Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H 2022

Understanding the Low Income Taxpayer Clinic List

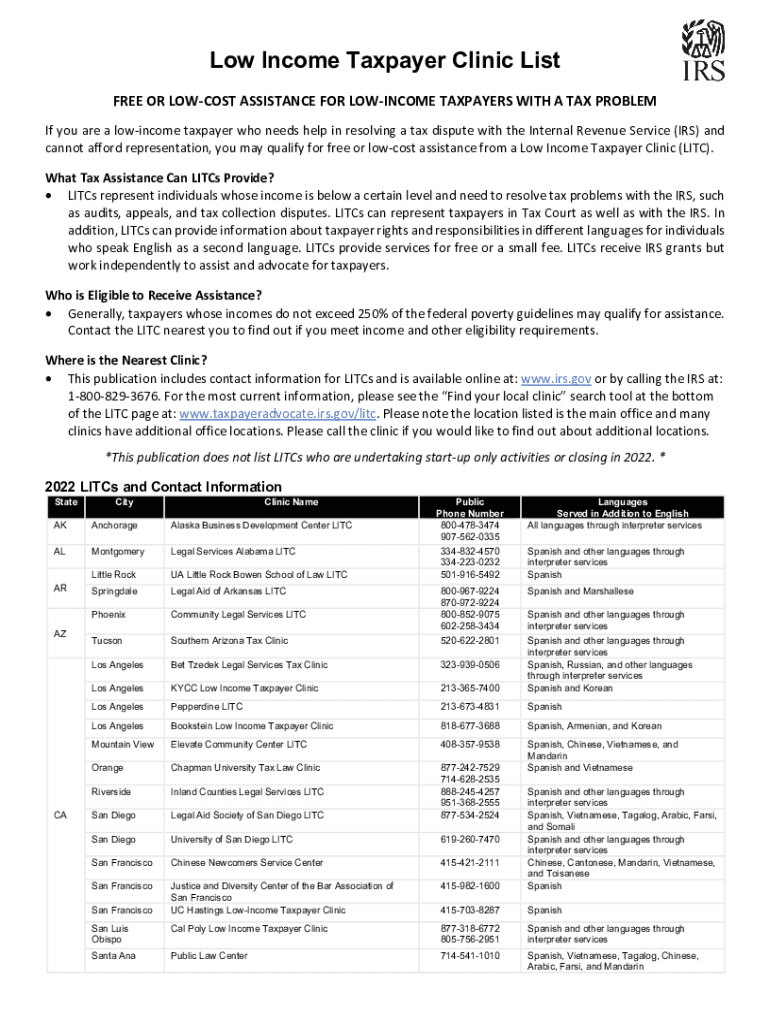

The Low Income Taxpayer Clinic List is a valuable resource provided by the Internal Revenue Service (IRS) to assist individuals with limited financial means. These clinics offer free or low-cost services to help taxpayers understand their rights and responsibilities, especially in disputes with the IRS. The list includes contact information for clinics across the United States, detailing the services they provide, which may include representation in audits, appeals, and collection matters.

How to Access the Low Income Taxpayer Clinic List

To obtain the Low Income Taxpayer Clinic List, taxpayers can visit the IRS website. The list is typically available in PDF format, making it easy to download and print. Users should ensure they are looking at the most recent version, as the IRS updates this list periodically to reflect changes in clinic availability and services. Additionally, the list can be accessed through local IRS offices or community organizations that partner with the IRS to provide taxpayer assistance.

Steps to Complete the Low Income Taxpayer Clinic List Form

Completing the Low Income Taxpayer Clinic List form involves several straightforward steps:

- Identify your eligibility based on income thresholds set by the IRS.

- Gather necessary documentation, such as proof of income and tax returns, to present to the clinic.

- Contact a clinic from the list to inquire about their services and availability.

- Schedule an appointment and prepare any questions or concerns you may have regarding your tax situation.

Legal Considerations for Using the Low Income Taxpayer Clinic List

The Low Income Taxpayer Clinic List is designed to ensure that eligible taxpayers can access legal assistance without the burden of high costs. Clinics operate under specific legal guidelines established by the IRS, ensuring compliance with federal laws. Taxpayers should be aware that services provided by these clinics are confidential, and the information shared will be protected under attorney-client privilege, where applicable.

Key Elements of the Low Income Taxpayer Clinic List

Several key elements define the Low Income Taxpayer Clinic List:

- Eligibility Criteria: Clinics generally serve individuals with incomes below a certain threshold, which varies based on family size and location.

- Services Offered: Many clinics provide assistance with audits, appeals, and representation before the IRS.

- Geographic Coverage: The list includes clinics from all states, ensuring that taxpayers can find assistance close to home.

- Contact Information: Each entry includes phone numbers, addresses, and sometimes websites for easy access.

Examples of Utilizing the Low Income Taxpayer Clinic List

Taxpayers can use the Low Income Taxpayer Clinic List in various scenarios:

- A taxpayer facing an audit can find a local clinic to help navigate the process.

- Individuals who have received a notice of tax debt can seek representation to negotiate with the IRS.

- Low-income families needing assistance with tax credits can consult clinics for guidance on eligibility and application processes.

Quick guide on how to complete low income taxpayer clinic list irs tax formslow income taxpayer clinicsinternal revenue serviceirs low income tax clinics can

Complete Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H effortlessly on any gadget

Digital document management has gained traction among corporations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the correct form and safely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without issues. Manage Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H with minimal effort

- Locate Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct low income taxpayer clinic list irs tax formslow income taxpayer clinicsinternal revenue serviceirs low income tax clinics can

Create this form in 5 minutes!

How to create an eSignature for the low income taxpayer clinic list irs tax formslow income taxpayer clinicsinternal revenue serviceirs low income tax clinics can

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to the 2022 internal revenue service?

airSlate SignNow is a digital signing solution that enables users to send and electronically sign documents easily and affordably. For the 2022 internal revenue service, this tool helps businesses manage their tax-related documents efficiently, ensuring compliance and timely submissions.

-

How can I integrate airSlate SignNow with my existing software for handling 2022 internal revenue service documents?

AirSlate SignNow offers seamless integrations with popular software including CRMs and document management systems. By connecting it with your existing tools, you can streamline the process of managing your 2022 internal revenue service documents, reducing manual work and saving time.

-

What features does airSlate SignNow provide to facilitate 2022 internal revenue service document management?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and advanced tracking to help manage your 2022 internal revenue service documents efficiently. These features ensure your documents are safe, easily accessible, and compliant with IRS regulations.

-

Is airSlate SignNow cost-effective for small businesses dealing with the 2022 internal revenue service?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. With tools specifically designed to handle documentation for the 2022 internal revenue service, you can reduce overhead costs while maintaining compliance and improving workflow.

-

How secure is airSlate SignNow for managing sensitive 2022 internal revenue service documents?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption methods and adheres to compliance standards to ensure that your sensitive 2022 internal revenue service documents are protected from unauthorized access.

-

Can airSlate SignNow help with eSigning forms required by the 2022 internal revenue service?

Absolutely! airSlate SignNow simplifies the eSigning process for all forms required by the 2022 internal revenue service. Users can easily create, send, and sign documents in a secure environment, making it ideal for IRS-related paperwork.

-

What support options are available for users needing assistance with 2022 internal revenue service processes?

airSlate SignNow provides comprehensive support through live chat, email, and a detailed help center. If you're dealing with 2022 internal revenue service processes, the support team is readily available to assist you with any challenges you may encounter.

Get more for Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H

Find out other Low Income Taxpayer Clinic List IRS Tax FormsLow Income Taxpayer ClinicsInternal Revenue ServiceIRS Low Income Tax Clinics Can H

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form