Internal Revenue Service Form 2019

What is the Internal Revenue Service Form

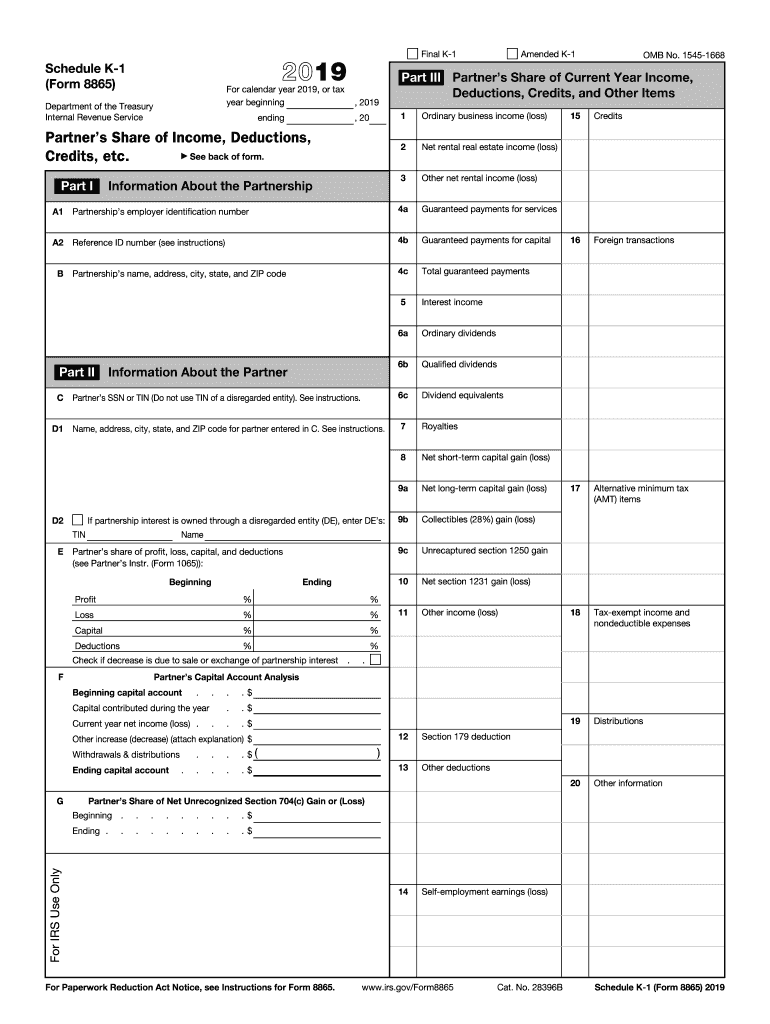

The 2019 Internal Revenue Service form is a crucial document used for various tax-related purposes in the United States. It serves as a means for taxpayers to report their income, claim deductions, and calculate their tax obligations. This form is integral to the annual tax filing process and can encompass various specific forms, such as the 2019 IRS Schedule K-1 form, which reports income, deductions, and credits from partnerships, S corporations, estates, and trusts. Understanding the purpose and requirements of these forms is essential for compliance with federal tax laws.

How to use the Internal Revenue Service Form

Using the 2019 Internal Revenue Service form involves several steps to ensure accurate completion and submission. Taxpayers should first determine which specific form they need based on their financial situation. After obtaining the correct form, individuals must carefully fill it out, providing all required information, such as personal details, income sources, and deductions. It is advisable to review the form for accuracy before submission. Once completed, the form can be filed electronically or mailed to the IRS, depending on the taxpayer's preference and the specific form's requirements.

Steps to complete the Internal Revenue Service Form

Completing the 2019 Internal Revenue Service form requires a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the correct form based on your filing status and income sources.

- Fill out the form, ensuring all personal and financial information is accurate.

- Double-check calculations for any credits or deductions claimed.

- Sign and date the form before submission.

Following these steps helps prevent errors that could lead to delays or penalties.

Legal use of the Internal Revenue Service Form

The legal use of the 2019 Internal Revenue Service form is governed by federal tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Taxpayers are responsible for ensuring that the information provided is truthful and complete. Failure to comply with these requirements can result in penalties, including fines and interest on unpaid taxes. Additionally, electronic submissions must adhere to eSignature regulations to maintain their legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 Internal Revenue Service form are critical for taxpayers to note. Generally, the deadline for individual tax returns is April 15 of the following year, although extensions may be available. It is essential to be aware of any changes to deadlines, especially for specific forms like the 2019 IRS Schedule K-1 form, which may have different due dates based on the entity type. Keeping track of these dates helps avoid late fees and ensures compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 2019 Internal Revenue Service form. The most common methods include:

- Online Submission: Many taxpayers choose to file electronically through IRS-approved software, which can streamline the process and reduce errors.

- Mail: Forms can be printed and mailed to the IRS, but this method may take longer for processing.

- In-Person: Some individuals may opt to file in person at designated IRS offices, particularly if they require assistance.

Choosing the right submission method can affect the speed and efficiency of the tax filing process.

Quick guide on how to complete 2019 internal revenue service form

Effortlessly Prepare Internal Revenue Service Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Internal Revenue Service Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Internal Revenue Service Form with Ease

- Find Internal Revenue Service Form and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Internal Revenue Service Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 internal revenue service form

Create this form in 5 minutes!

How to create an eSignature for the 2019 internal revenue service form

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2019 internal revenue service form?

The 2019 internal revenue service form refers to tax forms and documents used for filing income taxes with the IRS in 2019. Understanding this form is crucial for ensuring compliance with federal tax regulations and for securing any eligible deductions or credits during tax season.

-

How can airSlate SignNow help with the 2019 internal revenue service form?

airSlate SignNow provides an efficient solution for electronically signing and sending the 2019 internal revenue service form. With its user-friendly interface, you can complete and manage your tax documents securely, ensuring they are filed promptly and accurately.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing tiers, making it accessible for businesses of all sizes who need to manage documents like the 2019 internal revenue service form. Each plan comes with unique features tailored to different user needs, including eSigning and document management capabilities.

-

Are there any features specifically for handling the 2019 internal revenue service form?

Yes, airSlate SignNow includes features designed to streamline the process of completing and signing the 2019 internal revenue service form. These features include customizable templates, automated reminders for signers, and secure storage for easy access to your completed documents.

-

Can I integrate airSlate SignNow with other applications for the 2019 internal revenue service form?

Absolutely! airSlate SignNow supports integrative capabilities with various applications that can help manage the 2019 internal revenue service form, such as accounting software and cloud storage services. This integration facilitates seamless document flow and enhances productivity.

-

What benefits can I expect from using airSlate SignNow for the 2019 internal revenue service form?

Using airSlate SignNow for the 2019 internal revenue service form streamlines your document workflow, reduces turnaround times, and increases accuracy. The platform’s secure eSignature technology ensures compliance with IRS regulations, making tax filing simpler and more efficient.

-

Is it secure to use airSlate SignNow for sensitive documents like the 2019 internal revenue service form?

Yes, airSlate SignNow prioritizes the security of your sensitive documents, including the 2019 internal revenue service form. With robust encryption methods and compliance with industry regulations, your documents are protected and managed securely at all times.

Get more for Internal Revenue Service Form

Find out other Internal Revenue Service Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free