Federal 8865 Schedule K 1 Partner's Share of IncomeFederal 8865 Schedule K 1 Partner's Share of IncomeAbout Form 8865, 2022

Understanding the IRS 8865 Form

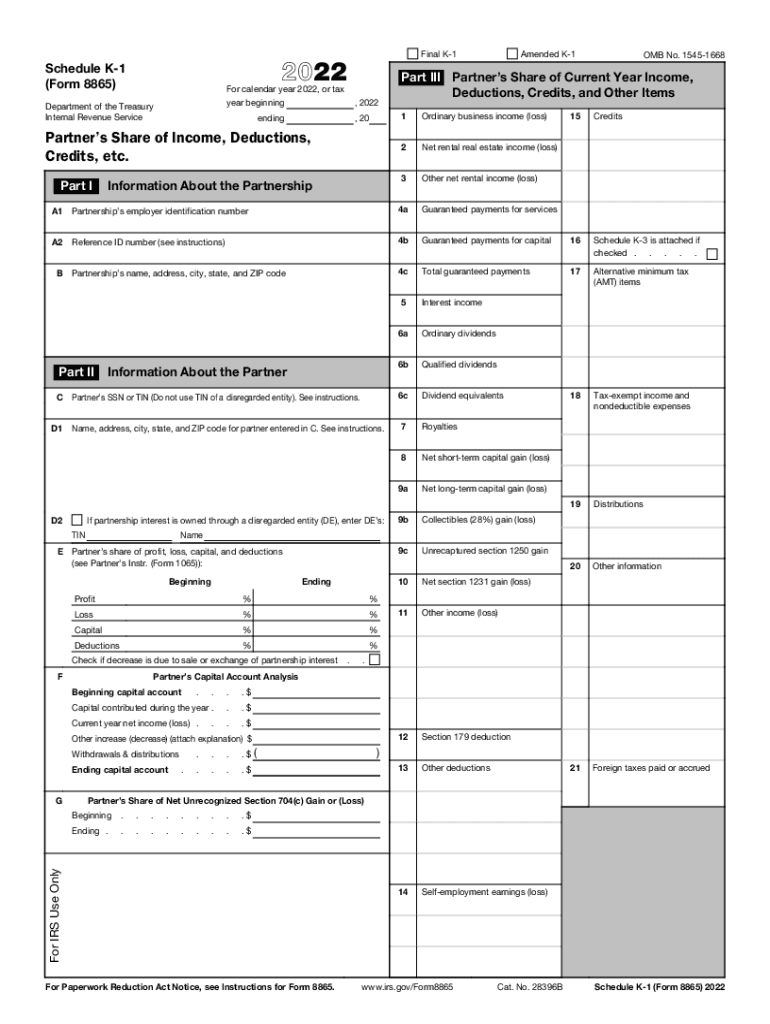

The IRS 8865 form, officially known as the Return of U.S. Persons With Respect to Certain Foreign Partnerships, is essential for U.S. taxpayers who have interests in foreign partnerships. This form is crucial for reporting income, deductions, and credits associated with these partnerships. It ensures compliance with U.S. tax laws and helps avoid penalties related to non-disclosure of foreign income. The IRS requires this form to gather information about foreign partnerships, which can include various entities such as limited liability companies (LLCs) and corporations.

Steps to Complete the IRS 8865 Form

Filling out the IRS 8865 form involves several steps to ensure accurate reporting. Begin by gathering all necessary information regarding the foreign partnership, including its name, address, and Employer Identification Number (EIN). Next, identify your ownership percentage and any income or loss from the partnership. It is important to accurately complete each section of the form, including parts that detail your share of the partnership's income, deductions, and credits. Once completed, review the form for accuracy before submission.

Filing Deadlines for the IRS 8865 Form

The IRS 8865 form must be filed by the due date of your tax return, including extensions. Typically, this means the form is due on April 15 for most taxpayers, but it may vary depending on your specific circumstances. If you are unable to meet the deadline, it is advisable to file for an extension to avoid penalties. Late filing can lead to significant fines, so timely submission is crucial.

Key Elements of the IRS 8865 Form

Several key elements must be included when completing the IRS 8865 form. These include your personal information, details about the foreign partnership, and your share of the partnership's income and deductions. Additionally, you must disclose any foreign taxes paid and the method used to calculate your share of the partnership's income. Understanding these elements is vital for accurate reporting and compliance with IRS regulations.

Legal Use of the IRS 8865 Form

The IRS 8865 form serves a legal purpose by ensuring that U.S. taxpayers report their interests in foreign partnerships. Proper completion of this form is essential for compliance with U.S. tax laws. Failure to file or inaccuracies can result in penalties, including fines and interest on unpaid taxes. It is important to understand the legal implications of this form and to seek professional advice if necessary.

Penalties for Non-Compliance with the IRS 8865 Form

Non-compliance with the IRS 8865 form can lead to severe penalties. If you fail to file the form when required, the IRS may impose fines that can reach thousands of dollars. Additionally, there may be penalties for inaccuracies, such as underreporting income or failing to disclose foreign partnerships. Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete federal 8865 schedule k 1 partners share of incomefederal 8865 schedule k 1 partners share of incomeabout form 8865 return of

Effortlessly complete Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865, on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865, on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865, with ease

- Find Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865, and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865, and ensure top-notch communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal 8865 schedule k 1 partners share of incomefederal 8865 schedule k 1 partners share of incomeabout form 8865 return of

Create this form in 5 minutes!

People also ask

-

What is the IRS 8865 form and why is it important?

The IRS 8865 form is used to report the income, deductions, gains, losses, and other information of foreign partnerships. Completing the IRS 8865 form accurately is crucial for compliance with U.S. tax laws and to avoid potential penalties.

-

How can airSlate SignNow help with the IRS 8865 form?

airSlate SignNow provides an efficient platform to create, send, and eSign the IRS 8865 form securely. With our solution, you can streamline the document workflow, ensuring that your forms are filled out correctly and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the IRS 8865 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you have access to all the necessary features to manage the IRS 8865 form without breaking your budget.

-

What features does airSlate SignNow offer for IRS 8865 form management?

airSlate SignNow includes features such as templates for the IRS 8865 form, secure eSigning, real-time tracking, and integration with other applications. These tools help you manage your documents efficiently and effectively.

-

Can I integrate airSlate SignNow with other software to manage the IRS 8865 form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to manage your IRS 8865 form alongside your other business processes. This integration enhances productivity and reduces manual errors.

-

What are the benefits of using airSlate SignNow for the IRS 8865 form?

Using airSlate SignNow for the IRS 8865 form provides numerous benefits, including enhanced document security, quicker turnaround times, and improved collaboration among team members. Our platform is designed to simplify the process and improve compliance.

-

Is airSlate SignNow user-friendly for those filling out the IRS 8865 form?

Yes, airSlate SignNow is designed with usability in mind. Our intuitive interface makes it easy for anyone to fill out and eSign the IRS 8865 form, regardless of their technical skills, ensuring a smooth and efficient experience.

Get more for Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865,

- Nevada property 497320854 form

- Nevada probate form

- Nevada summary administration form

- Nevada unlawful form

- Nevada tenant law form

- Durable power of attorney for health care and living will nevada form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497320861 form

- Nv annual form

Find out other Federal 8865 Schedule K 1 Partner's Share Of IncomeFederal 8865 Schedule K 1 Partner's Share Of IncomeAbout Form 8865,

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors