Irs Publication 4134 2018

What is the IRS Publication 4134?

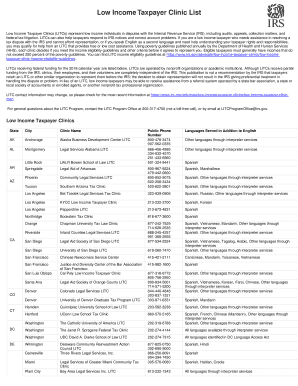

The IRS Publication 4134 provides crucial information regarding the Low Income Taxpayer Clinic (LITC) program. This publication outlines the services available to low-income taxpayers, including assistance with tax disputes and representation before the IRS. It serves as a resource for individuals who may need help navigating tax issues due to financial constraints.

How to Use the IRS Publication 4134

Using the IRS Publication 4134 involves understanding the resources it offers and determining eligibility for assistance. Taxpayers can refer to this publication to find a list of LITCs, which provide free or low-cost legal assistance. It is important to review the criteria outlined in the publication to ensure that the services align with individual tax situations.

Steps to Complete the IRS Publication 4134

Completing the IRS Publication 4134 requires following specific steps to ensure that taxpayers can access the necessary resources. First, individuals should download the publication, which is available in PDF format. Next, they should review the eligibility requirements for LITCs and identify a clinic that serves their area. Finally, taxpayers can reach out to the selected clinic for assistance, ensuring they have all relevant documentation ready for review.

Legal Use of the IRS Publication 4134

The legal use of the IRS Publication 4134 is centered around its role in informing taxpayers of their rights and available resources. This publication is recognized by the IRS as a legitimate source of information regarding low-income taxpayer assistance. Utilizing the publication ensures that individuals are aware of their entitlements and can seek help in compliance with IRS regulations.

Key Elements of the IRS Publication 4134

Key elements of the IRS Publication 4134 include detailed descriptions of the services offered by LITCs, eligibility criteria for taxpayers, and a comprehensive list of clinics across the United States. Additionally, the publication outlines the types of issues that LITCs can assist with, such as audits, appeals, and tax debt relief. Understanding these elements is essential for taxpayers seeking support.

Eligibility Criteria

Eligibility criteria for assistance through the IRS Publication 4134 typically include income thresholds based on the federal poverty level. Taxpayers must demonstrate that their income falls below a certain percentage of this level to qualify for services from LITCs. Additionally, individuals must have a tax issue that falls within the scope of the clinic's services, such as disputes with the IRS or questions regarding tax compliance.

Quick guide on how to complete irs publication 4134

Effortlessly Prepare Irs Publication 4134 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect environmentally-friendly substitute to conventional printed and signed paperwork, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without delays. Manage Irs Publication 4134 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Alter and Electronically Sign Irs Publication 4134 with Ease

- Obtain Irs Publication 4134 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Publication 4134 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs publication 4134

Create this form in 5 minutes!

How to create an eSignature for the irs publication 4134

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is publication 4134 and how does it relate to airSlate SignNow?

Publication 4134 refers to IRS guidance on electronic signatures, which is crucial for businesses using airSlate SignNow. Adhering to this publication ensures that your eSigned documents meet legal standards, making airSlate SignNow a reliable choice for compliance.

-

How does airSlate SignNow comply with publication 4134?

AirSlate SignNow adheres to publication 4134 by using advanced security measures and an audit trail for all eSigned documents. This compliance guarantees that your electronic signatures carry the same weight as traditional signatures, safeguarding your transactions.

-

What features of airSlate SignNow support the requirements of publication 4134?

AirSlate SignNow offers features like secure authentication, comprehensive audit trails, and custom signing workflows that align with the guidelines laid out in publication 4134. These features ensure that your signing process is both efficient and compliant.

-

Is airSlate SignNow cost-effective for businesses considering publication 4134 compliance?

Yes, airSlate SignNow is known for its cost-effective pricing plans that cater to various business sizes while ensuring compliance with publication 4134. This affordability allows businesses to access professional eSigning solutions without compromising legal adherence.

-

How can airSlate SignNow benefit my organization in terms of publication 4134?

Using airSlate SignNow helps your organization streamline the eSigning process while ensuring compliance with publication 4134. The ease of use and reliability of our solution can signNowly reduce turnaround times and enhance document management.

-

What integrations does airSlate SignNow offer that are relevant to publication 4134?

AirSlate SignNow integrates seamlessly with various platforms such as Google Drive and Salesforce, which are essential for businesses looking to adhere to publication 4134. These integrations enhance workflow efficiency and keep all your documents organized.

-

Can I trust airSlate SignNow for high-volume transactions involving publication 4134?

Absolutely! AirSlate SignNow is designed to handle high-volume transactions while ensuring compliance with publication 4134. Our platform is robust, scalable, and capable of processing a signNow number of eSigned documents efficiently.

Get more for Irs Publication 4134

Find out other Irs Publication 4134

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement