Tax Withholding 2023-2026

What is the Tax Withholding

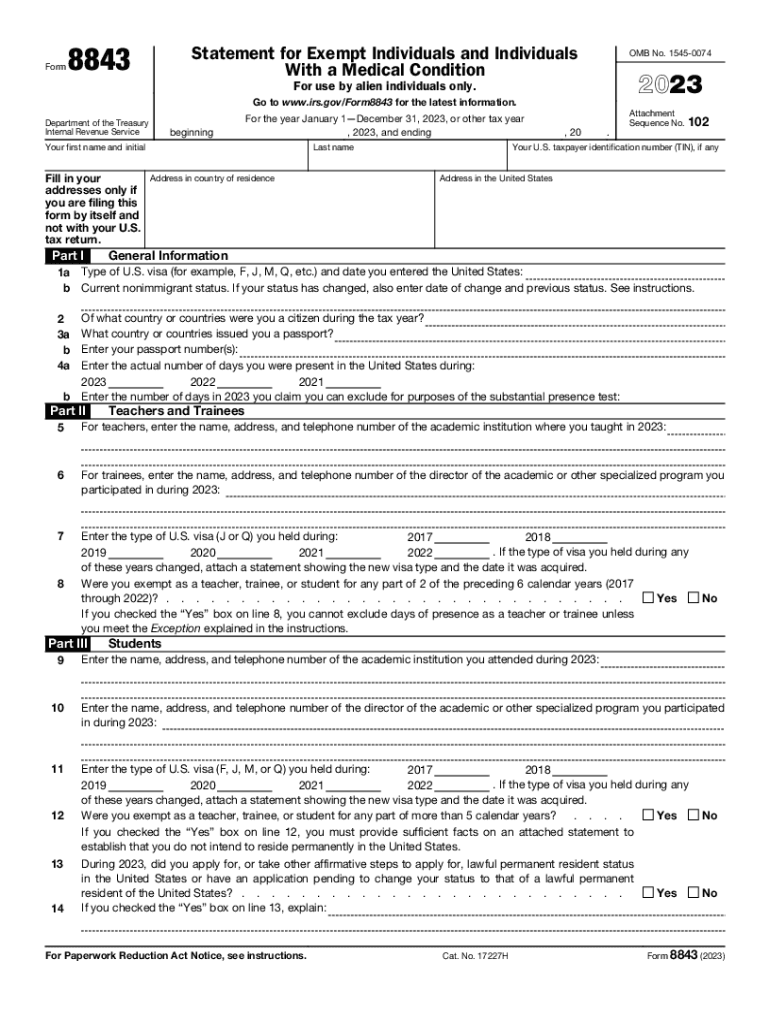

The tax withholding refers to the amount of an employee's earnings that an employer deducts and sends directly to the IRS as a prepayment of the employee's income tax. This process is essential for ensuring that individuals meet their tax obligations throughout the year, rather than facing a large tax bill when filing their annual returns. For those filling out the 2018 Form 8843, understanding tax withholding is crucial, especially for non-resident aliens and international students who may qualify for certain exemptions.

Steps to complete the Tax Withholding

Completing the tax withholding process involves several key steps:

- Gather necessary information: Collect your personal details, including your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Fill out Form W-4: This form helps your employer determine the correct amount of tax to withhold from your paycheck based on your filing status and any allowances you claim.

- Submit the form to your employer: Ensure that your employer receives your completed Form W-4 to adjust your withholding accurately.

- Review your pay stubs: Regularly check your pay stubs to confirm that the correct amount is being withheld.

IRS Guidelines

The IRS provides specific guidelines regarding tax withholding that must be followed. These guidelines include the requirement for employers to withhold federal income tax based on the employee's W-4 form and the applicable tax rates. Additionally, non-resident aliens must follow special rules outlined in IRS publications, particularly concerning the exemptions available under tax treaties. Understanding these guidelines is essential for compliance and to avoid penalties.

Filing Deadlines / Important Dates

For individuals completing the 2018 Form 8843, it is vital to be aware of the filing deadlines. Generally, the deadline for filing tax returns is April fifteenth of the following year. However, non-resident aliens may have different deadlines based on their specific circumstances. It is advisable to check the IRS website or consult a tax professional to ensure compliance with all relevant dates.

Required Documents

When preparing to complete the 2018 Form 8843, you will need several documents to ensure accurate reporting and compliance. These include:

- Your passport and visa information.

- Form W-2 or 1099, if applicable.

- Any documentation related to tax treaty benefits.

- Records of your physical presence in the United States.

Eligibility Criteria

Eligibility for completing the 2018 Form 8843 primarily applies to non-resident aliens, including international students and scholars. To qualify, individuals must meet specific criteria regarding their visa status and the duration of their stay in the United States. Understanding these criteria helps ensure proper completion of the form and compliance with IRS regulations.

Quick guide on how to complete tax withholding

Complete Tax Withholding effortlessly on any gadget

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Tax Withholding on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Tax Withholding without hassle

- Locate Tax Withholding and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Tax Withholding and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax withholding

Create this form in 5 minutes!

How to create an eSignature for the tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 8843 IRS form?

The 2018 8843 IRS form is a statement for exempt individuals and individuals with a medical condition that allows them to exclude days of presence in the U.S. for tax purposes. It's crucial for non-resident aliens to complete this form to avoid being taxed on earnings. Understanding how to fill out the 2018 8843 IRS form can help you maintain compliance and avoid penalties.

-

Who needs to file the 2018 8843 IRS form?

Individuals who are non-resident aliens, such as students and teachers on J or F visas, are required to file the 2018 8843 IRS form. This form is necessary for those who need to claim a tax exemption based on their visa status. If you're unsure whether you need to file, consult with a tax professional familiar with the 2018 8843 IRS requirements.

-

How does airSlate SignNow simplify the process of filing the 2018 8843 IRS form?

airSlate SignNow provides a seamless solution for electronically signing and sending the 2018 8843 IRS form. With our easy-to-use interface, you can avoid delays associated with paper forms and ensure timely submission. This not only saves time but also helps you maintain proper tax compliance.

-

What features does airSlate SignNow offer for managing IRS forms like the 2018 8843?

airSlate SignNow offers features such as document templates, in-app editing, and secure eSignature capabilities, which are essential for managing IRS forms like the 2018 8843. These functionalities provide users with a streamlined experience, enabling them to complete and submit their forms effectively. Our platform ensures that all your documents are securely stored and easily accessible.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. Whether you're an individual or a larger organization, our plans ensure that you can access features necessary for managing documentation, including the 2018 8843 IRS form. Visit our website to choose a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other software to manage IRS tax documents?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage IRS tax documents like the 2018 8843 IRS form. Our platform can connect with popular solutions such as Google Drive and Dropbox to streamline your document workflows. This interoperability enhances document management efficiency.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers several benefits, including increased efficiency, enhanced security, and simplified compliance processes. Our platform is designed to help you manage forms like the 2018 8843 IRS quickly and with confidence. This ultimately leads to a better overall experience during tax season.

Get more for Tax Withholding

- Billing form 100117553

- Professional recommendation form saint leo university

- Di 9 form

- Irs publication 1660 form

- Form 6 9 certificate of construction completion the texas glo texas

- Youth needs assessment form updated a158 layout 1 qxd

- Group dentaloutpatienthospitalisation benefit claim form

- Two member llc operating agreement template form

Find out other Tax Withholding

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed