1040 Schedule 2 2020

What is the 1040 Schedule 2

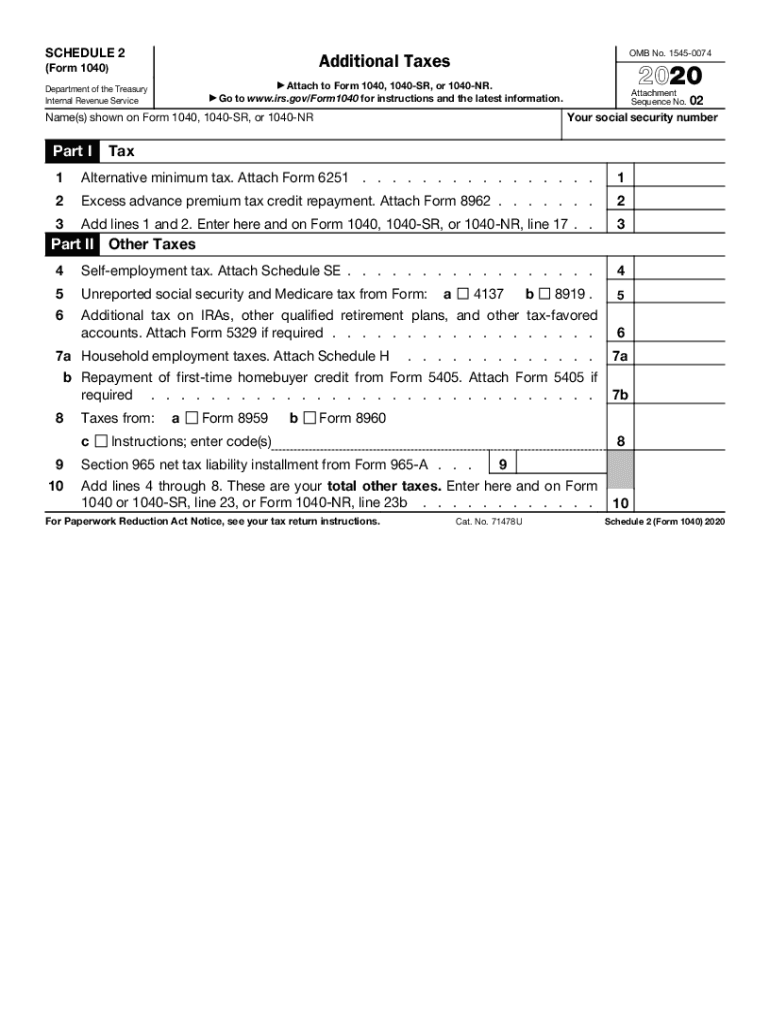

The 2020 Schedule 2 is a tax form used by individuals to report additional taxes owed to the IRS. This form is part of the overall 1040 tax return and is specifically designed to capture various types of additional taxes that may not be included on the main 1040 form. Common reasons for filing Schedule 2 include self-employment tax, alternative minimum tax, and household employment taxes. Understanding this form is crucial for ensuring compliance with tax regulations and accurately reporting your tax liabilities.

How to use the 1040 Schedule 2

Using the 2020 Schedule 2 involves several steps to ensure accurate reporting of additional taxes. First, determine if you need to file this form based on your tax situation. If applicable, gather all necessary information regarding the additional taxes you owe. Complete the form by following the instructions provided by the IRS, ensuring that all figures are accurate and reflect your financial situation. Finally, attach the completed Schedule 2 to your 1040 form when submitting your tax return.

Steps to complete the 1040 Schedule 2

Completing the 2020 Schedule 2 requires careful attention to detail. Follow these steps:

- Review your tax situation to confirm the need for Schedule 2.

- Gather all relevant documents, including income statements and records of any additional taxes.

- Fill out the form, ensuring that you accurately report the amounts for each applicable tax category.

- Double-check your entries for accuracy and completeness.

- Attach the Schedule 2 to your 1040 form before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the 2020 Schedule 2. It is essential to refer to the IRS instructions for this form to understand the requirements fully. These guidelines include information on who must file, how to calculate additional taxes, and any necessary documentation. Adhering to these guidelines helps ensure that your tax return is processed smoothly and reduces the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

Timely filing of the 2020 Schedule 2 is crucial to avoid penalties. The standard deadline for filing your federal tax return, including the 1040 and Schedule 2, is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file any necessary extensions if you cannot meet the standard deadline.

Penalties for Non-Compliance

Failing to file the 2020 Schedule 2 when required can result in significant penalties. The IRS may impose fines for late filing or for inaccuracies on the form. Additionally, any unpaid taxes reported on Schedule 2 may accrue interest over time. It is essential to understand these potential penalties to avoid unnecessary financial burdens and to ensure compliance with tax laws.

Quick guide on how to complete 2020 1040 schedule 2

Prepare 1040 Schedule 2 effortlessly on any device

The management of online documents has gained traction among both companies and individuals. It serves as a perfect environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without holdups. Manage 1040 Schedule 2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 1040 Schedule 2 with ease

- Obtain 1040 Schedule 2 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign 1040 Schedule 2 and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 1040 schedule 2

Create this form in 5 minutes!

People also ask

-

What is the 2020 schedule 2 and how does airSlate SignNow help?

The 2020 schedule 2 refers to a specific tax form used by businesses for reporting. airSlate SignNow simplifies the process by allowing you to easily send, sign, and manage your 2020 schedule 2 documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for managing the 2020 schedule 2 documents?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. With flexible options, you can choose a plan that aligns with your requirements for processing the 2020 schedule 2 efficiently.

-

What features does airSlate SignNow offer for the 2020 schedule 2?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking to manage your 2020 schedule 2 documents. These tools streamline the signing process, saving you time and enhancing productivity.

-

Can I integrate airSlate SignNow with other software when handling the 2020 schedule 2?

Yes, airSlate SignNow easily integrates with various software applications, making it convenient to manage your 2020 schedule 2 along with your existing tools. This flexibility helps maintain workflow efficiency across platforms.

-

Is airSlate SignNow secure for sending sensitive 2020 schedule 2 documents?

Absolutely! airSlate SignNow prioritizes your security, using encryption and compliance measures to protect sensitive information including your 2020 schedule 2 documents. You can trust that your data is safe and confidential.

-

How can airSlate SignNow improve the efficiency of managing the 2020 schedule 2?

By automating the signing process and providing user-friendly interfaces, airSlate SignNow signNowly enhances the efficiency of managing your 2020 schedule 2. You'll experience faster turnaround times and reduce the chances of errors.

-

What kind of support does airSlate SignNow offer for the 2020 schedule 2?

airSlate SignNow offers comprehensive support resources, including documentation, tutorials, and customer support for any inquiries about the 2020 schedule 2. Our team is ready to assist you in optimizing your document management.

Get more for 1040 Schedule 2

- Warranty deed from two individuals to llc virginia form

- Affidavit of payment prior to sale corporation or llc virginia form

- Affidavit of payment prior to sale or refinance individual virginia form

- Quitclaim deed by two individuals to corporation virginia form

- Warranty deed corporation 497428053 form

- Va sale form

- Quitclaim deed from individual to corporation virginia form

- Warranty deed from individual to corporation virginia form

Find out other 1040 Schedule 2

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple