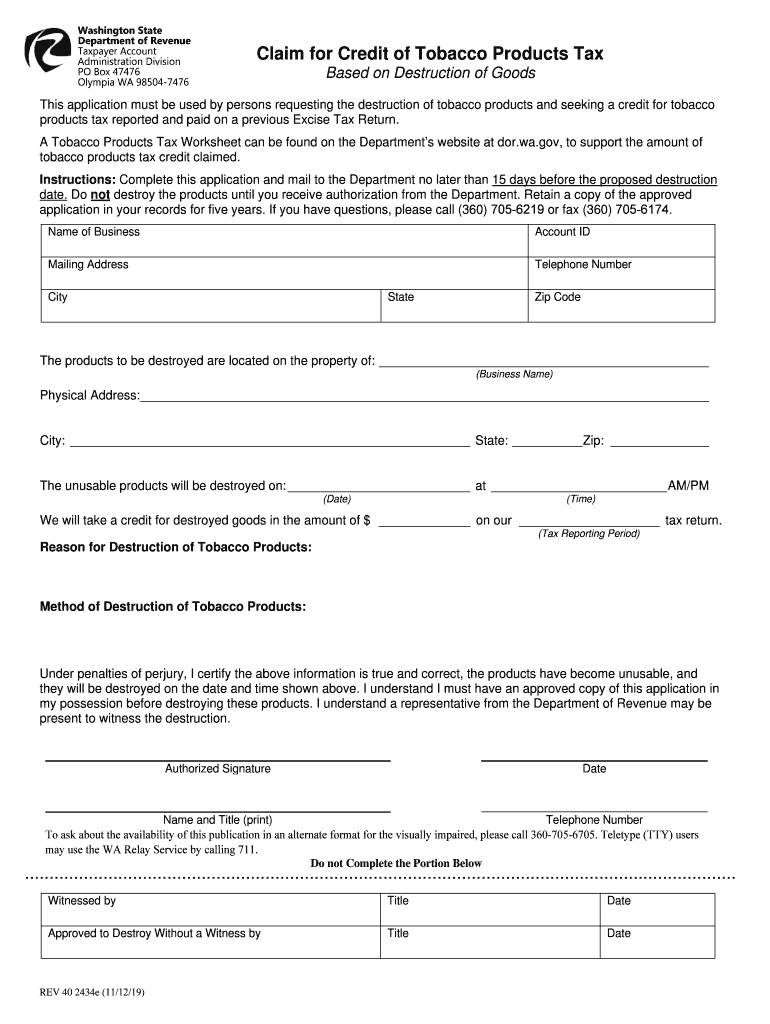

Cigarette Tax Washington State Department of Revenue Form

What is the Cigarette Tax Washington State Department Of Revenue

The Cigarette Tax imposed by the Washington State Department of Revenue is a specific tax levied on the sale of cigarettes within the state. This tax is designed to regulate tobacco consumption and generate revenue for public health initiatives. The tax rate can vary, and it is essential for retailers and consumers to understand the implications of this tax on pricing and compliance.

Steps to complete the Cigarette Tax Washington State Department Of Revenue

Completing the Cigarette Tax form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including business details and sales data.

- Access the Cigarette Tax form through the Washington State Department of Revenue website.

- Fill out the form with accurate sales figures and tax calculations.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, following the specified guidelines.

Required Documents

To complete the Cigarette Tax form, specific documents may be required. These typically include:

- Proof of business registration.

- Sales records for the reporting period.

- Any previous tax returns related to cigarette sales.

Form Submission Methods

The Cigarette Tax form can be submitted through various methods, offering flexibility for businesses. Options include:

- Online submission through the Washington State Department of Revenue portal.

- Mailing the completed form to the designated address.

- In-person submission at local Department of Revenue offices.

Penalties for Non-Compliance

Failure to comply with the Cigarette Tax regulations can result in significant penalties. Common consequences include:

- Fines based on the amount of tax owed.

- Interest on unpaid taxes.

- Potential legal action for persistent non-compliance.

Eligibility Criteria

Understanding the eligibility criteria for the Cigarette Tax is crucial for businesses involved in the sale of cigarettes. Generally, eligibility includes:

- Being a registered business in Washington State.

- Engaging in the sale of cigarettes as part of your product offerings.

- Complying with all state regulations regarding tobacco sales.

Quick guide on how to complete cigarette tax washington state department of revenue

Complete Cigarette Tax Washington State Department Of Revenue seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Cigarette Tax Washington State Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Cigarette Tax Washington State Department Of Revenue effortlessly

- Find Cigarette Tax Washington State Department Of Revenue and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Cigarette Tax Washington State Department Of Revenue to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Cigarette Tax Washington State Department Of Revenue?

The Cigarette Tax Washington State Department Of Revenue is an excise tax imposed on the sale of cigarettes in Washington State. This tax aims to regulate cigarette consumption and generate revenue for public health initiatives. Understanding this tax is crucial for businesses involved in the sale of tobacco products.

-

How is the Cigarette Tax Washington State Department Of Revenue calculated?

The Cigarette Tax Washington State Department Of Revenue is calculated based on the number of cigarettes sold. It is typically assessed at a specific rate per cigarette. Businesses must accurately account for this tax to ensure compliance with state regulations and avoid penalties.

-

What are the implications of the Cigarette Tax Washington State Department Of Revenue for retailers?

Retailers must remain compliant with the Cigarette Tax Washington State Department Of Revenue to avoid legal issues. This includes properly collecting the tax from consumers and remitting it to the state. Additionally, understanding this tax can help retailers better manage their pricing strategies.

-

How can businesses efficiently manage Cigarette Tax Washington State Department Of Revenue documents?

Businesses can use airSlate SignNow to streamline the management of documents related to the Cigarette Tax Washington State Department Of Revenue. The platform allows for easy eSigning and document sharing, ensuring timely compliance with tax regulations. This will help businesses save time and reduce administrative burdens.

-

Are there any benefits of eSigning Cigarette Tax Washington State Department Of Revenue documents?

eSigning documents related to the Cigarette Tax Washington State Department Of Revenue offers signNow benefits, including speed and efficiency. With airSlate SignNow, businesses can quickly complete necessary documents without delays. This can lead to better compliance and improved cash flow.

-

What features does airSlate SignNow offer for managing Cigarette Tax Washington State Department Of Revenue forms?

airSlate SignNow provides features that simplify the eSigning process for Cigarette Tax Washington State Department Of Revenue forms. These include customizable templates, automated reminders, and secure storage. Such features enhance efficiency and ensure documents are handled properly.

-

Is airSlate SignNow cost-effective for managing tax-related documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax-related documents, including those related to the Cigarette Tax Washington State Department Of Revenue. It helps businesses save on printing and mailing costs while providing a user-friendly interface for document management. This makes it an ideal choice for small to medium-sized businesses.

Get more for Cigarette Tax Washington State Department Of Revenue

Find out other Cigarette Tax Washington State Department Of Revenue

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form