Sindh Revenue Board Form

What is the Sindh Revenue Board

The Sindh Revenue Board (SRB) is a government body responsible for the collection and management of various taxes in the Sindh province of Pakistan. Established to enhance tax compliance and efficiency, the SRB oversees the implementation of the Sindh Sales Tax on Services Act. It plays a crucial role in the provincial economy by ensuring that revenue is collected effectively and transparently.

Key elements of the Sindh Revenue Board

The Sindh Revenue Board has several key elements that define its operations and responsibilities:

- Tax Collection: The SRB is responsible for collecting sales tax on services provided within the province.

- Policy Formulation: It develops policies and guidelines to improve tax compliance and administration.

- Public Awareness: The board conducts awareness campaigns to educate taxpayers about their obligations and rights.

- Dispute Resolution: The SRB provides mechanisms for resolving disputes between taxpayers and the government.

Steps to complete the Sindh Revenue Board

Completing the necessary forms for the Sindh Revenue Board involves several steps:

- Gather Required Information: Collect all relevant details, including business registration and tax identification numbers.

- Fill Out the Form: Accurately complete the required forms, ensuring all information is correct.

- Submit the Form: Submit your completed form to the SRB through the designated channels, which may include online submission or in-person delivery.

- Follow Up: After submission, monitor the status of your application or compliance to address any issues promptly.

Legal use of the Sindh Revenue Board

The legal framework governing the Sindh Revenue Board is crucial for ensuring compliance and accountability. The SRB operates under the Sindh Sales Tax on Services Act, which outlines the legal obligations of taxpayers and the authority of the board. Understanding this legal context is essential for businesses to navigate their tax responsibilities effectively.

Required Documents

When dealing with the Sindh Revenue Board, specific documents are necessary for compliance and form submission:

- Business Registration Certificate: Proof of business registration in Sindh.

- Tax Identification Number (TIN): Essential for tax-related transactions.

- Financial Statements: Recent financial documents may be required to assess tax liabilities.

- Previous Tax Returns: Copies of past tax returns may be necessary for reference.

Form Submission Methods (Online / Mail / In-Person)

The Sindh Revenue Board offers various methods for submitting forms, making it accessible for taxpayers:

- Online Submission: Many forms can be submitted electronically through the SRB's official website.

- Mail: Taxpayers may also choose to send completed forms via postal service.

- In-Person: Forms can be submitted directly at designated SRB offices for those who prefer face-to-face interactions.

Quick guide on how to complete sindh revenue board

Complete Sindh Revenue Board effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sindh Revenue Board on any device with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and electronically sign Sindh Revenue Board with ease

- Obtain Sindh Revenue Board and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Sindh Revenue Board while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

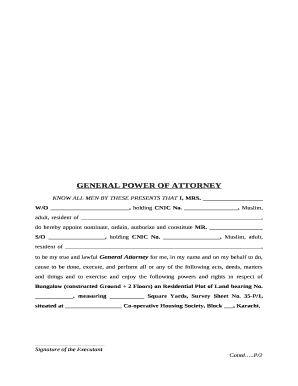

What is a Pakistan general power attorney?

A Pakistan general power attorney is a legal document that grants one individual the authority to act on behalf of another in legal and financial matters. This document is crucial for delegating responsibilities, ensuring smooth handling of affairs when the principal cannot do so themselves. Understanding its implications can signNowly impact business operations and personal matters.

-

How can airSlate SignNow help with creating a Pakistan general power attorney?

airSlate SignNow offers an intuitive platform for drafting and signing a Pakistan general power attorney. Our user-friendly templates and eSigning capabilities ensure that the document can be completed quickly and efficiently. This minimizes delays typically associated with traditional document handling.

-

Is there a cost associated with the Pakistan general power attorney template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the Pakistan general power attorney template. Our pricing is designed to be cost-effective, providing great value for the features and tools offered. Detailed pricing plans are available on our website, allowing you to choose what best fits your needs.

-

What are the benefits of using airSlate SignNow for business-related power of attorney documents?

Using airSlate SignNow for your Pakistan general power attorney documents streamlines the signing process, making it quicker and more efficient. Our platform enhances collaboration among stakeholders, reduces paper usage, and ensures compliance with legal standards. Additionally, electronic signatures are valid and recognized in Pakistan, simplifying document management.

-

Can the Pakistan general power attorney be integrated with other software on airSlate SignNow?

Yes, airSlate SignNow provides various integration options that can connect your Pakistan general power attorney processes with other business apps. This enhances workflow efficiency by enabling seamless data transfer and real-time collaboration. Check our integrations page for a full list of compatible applications.

-

How secure is the airSlate SignNow platform for storing sensitive documents like a Pakistan general power attorney?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and multi-factor authentication to protect your documents, including your Pakistan general power attorney. Regular security audits and compliance with data protection regulations further ensure that your sensitive information is safe and secure.

-

Is technical support available for issues related to the Pakistan general power attorney documents?

Absolutely! airSlate SignNow offers comprehensive technical support for all users. If you encounter any issues with creating or managing your Pakistan general power attorney documents, our support team is available to provide assistance and resolve any concerns promptly.

Get more for Sindh Revenue Board

Find out other Sindh Revenue Board

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy