Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition Irs 2011

What is the Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

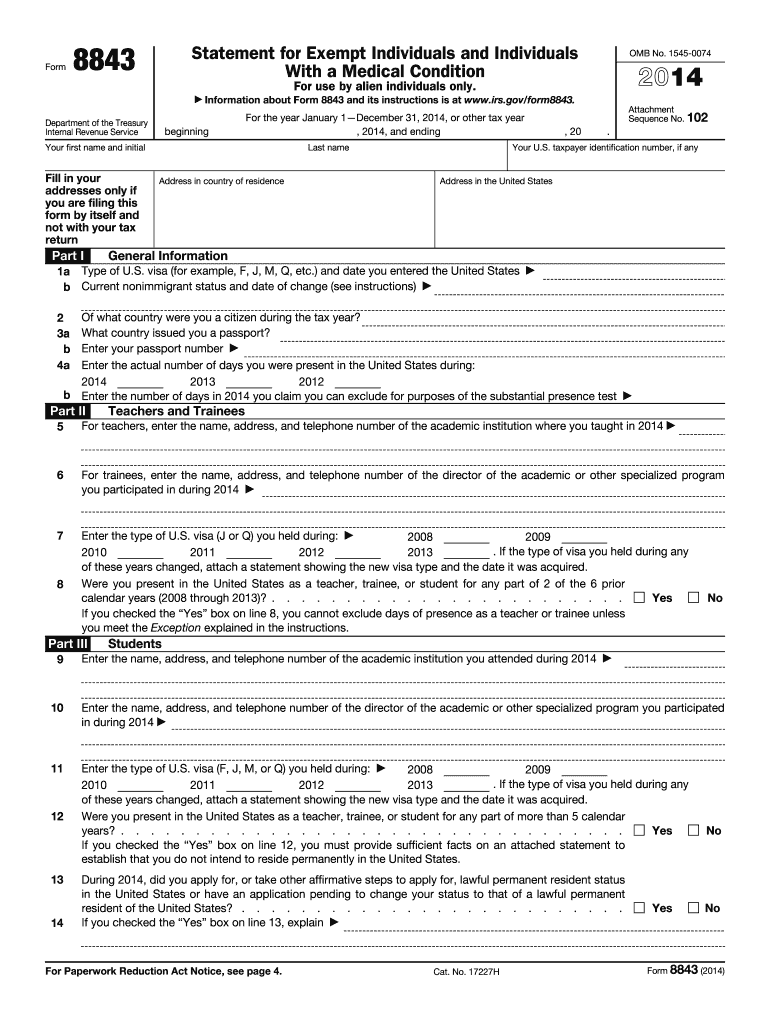

The Form 8843 is a statement required by the Internal Revenue Service (IRS) for certain individuals who are exempt from the substantial presence test. This form is primarily used by non-resident aliens who are in the United States on specific types of visas, such as students or teachers, and those with medical conditions. It helps establish their non-resident status for tax purposes, allowing them to avoid being taxed as residents.

How to use the Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

To use the Form 8843, individuals must first determine if they meet the criteria for exemption. This includes checking their visa type and the duration of their stay in the U.S. Once eligibility is confirmed, they should complete the form accurately, providing all necessary information about their presence in the U.S. and any medical conditions that apply. After completion, the form should be filed with the IRS as part of the tax return process, typically alongside Form 1040NR or 1040NR-EZ.

Steps to complete the Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

Completing the Form 8843 involves several key steps:

- Gather necessary information, including details about your visa, entry dates, and any medical conditions.

- Download the Form 8843 from the IRS website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form along with your tax return by the required deadline.

Legal use of the Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

The legal use of the Form 8843 is crucial for maintaining compliance with U.S. tax laws. By submitting this form, individuals affirm their non-resident status, which can prevent unnecessary taxation on income earned outside the U.S. It is essential to ensure that the form is completed truthfully and accurately, as any discrepancies may lead to penalties or issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8843 typically align with the tax return deadlines. For most individuals, this means the form must be submitted by April 15 of the following year after the tax year ends. However, if an extension is filed for the tax return, the Form 8843 must also be submitted by the extended deadline. It is important to keep track of these dates to avoid late filing penalties.

Eligibility Criteria

Eligibility for using the Form 8843 generally includes non-resident aliens who are in the U.S. under specific visa types, such as F, J, M, or Q visas. Additionally, individuals who have a medical condition that prevents them from meeting the substantial presence test may also qualify. It is essential to review the IRS guidelines to ensure compliance with the eligibility criteria before filing.

Quick guide on how to complete 2014 form 8843 statement for exempt individuals and individuals with a medical condition irs

Complete Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs effortlessly on any device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without hassle. Handle Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs on any platform through airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs effortlessly

- Obtain Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring new printed copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8843 statement for exempt individuals and individuals with a medical condition irs

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8843 statement for exempt individuals and individuals with a medical condition irs

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS?

Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS is a document that allows certain non-resident aliens to claim tax exemptions. This form is essential for individuals who qualify as exempt under the IRS tax code, helping them avoid unnecessary taxation.

-

How can airSlate SignNow help with filing Form 8843?

airSlate SignNow streamlines the process of preparing and eSigning Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS. Our platform offers easy-to-use templates and allows you to seamlessly collect necessary information, making filing a breeze.

-

Is there a cost associated with using airSlate SignNow for Form 8843?

Yes, airSlate SignNow offers competitively priced plans for businesses needing to manage Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS. Our cost-effective solution ensures you get the most value while simplifying your document processes.

-

What features does airSlate SignNow provide for documents like Form 8843?

With airSlate SignNow, you get features such as electronic signatures, customizable templates, and secure cloud storage for Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS. These features enhance document management and compliance efforts for users.

-

Can I integrate airSlate SignNow with other software for Form 8843?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS alongside your existing tools. This helps to streamline workflows and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 8843?

Using airSlate SignNow for Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS simplifies the entire eSigning process and ensures compliance. Our platform saves time and effort, making it easier for individuals and businesses to meet IRS filing requirements.

-

Is airSlate SignNow secure for signing documents like Form 8843?

Yes, airSlate SignNow prioritizes security by implementing robust encryption and compliance measures for documents, including Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition IRS. You can confidently manage and sign your documents knowing they are protected.

Get more for Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

- Demolition contract for contractor idaho form

- Framing contract for contractor idaho form

- Security contract for contractor idaho form

- Insulation contract for contractor idaho form

- Paving contract for contractor idaho form

- Site work contract for contractor idaho form

- Siding contract for contractor idaho form

- Refrigeration contract for contractor idaho form

Find out other Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition Irs

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free