Form 8843 Statement for Exempt Individuals and Individuals 2021

What is the Form 8843 Statement for Exempt Individuals and Individuals?

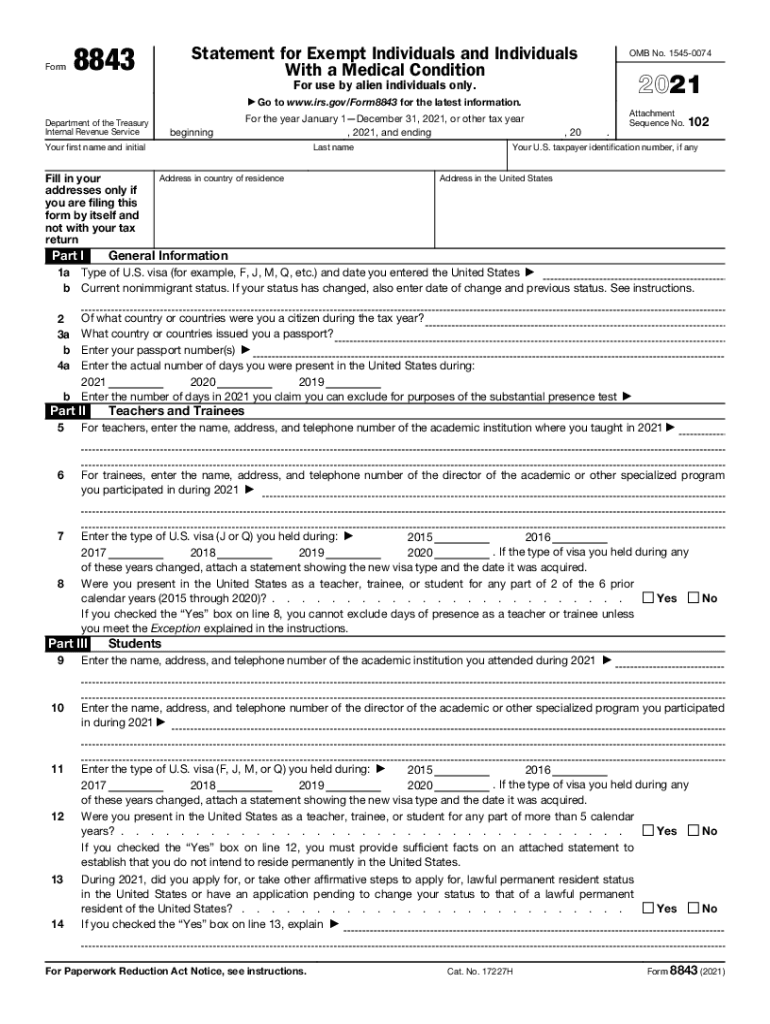

The Form 8843 is a statement required by the Internal Revenue Service (IRS) for certain non-resident aliens in the United States. This form is specifically designed for individuals who are exempt from the substantial presence test due to their status as students, teachers, or trainees. It serves to provide information about the individual's residency status and the days they were present in the U.S. during the tax year. Filing this form is crucial for maintaining the correct tax status and ensuring compliance with IRS regulations.

Steps to Complete the Form 8843 Statement for Exempt Individuals and Individuals

Completing the Form 8843 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and identification details such as your visa type. Next, fill out the form by providing details about your presence in the U.S., including the number of days you were present during the tax year. It is important to indicate your exempt status clearly. After completing the form, review it for any errors before submitting it to the IRS. Ensure that you keep a copy for your records.

Filing Deadlines / Important Dates

The deadline for submitting the Form 8843 typically coincides with the federal tax return filing deadline, which is usually April 15 each year. However, if you are a non-resident alien who is not required to file a tax return, you still must submit Form 8843 by this date to maintain your exempt status. It is essential to stay informed about any changes to deadlines that the IRS may announce, especially in light of special circumstances that may affect filing dates.

Legal Use of the Form 8843 Statement for Exempt Individuals and Individuals

The legal use of Form 8843 is vital for individuals who wish to maintain their non-resident status for tax purposes. By filing this form, you can establish your eligibility for exemptions under U.S. tax law. It is important to understand that failing to file Form 8843 can lead to unintended tax consequences, including being classified as a resident alien, which may subject you to different tax obligations. Therefore, ensuring the proper completion and timely submission of this form is essential for compliance.

Eligibility Criteria for the Form 8843 Statement for Exempt Individuals and Individuals

Eligibility for filing Form 8843 primarily includes individuals who are classified as non-resident aliens under U.S. tax law. This typically encompasses foreign students, teachers, and trainees who are in the U.S. on specific visa types, such as F, J, M, or Q visas. To qualify for the exemptions provided by this form, individuals must meet certain criteria regarding their presence in the U.S. and the purpose of their stay. Understanding these criteria is crucial for ensuring that you file the form correctly and maintain your exempt status.

Form Submission Methods

Submitting Form 8843 can be done through various methods, depending on individual preferences and circumstances. The form can be mailed directly to the IRS, which is the traditional method for submission. Alternatively, for those who are filing a tax return, the form can be included with the tax documents. It is important to ensure that the form is sent to the correct address based on your specific situation. Digital submission options may be limited, so verifying the latest IRS guidelines is advisable.

IRS Guidelines for the Form 8843 Statement for Exempt Individuals and Individuals

The IRS provides specific guidelines for completing and submitting Form 8843. These guidelines outline the necessary information required, the correct format for submission, and the consequences of failing to file. It is essential to refer to the IRS instructions for Form 8843 to ensure compliance with all requirements. Understanding these guidelines can help avoid common pitfalls and ensure that your filing is accepted without issues.

Quick guide on how to complete form 8843 statement for exempt individuals and individuals

Effortlessly Prepare Form 8843 Statement For Exempt Individuals And Individuals on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to find the suitable form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Form 8843 Statement For Exempt Individuals And Individuals on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Method to Modify and Electronically Sign Form 8843 Statement For Exempt Individuals And Individuals with Ease

- Find Form 8843 Statement For Exempt Individuals And Individuals and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Decide how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 8843 Statement For Exempt Individuals And Individuals to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8843 statement for exempt individuals and individuals

Create this form in 5 minutes!

How to create an eSignature for the form 8843 statement for exempt individuals and individuals

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is form 8843 and who needs to file it?

Form 8843 is a statement for exempt individuals and individuals with a medical condition. It is typically filed by nonresident aliens who are in the U.S. under certain visas. Understanding how to complete form 8843 is crucial for compliance with IRS regulations.

-

How does airSlate SignNow help in filing form 8843?

airSlate SignNow simplifies the process of filling out form 8843 by allowing users to quickly eSign and manage their documents. With easy-to-use templates and a secure platform, users can ensure their form 8843 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 8843?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for individuals and businesses. The plans include features that enable seamless eSigning and document management for form 8843, ensuring you stay compliant without breaking the bank.

-

What features does airSlate SignNow offer for form 8843 processing?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage for your form 8843. These features help streamline the document signing process, making it easier to manage essential documents.

-

Can airSlate SignNow integrate with other applications for handling form 8843?

Yes, airSlate SignNow integrates seamlessly with an array of applications such as Google Drive, Dropbox, and Microsoft Office. These integrations allow you to easily access and share your form 8843 documents directly from your preferred tools.

-

What are the benefits of using airSlate SignNow for form 8843?

Using airSlate SignNow for your form 8843 provides multiple benefits, including enhanced security, easy access across devices, and streamlined workflows. This ensures that your important documents are handled efficiently and securely.

-

Is airSlate SignNow secure for sharing form 8843 documents?

Absolutely! airSlate SignNow employs advanced security measures including encryption and multi-factor authentication to protect your form 8843 documents. You can trust that your sensitive information is safe while using our platform.

Get more for Form 8843 Statement For Exempt Individuals And Individuals

- Quitclaim deed from individual to individual hawaii form

- Warranty deed from individual to individual hawaii form

- Hawaii transfer deed form

- Warranty deed husband and wife to three individuals hawaii form

- Hi estate form

- Hawaii deed 497304314 form

- Discovery interrogatories from plaintiff to defendant with production requests hawaii form

- Hi attorney form

Find out other Form 8843 Statement For Exempt Individuals And Individuals

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later