5 Things You Should Know About IRS Form 8865 2024-2026

Understanding IRS Form 8865

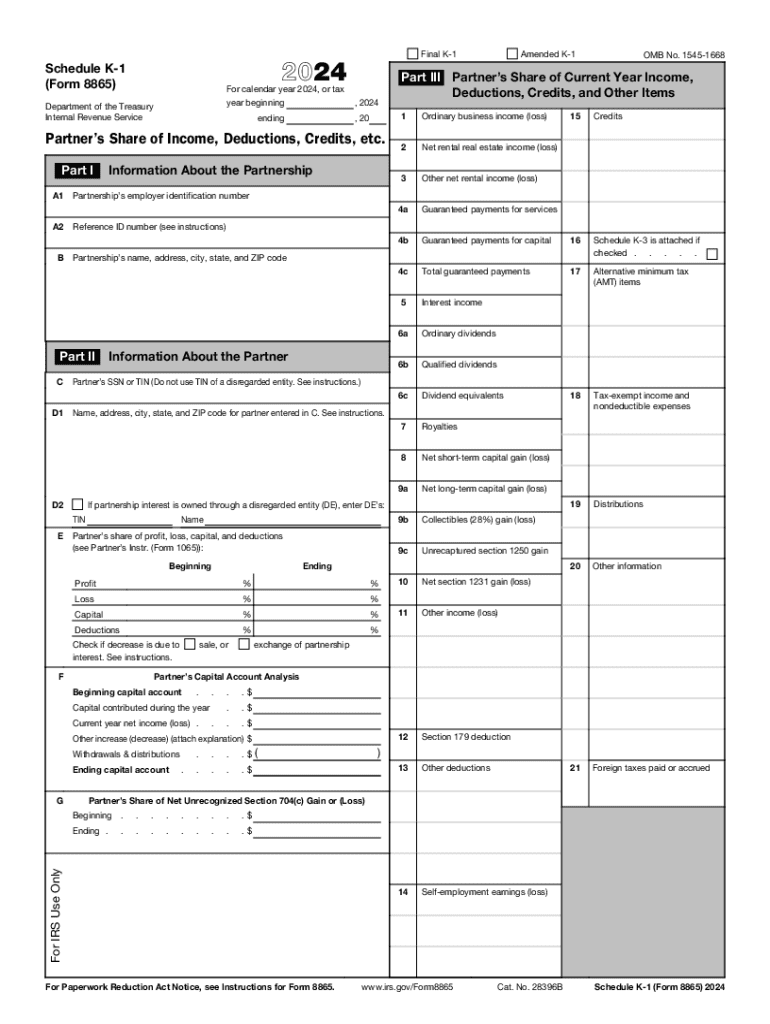

IRS Form 8865 is used to report information about foreign partnerships. U.S. persons who own an interest in a foreign partnership must file this form to comply with U.S. tax laws. The form captures details about the partnership's income, deductions, and credits, ensuring that the IRS has a complete picture of the taxpayer's foreign activities. It's essential for U.S. taxpayers with international business interests to understand their obligations regarding this form.

How to Complete IRS Form 8865

Filling out IRS Form 8865 requires careful attention to detail. The form is divided into several parts, each focusing on different aspects of the partnership's financials. Taxpayers must provide information such as the partnership's name, address, and Employer Identification Number (EIN). Additionally, they need to report their share of the partnership's income and any other relevant financial data. It is advisable to have all necessary documentation on hand, including financial statements and partnership agreements, to ensure accurate reporting.

Filing Deadlines for IRS Form 8865

The filing deadline for IRS Form 8865 generally aligns with the taxpayer's tax return due date. For most individuals, this is April 15. However, if the taxpayer is granted an extension for their tax return, the deadline for submitting Form 8865 is also extended. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file IRS Form 8865 can result in significant penalties. The IRS imposes a penalty of $10,000 for each failure to file, which can escalate if the form is not submitted within a specified time frame after receiving a notice from the IRS. Additionally, there may be further penalties for inaccuracies or omissions on the form. Understanding these consequences emphasizes the importance of timely and accurate filing.

Eligibility Criteria for Filing IRS Form 8865

Not every U.S. person is required to file IRS Form 8865. The eligibility criteria primarily focus on ownership interests in foreign partnerships. Generally, a U.S. person must file if they own at least a ten percent interest in the foreign partnership or if they are a partner in a foreign partnership that meets certain criteria. It is important for taxpayers to assess their ownership stakes carefully to determine their filing obligations.

Create this form in 5 minutes or less

Find and fill out the correct 5 things you should know about irs form 8865

Create this form in 5 minutes!

How to create an eSignature for the 5 things you should know about irs form 8865

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8865 and why is it important?

IRS Form 8865 is used to report information regarding foreign partnerships. Understanding the 5 Things You Should Know About IRS Form 8865 is crucial for businesses involved in international transactions to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with IRS Form 8865?

airSlate SignNow simplifies the process of preparing and signing IRS Form 8865. By utilizing our platform, you can efficiently manage document workflows and ensure that all necessary signatures are obtained, addressing the 5 Things You Should Know About IRS Form 8865.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. By understanding the 5 Things You Should Know About IRS Form 8865, you can determine how our cost-effective solution can fit into your budget while ensuring compliance.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure storage. These features are essential for managing IRS Form 8865 efficiently, aligning with the 5 Things You Should Know About IRS Form 8865 to streamline your compliance process.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. Knowing the 5 Things You Should Know About IRS Form 8865 can help you leverage these integrations to improve your document management and compliance efforts.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance measures. Understanding the 5 Things You Should Know About IRS Form 8865 will help you appreciate the importance of using a secure platform for sensitive tax documents.

-

How does airSlate SignNow improve collaboration on IRS Form 8865?

airSlate SignNow enhances collaboration by allowing multiple users to review and sign IRS Form 8865 in real-time. This feature is part of the 5 Things You Should Know About IRS Form 8865, making it easier for teams to work together and ensure timely submissions.

Get more for 5 Things You Should Know About IRS Form 8865

Find out other 5 Things You Should Know About IRS Form 8865

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple