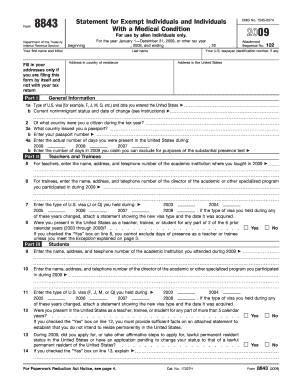

Irs Form 8843 2021

What is the IRS Form 8843

The IRS Form 8843 is a document required by the Internal Revenue Service for certain non-resident aliens who are in the United States. This form is primarily used to claim a tax exemption for the days spent in the U.S. as a student, teacher, or trainee. It helps establish the individual's non-resident status for tax purposes, which can affect their tax obligations and eligibility for certain tax benefits.

How to use the IRS Form 8843

To use the IRS Form 8843, individuals must first determine if they are required to file it. Typically, non-resident aliens who are students or scholars on specific visas, such as F, J, M, or Q, need to complete this form. After confirming eligibility, the form must be filled out accurately, providing personal information and details about the individual’s stay in the U.S. Once completed, it should be submitted to the IRS along with any other required tax forms.

Steps to complete the IRS Form 8843

Completing the IRS Form 8843 involves several key steps:

- Gather necessary personal information, including your name, address, and identification number.

- Provide details about your visa status and the educational institution you are associated with.

- Indicate the number of days you were present in the U.S. during the tax year.

- Review the form for accuracy and completeness.

- Submit the form to the IRS, ensuring it is sent before the deadline.

Legal use of the IRS Form 8843

The legal use of the IRS Form 8843 is crucial for maintaining compliance with U.S. tax laws. This form must be filed by eligible non-resident aliens to avoid potential penalties. By accurately completing and submitting the form, individuals affirm their non-resident status, which can protect them from being taxed on worldwide income. It is essential to follow IRS guidelines to ensure the form is valid and legally recognized.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8843 typically align with the annual tax filing season. Generally, the form must be submitted by April fifteenth of the year following the tax year in question. However, if the individual is a non-resident alien who is not required to file a federal tax return, they still need to submit Form 8843 by the deadline to maintain compliance. It is advisable to check for any updates or changes to the deadlines each tax year.

Required Documents

When completing the IRS Form 8843, certain documents may be required to support the information provided. These can include:

- Passport and visa details.

- Form I-20 or DS-2019, depending on your visa type.

- Proof of enrollment in an educational institution.

- Any previous tax documents, if applicable.

Form Submission Methods

The IRS Form 8843 can be submitted in several ways. Individuals can file the form electronically using approved tax software, which often simplifies the process. Alternatively, it can be printed and mailed directly to the IRS. It is important to ensure that the form is sent to the correct address, as specified by the IRS, to avoid delays or issues with processing.

Quick guide on how to complete irs form 8843 2009

Complete Irs Form 8843 with ease on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Irs Form 8843 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Irs Form 8843 without effort

- Obtain Irs Form 8843 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Irs Form 8843 and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8843 2009

Create this form in 5 minutes!

How to create an eSignature for the irs form 8843 2009

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is IRS Form 8843?

IRS Form 8843 is a statement for exempt individuals and individuals with a medical condition. It is essential for international students and scholars to report their presence in the U.S. for tax purposes. Filing IRS Form 8843 helps you confirm your non-resident status and avoid unnecessary taxation.

-

How can airSlate SignNow assist with IRS Form 8843?

airSlate SignNow streamlines the process of completing and submitting IRS Form 8843. Our platform allows users to eSign and securely send the form digitally, ensuring compliance with IRS regulations. With airSlate SignNow, you can easily manage your documentation needs without unnecessary hassle.

-

What are the benefits of using airSlate SignNow for IRS Form 8843?

Using airSlate SignNow for IRS Form 8843 provides a convenient and efficient way to manage your tax documents. The platform is user-friendly and reduces the time spent on paperwork, allowing you to focus on your studies or work. Additionally, you receive seamless access to your documents anytime and anywhere.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8843?

Yes, airSlate SignNow offers various pricing plans to suit different needs when handling IRS Form 8843. Plans are affordable, making it an effective solution for students and professionals alike. You can also enjoy a free trial to see how the platform can simplify your document processes.

-

Can I integrate airSlate SignNow with other tools for IRS Form 8843?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Salesforce. This allows you to manage documents related to IRS Form 8843 within your existing workflows, enhancing productivity and efficiency.

-

What features does airSlate SignNow offer for IRS Form 8843 management?

airSlate SignNow provides several features to enhance IRS Form 8843 management, including customizable templates, secure eSigning, and automated workflows. You'll benefit from reminders and tracking capabilities to ensure your submissions are timely. Overall, these features simplify complex documentation processes.

-

How secure is my information when using airSlate SignNow for IRS Form 8843?

Security is a top priority at airSlate SignNow. Our platform employs robust encryption and security protocols to protect your information related to IRS Form 8843. You can confidently eSign and share your documents, knowing that your personal and financial data are safeguarded.

Get more for Irs Form 8843

Find out other Irs Form 8843

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe