Pepa Form

What is the Pepa Form

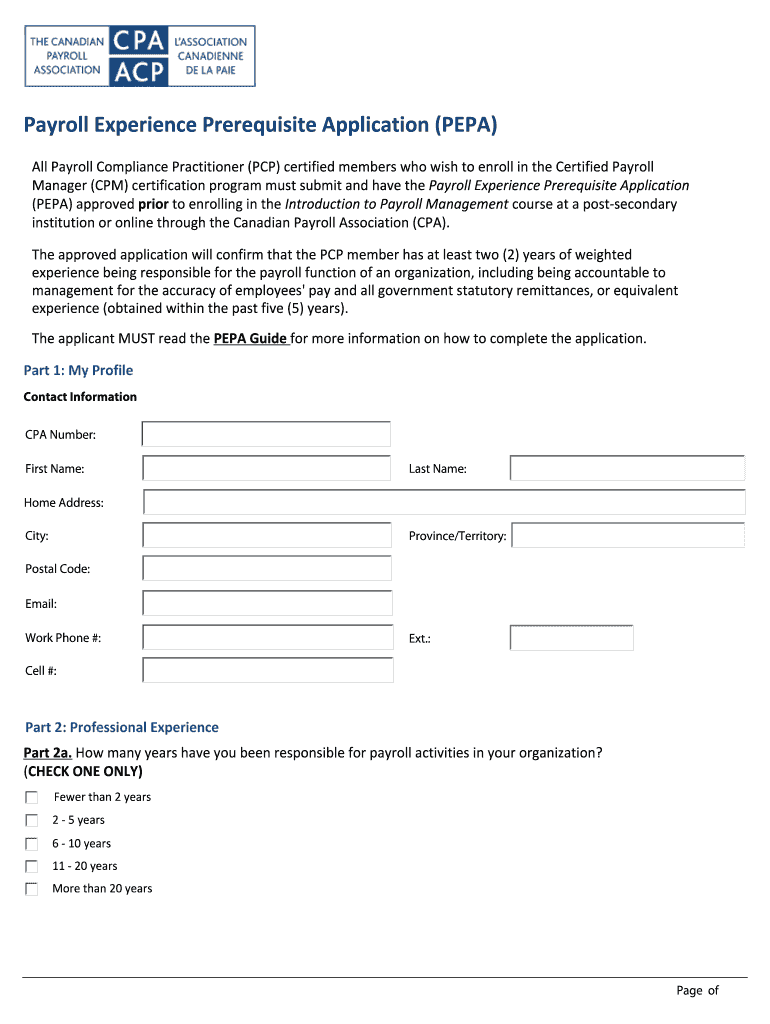

The Pepa Form is a crucial document used primarily for payroll processing within organizations. It serves as an application to collect necessary information from employees regarding their tax withholding preferences and personal details. This form is essential for ensuring compliance with federal and state tax regulations, as it helps employers accurately calculate payroll taxes and deductions. Understanding the purpose and requirements of the Pepa Form is vital for both employers and employees to facilitate smooth payroll operations.

How to Obtain the Pepa Form

To obtain the Pepa Form, individuals can typically access it through their employer's human resources department or payroll system. Many organizations provide this form electronically, allowing employees to fill it out digitally. Alternatively, the form may be available on official government or tax-related websites. It is important to ensure that the most current version of the form is used, as updates may occur that reflect changes in tax laws or regulations.

Steps to Complete the Pepa Form

Completing the Pepa Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number, address, and employment details. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form accurately, paying close attention to the sections related to tax withholding preferences. Once completed, review the form for any errors before submitting it to your employer's payroll department.

Legal Use of the Pepa Form

The Pepa Form is legally binding when completed correctly and submitted according to regulatory guidelines. It must adhere to the requirements set forth by the IRS and state tax authorities. Employers are responsible for maintaining the confidentiality of the information provided on the form and ensuring that it is used solely for payroll processing purposes. Failure to comply with legal standards can result in penalties for both employers and employees.

Key Elements of the Pepa Form

Several key elements are essential to the Pepa Form. These include personal identification information, tax filing status, and the number of allowances claimed. Additionally, the form may require employees to indicate any additional withholding amounts they wish to have deducted from their paychecks. Understanding these elements is crucial for employees to make informed decisions regarding their tax withholdings and overall payroll deductions.

Form Submission Methods

The Pepa Form can be submitted through various methods, depending on the employer's policies. Common submission methods include online submission through a payroll portal, email, or traditional mail. Some employers may also allow in-person submissions at their human resources office. It is important to follow the specific guidelines provided by the employer to ensure timely processing of the form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Pepa Form. These guidelines outline the necessary information required, the importance of accuracy in reporting, and the implications of incorrect submissions. Familiarizing oneself with these guidelines can help employees avoid common pitfalls and ensure compliance with federal tax regulations. Employers are also encouraged to stay updated on any changes to IRS requirements that may affect the Pepa Form.

Quick guide on how to complete pepa form

Complete Pepa Form effortlessly on any device

Online document organization has gained traction among both companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents quickly without delays. Manage Pepa Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Pepa Form without hassle

- Locate Pepa Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pepa Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a pepa form in airSlate SignNow?

The pepa form in airSlate SignNow is an electronic document format that allows users to easily create, send, and eSign forms. It streamlines the signing process while ensuring security and compliance, making it ideal for businesses of all sizes.

-

How much does it cost to use the pepa form feature?

airSlate SignNow offers competitive pricing for the pepa form feature. Plans are designed to suit different business needs, and you can choose from monthly or annual subscriptions. Check our website for the latest pricing details and special offers.

-

What are the main features of the pepa form?

The pepa form includes features such as customizable templates, secure electronic signatures, and real-time tracking. These capabilities enhance the document workflow, allowing businesses to save time and reduce paperwork signNowly.

-

What are the benefits of using a pepa form for my business?

Using a pepa form can help your business streamline the signing process, reduce turnaround time, and improve document accuracy. Additionally, it allows for secure and efficient transactions, which can enhance customer satisfaction and trust.

-

Can I integrate the pepa form with other applications?

Yes, airSlate SignNow allows you to integrate the pepa form with various third-party applications. This ability to connect with CRM, project management, and cloud storage solutions facilitates better data management and workflow efficiency.

-

Is the pepa form feature secure?

Absolutely! The pepa form in airSlate SignNow utilizes advanced security protocols, including encryption and secure access controls. This ensures that all documents are protected and confidential information is secure throughout the signing process.

-

How can I create a pepa form in airSlate SignNow?

Creating a pepa form in airSlate SignNow is straightforward. You can start by choosing a template, customizing it to meet your needs, and then saving it for future use. The intuitive interface makes this process user-friendly for all levels of experience.

Get more for Pepa Form

Find out other Pepa Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy