share documents while ensuring compliance with state regulations. Additionally, our platform offers templates that can be customized for Nebraska tax forms to enhance efficiency.

-

How can airSlate SignNow help me with electronic signatures for Nebraska 2022 tax forms?

With airSlate SignNow, you can electronically sign Nebraska 2022 tax forms securely and conveniently. Our platform adheres to the Electronic Signatures in Global and National Commerce Act (ESIGN), ensuring that your eSignatures are legally binding. This eliminates the hassle of printing and mailing documents, saving you time and resources.

-

What is the pricing structure for airSlate SignNow focused on Nebraska 2022 tax management?

airSlate SignNow offers flexible pricing plans designed to cater to various business needs, including those focused on Nebraska 2022 tax management. Pricing starts at a competitive monthly rate, with options for monthly or annual subscriptions. Each plan provides access to essential features, allowing you to choose the one that best fits your requirements.

-

Are there any integrations available with airSlate SignNow that assist with Nebraska 2022 tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software that can assist with Nebraska 2022 tax filing. These integrations enhance workflows by allowing users to transfer documents directly to their tax systems. This connectivity helps ensure that all your tax-related documents are organized and up-to-date.

-

What are the benefits of using airSlate SignNow for Nebraska 2022 tax documentation?

Using airSlate SignNow for Nebraska 2022 tax documentation offers numerous benefits, such as increased efficiency, improved accuracy, and enhanced security. Businesses can streamline their documentation process, reduce errors, and ensure compliance with local regulations. Furthermore, our platform provides an audit trail for all signed documents, adding an extra layer of security.

-

Is there a mobile app available for managing Nebraska 2022 tax documents with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows users to manage their Nebraska 2022 tax documents on-the-go. Whether you need to sign a document or send files for eSignature, our mobile app ensures that you remain productive and connected. This flexibility is ideal for busy professionals managing tax obligations.

-

How does airSlate SignNow ensure the security of Nebraska 2022 tax data?

airSlate SignNow prioritizes the security of your Nebraska 2022 tax data by implementing strong encryption measures and secure data storage practices. Our platform complies with industry standards to protect sensitive information against unauthorized access. Additionally, you can customize user permissions to fortify data security further.

Get more for Tax Forms Nebraska Public Employees Retirement Systems

- Secretary of state annual reports soskygov form

- Fertilizer license massachusetts form

- Verification of supervised professional practice ncblpc form

- Nc abc inventory form

- Pdf verification of supervised professional practice form

- Ny doing business name form

- Www dec ny gov permits 25010 html form

- Select and check one form

Find out other Tax Forms Nebraska Public Employees Retirement Systems

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online