Formulario 9465SP Internal Revenue Service Irs

What is the Formulario 9465SP Internal Revenue Service Irs

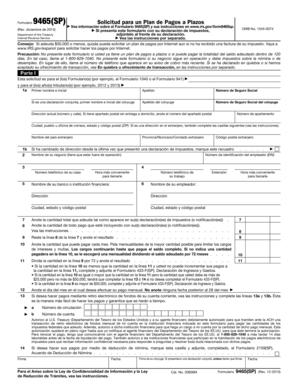

The Formulario 9465SP is a crucial document provided by the Internal Revenue Service (IRS) that allows taxpayers in the United States to request a monthly installment plan for paying their federal taxes. This form is specifically designed for Spanish-speaking taxpayers, ensuring accessibility and understanding of the payment options available. By submitting this form, individuals can manage their tax liabilities more effectively, avoiding penalties and interest associated with late payments.

How to use the Formulario 9465SP Internal Revenue Service Irs

Using the Formulario 9465SP involves several straightforward steps. First, taxpayers need to download the form from the IRS website or obtain a physical copy. After filling out the required personal information, including Social Security number and tax details, individuals must indicate the amount they owe and propose a monthly payment amount. Once completed, the form should be submitted to the IRS either by mail or electronically, depending on the specific instructions provided on the form.

Steps to complete the Formulario 9465SP Internal Revenue Service Irs

Completing the Formulario 9465SP requires careful attention to detail. Here are the essential steps:

- Download the form from the IRS website or request a paper version.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the total amount owed to the IRS and the proposed monthly payment.

- Sign and date the form to validate your request.

- Submit the completed form to the IRS as instructed, either online or by mail.

Legal use of the Formulario 9465SP Internal Revenue Service Irs

The Formulario 9465SP is legally binding once it is signed and submitted to the IRS. It serves as a formal request for an installment agreement, allowing taxpayers to pay their tax liabilities over time. To ensure the legal validity of the form, it is essential to provide accurate information and adhere to IRS guidelines. Failure to comply with the terms of the installment agreement can result in penalties, so understanding the legal implications is vital for taxpayers.

Eligibility Criteria

To qualify for using the Formulario 9465SP, taxpayers must meet specific criteria set by the IRS. These include:

- Owing federal taxes that are not currently in a bankruptcy proceeding.

- Having a balance due of $50,000 or less in combined tax, penalties, and interest.

- Being able to pay the proposed monthly amount within the designated time frame.

Meeting these criteria ensures that taxpayers can effectively utilize the installment agreement option for their tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Formulario 9465SP to the IRS. The form can be submitted online through the IRS website if the taxpayer meets the eligibility requirements. Alternatively, individuals may choose to mail the completed form to the appropriate IRS address listed on the form. In-person submission is generally not available for this specific form, making online and mail submissions the primary methods for processing requests.

Quick guide on how to complete formulario 9465sp internal revenue service irs

Complete Formulario 9465SP Internal Revenue Service Irs effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Formulario 9465SP Internal Revenue Service Irs on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Formulario 9465SP Internal Revenue Service Irs with ease

- Obtain Formulario 9465SP Internal Revenue Service Irs and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Formulario 9465SP Internal Revenue Service Irs to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Formulario 9465SP from the Internal Revenue Service (IRS)?

Formulario 9465SP is a form provided by the Internal Revenue Service (IRS) that allows taxpayers to request a payment plan for their tax liabilities. By submitting this form, individuals can effectively manage their tax payments without facing penalties. Understanding how to properly fill out this form is essential for maintaining compliance with IRS regulations.

-

How can airSlate SignNow help with Formulario 9465SP Internal Revenue Service IRS submissions?

AirSlate SignNow simplifies the process of submitting Formulario 9465SP by allowing users to eSign and send documents online quickly. With its intuitive interface, users can ensure that their form is accurately filled out and submitted on time, signNowly reducing the risk of errors. This helps taxpayers remain organized and compliant with IRS requirements.

-

What are the pricing options for airSlate SignNow related to Formulario 9465SP Internal Revenue Service IRS processing?

AirSlate SignNow offers various pricing plans that cater to different business needs, making it an affordable choice for handling Formulario 9465SP submissions. The plans include essential features for document management and eSigning, ensuring businesses get the best value for their investment. Interested customers can choose a plan that aligns with their document processing volume.

-

Does airSlate SignNow provide templates for Formulario 9465SP Internal Revenue Service IRS?

Yes, airSlate SignNow offers customizable templates for Formulario 9465SP, ensuring that users can quickly create and fill out the necessary forms with ease. These templates save time and reduce errors by guiding users through the required fields. This feature is especially beneficial for those unfamiliar with IRS forms.

-

What are the benefits of using airSlate SignNow for Formulario 9465SP submissions?

Using airSlate SignNow for Formulario 9465SP submissions offers several benefits, including faster processing times and enhanced document security. The platform allows users to track the status of their submissions and provides notifications for completed tasks. This level of efficiency helps users maintain peace of mind when dealing with the IRS.

-

Can airSlate SignNow integrate with my existing business tools for Formulario 9465SP Internal Revenue Service IRS management?

Absolutely! AirSlate SignNow integrates seamlessly with various business tools, making it easier to manage Formulario 9465SP alongside other critical applications. This integration streamlines workflows and allows users to manage all of their documents in one centralized location, improving efficiency and productivity.

-

Is airSlate SignNow secure for handling Formulario 9465SP Internal Revenue Service IRS documents?

Yes, airSlate SignNow employs advanced security measures to ensure that all documents, including Formulario 9465SP submissions, are safely handled. With encryption and compliance with industry standards, businesses can trust that their information will remain confidential and secure during the submission process.

Get more for Formulario 9465SP Internal Revenue Service Irs

- Warranty deed from corporation to husband and wife utah form

- Quitclaim deed from corporation to individual utah form

- Utah warranty deed 497427342 form

- Quitclaim deed from corporation to llc utah form

- Quitclaim deed from corporation to corporation utah form

- Warranty deed from corporation to corporation utah form

- Quitclaim deed from corporation to two individuals utah form

- Warranty deed from corporation to two individuals utah form

Find out other Formulario 9465SP Internal Revenue Service Irs

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF